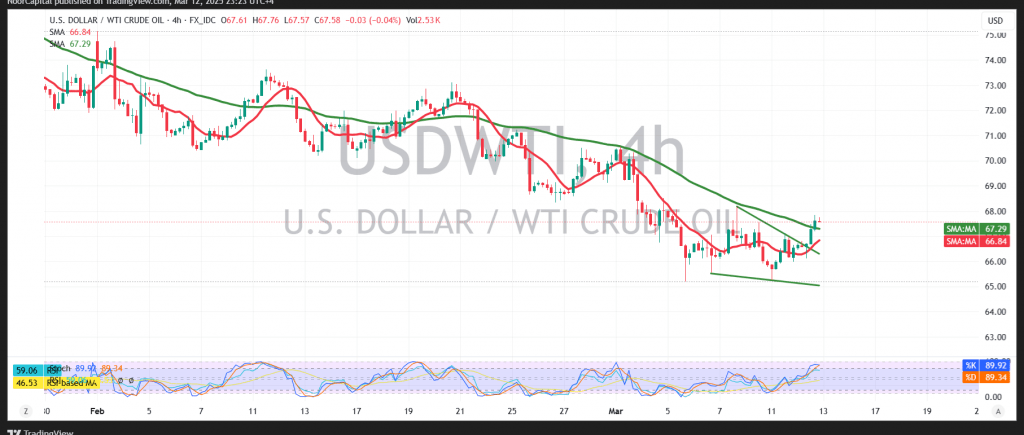

After several consecutive sessions of decline, U.S. crude oil futures have staged a bullish rebound, attempting to hold above the psychological barrier of 67.00.

Technical Analysis

On the 4-hour chart, we maintain a cautiously positive outlook, supported by the Relative Strength Index (RSI) attempting to gain upward momentum and the 50-day simple moving average (SMA) providing additional support.

If prices consolidate above 67.50, this could act as a catalyst for further gains toward 68.25 and potentially 68.85.

However, failure to hold above 67.00, along with a drop below 66.60, may lead to renewed bearish pressure, targeting 65.55 and 64.90 in the next sessions.

Market Watch & Risk Factors

Risk remains elevated amid ongoing trade tensions, making all scenarios possible.

Key U.S. economic data releases today, including monthly and annual producer price index (PPI) reports and weekly jobless claims, could trigger high volatility in the market.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations