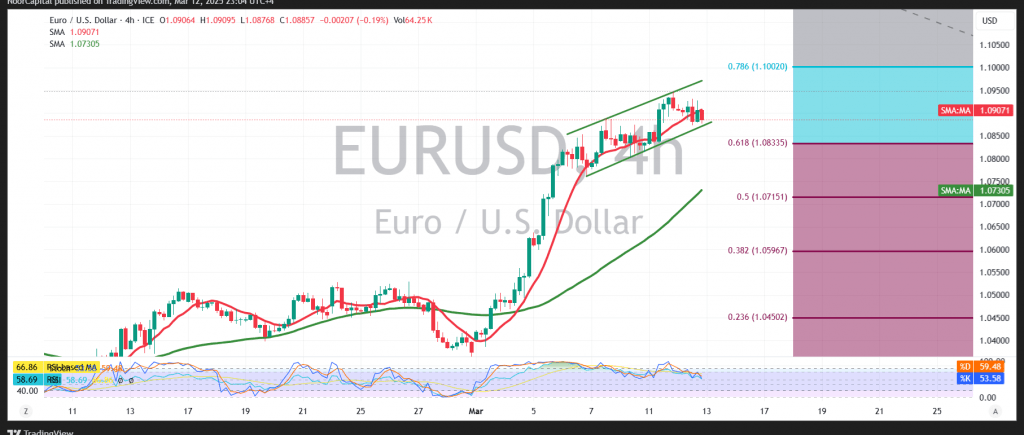

The EUR/USD pair successfully reached the first target outlined in the previous technical report at 1.0940, recording a high of 1.0945.

Technical Analysis

Looking at the 4-hour chart, the pair has established strong support at 1.0830, corresponding to the 61.80% Fibonacci retracement level. Additionally, the Stochastic indicator continues to gain upward momentum, reinforcing the potential for further gains.

As long as intraday trading remains above 1.0830 and, more broadly, above 1.0800, the upward trend remains valid, with 1.0945 as the next target. A confirmed breakout above this level could extend gains toward 1.0975, marking the next key resistance.

However, if trading falls below 1.0800 and an hourly candle closes beneath this level, bearish momentum could resume, leading to a potential retest of 1.0775 and possibly 1.0715 (the 50.0% Fibonacci retracement level).

Market Watch & Risk Factors

Risk remains elevated amid ongoing economic uncertainties, making all market scenarios possible.

High-impact U.S. economic data is expected today, including monthly and annual producer price index (PPI) reports and weekly jobless claims. These releases could introduce high volatility to the market.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations