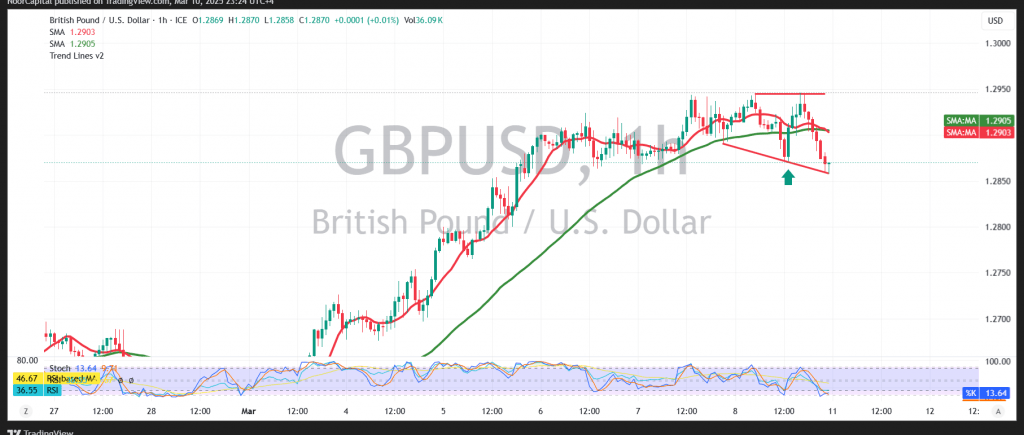

The British pound achieved the desired target against the US dollar at 1.2920, reaching a high of 1.2924 After two consecutive sessions of gains, the pair encountered strong resistance near 1.2940, which has shifted the bias to bearish.

On the 4‑hour chart, GBP/USD is trading negatively below the key psychological support at 1.2900, while the Stochastic indicator remains in oversold territory. There may be limited upward attempts if daily trading can hold above 1.2840; in such a case, a break of 1.2900 could set the stage for a move toward 1.2975 and even 1.3000. Conversely, if trading loses stability below 1.2840, the pair could face temporary negative pressure with a potential retest of 1.2760.

Risk Considerations:

Today, we are expecting high-impact US economic data on Job Openings and Labor Turnover Survey (JOLTS), which may trigger significant volatility.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations