US Dollar turned lower last week after the strong bad effect of Trump’s trade rhetoric faded to some extent. The currency also missed the opportunity to make use of the testimony of Fed’s chief Jerome Powell against the Senate. Recent inflation and spending data played a role in dollar weakness escalation.

There was no new in Powell’s testimony as if he was providing US legislators with a copy of the statements he gave after FOMC meeting in January. So every word he said was strongly priced by investors, which pressured the dollar.

Fears of Trump’s tariffs talk and measures abated to some extent after they were a main source of upside momentum for the greenback. Last week saw the third postponing of tariffs after US administration announced that it will delay enaction of “Reciprocal tariffs” to the first of April.

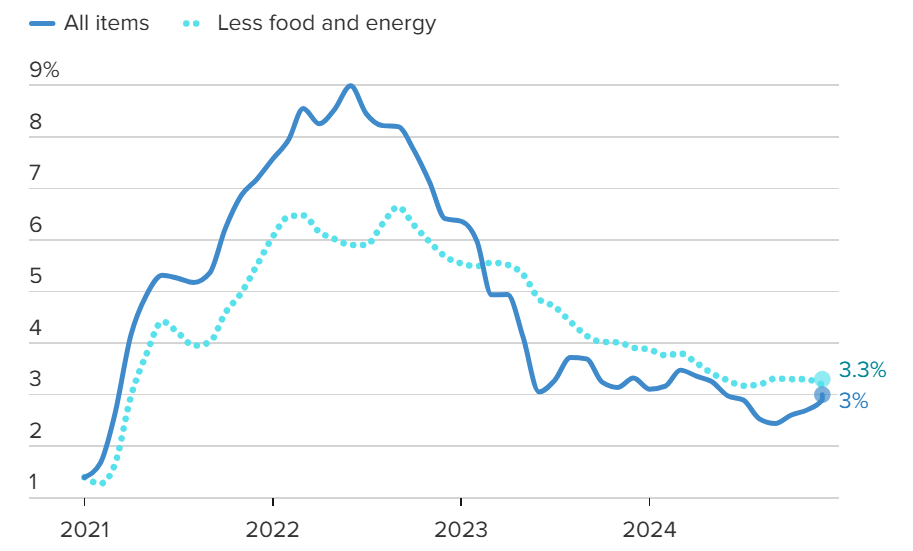

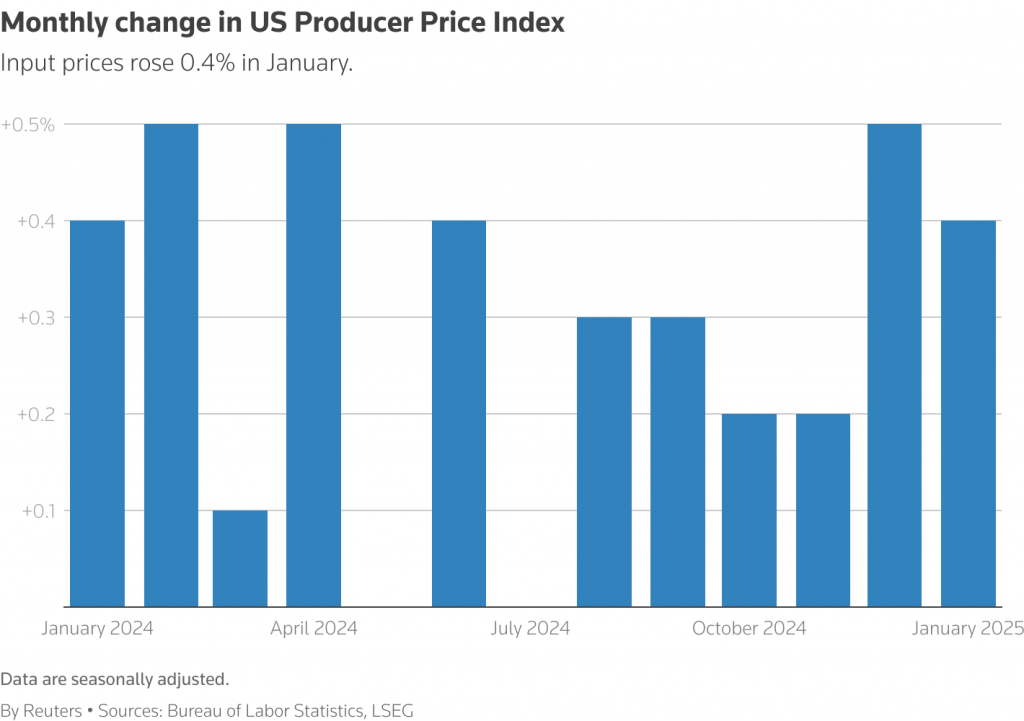

Although CPIs and some PPIs were hotter than expected, core PPI readings rose less than expected, which pushed USD down at the end of last week trading.

Retail sales in USA showed sharp decline, shedding light on weak demand. Although such decline was due to Los Angeles fire, deterioration in consumer spending could cause a stall in price growth.

Trump’s tariffs in a week

Bad effect of trumps threats and decisions of tariffs weakened at the end of last week after announcing that the new administration will postpone “Reciprocal Tariffs” on some countries till the first of the coming month.

This is the third time the White House postpones tariffs enaction after it did when delayed an addition 25% tariffs on US imports from Canada and Mexico.

Investors interpreted the delay as a sign of using the trade rhetoric of Trump as a means of pulling US trade partners to negotiations to make good deals with USA. Such interpretation weakened the effect of these threats.

Powell’s Testimony

Federal Reserve chief Jerome Powell said in his testimony against the Senate that “Economy is strong”, adding that labour market conditions are tight. But he said that improvement of such conditions is no longer negative for US economy.

He added that “Inflation is closer to target”, stressing that the Fed is giving attention to the double-face risk encountering the dual mandate. (Price stability & maximum employment).

“Inflation expectations are suggesting more slump. Current monetary policy stance is well-positioned” Powell said.

He also expected that Interest rate could be held unchanged “for longer time”, repeating that the Fed is avoiding cutting rates “So Fast, So Much”.

He also said: “We need to see more progress on the front of inflation”, suggesting: “We may cut rates if labour market conditions worsen of inflation increased unexpectedly”.

OPEC and oil

On Wednesday, OPEC maintained its forecast for robust global oil demand growth in 2025, highlighting that air and road travel would bolster consumption and that potential trade tariffs were unlikely to impede economic growth.

According to its monthly report, the Organization of the Petroleum Exporting Countries projected that world oil demand would increase by 1.45 million barrels per day (bpd) in 2025 and by 1.43 million bpd in 2026. Both forecasts remained unchanged from the previous month.

OPEC stated in its report, “The extent to which potential tariffs and other policy measures will have an impact remains to be seen. However, they are not expected to significantly alter the current growth assumptions.” Following the release of the OPEC report, oil prices remained steady, with Brent crude trading lower towards $76 a barrel.

The International Energy Agency (IEA) projects demand growth for 2025 at 1.05 million barrels per day (bpd), which is lower than OPEC’s forecast. However, the disparity between their 2025 projections is much smaller compared to 2024 when differences over the pace of the energy transition led to a record-high divergence.

ECB and Euro

The European Central Bank should avoid hastening further interest-rate cuts, particularly as borrowing costs near a level that neither constrains nor stimulates the economy, said Governing Council member Joachim Nagel.

“As we approach the neutral rate, it becomes increasingly prudent to adopt a gradual approach,” remarked the German central-bank chief on Wednesday. According to Bundesbank staff estimates, the neutral rate is between 1.8% and 2.5%, just below the current deposit rate of 2.75%.

This week

This week will be a holiday-shortened one for celebrating the Presidents Day. But on Wednesday, FOMC minutes will be released amid anticipation among investors to any signals related to future track of monetary policy.

The minutes are widely expected to mirror Fed’s Powell testimony on economic conditions against the Senate last week.

A number of Fed’s members are scheduled to speck this week. Their comments are expected to deal with several monetary policy issues.

PMI readings and housing data are scheduled to be released this week, which could add more clarity to the economic landscape in USA.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations