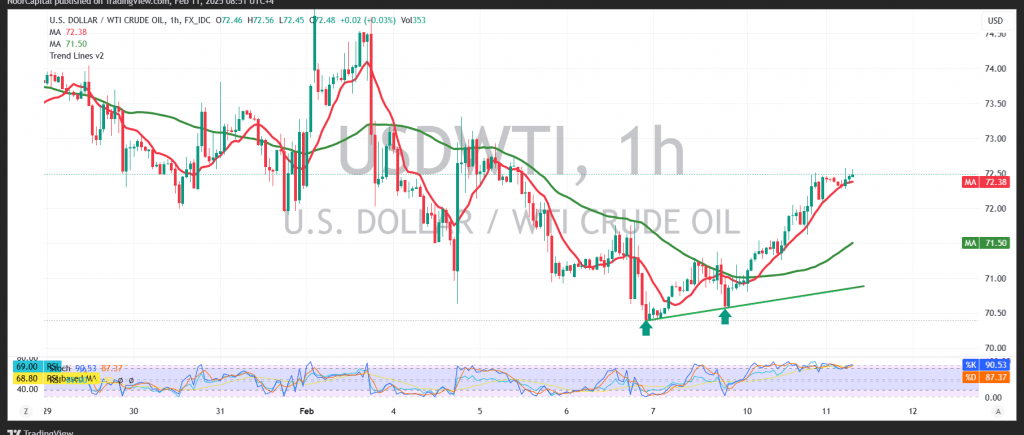

U.S. crude oil futures extended their gains, finding support at $70.90 and reaching a session high of $72.57 per barrel.

Technical Outlook:

- The 4-hour chart shows that simple moving averages are supporting the price from below, offering a positive momentum boost.

- Oil has stabilized above $72.30, reinforcing the potential for further upside.

Key Levels to Watch:

- Bullish Scenario:

- If oil holds above $72.30, it may target $73.10 as the next resistance.

- A break above $73.10 could accelerate gains toward $73.90.

- Bearish Scenario:

- A break below $71.45 could shift momentum downward.

- This may lead to a retracement toward $70.35.

Market Risks & Considerations:

- Fed Chairman Jerome Powell’s testimony today may cause high volatility in crude oil prices.

- Ongoing trade tensions and global macroeconomic factors continue to pose high risks.

⚠ Risk Warning: The market remains volatile, and all scenarios are possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations