Last week was eventful, marked by a series of significant developments. These included policy directions anticipated from President-elect Donald Trump’s administration, future paths for central banks, particularly the Federal Reserve, and the impact of key US economic releases.

The Eurozone has seen significant developments, particularly CPI front. Several European leaders have accused Elon Musk, owner of “X” and Tesla, of meddling activities in German elections.

Trump’s Tariffs

The Washington Post reported that President-elect Donald Trump’s aides are considering comprehensive tariff plans that would only cover essential imports. If implemented, this plan could ease the impact of Trump’s trade restrictions on global commerce by potentially reducing inflationary pressures more than expected.

This news had a positive impact on risk assets in global financial markets, particularly on US stocks and other assets that thrive on investor optimism. However, this effect quickly dissipated following the release of negative reports on the same issue.

CNN reported that Trump’s team might be attempting to fast-track the implementation of additional tariffs before any other economic and trade policies are put into effect.

CNN reported that President-elect Donald Trump is currently considering declaring a national economic emergency to implement additional tariffs planned by him and his team. These tariffs are a key part of Trump’s inflationary economic policies, which the new administration intends to follow.

Tariffs and other trade restrictions would increase the cost of imported goods in the US, which would then be passed on to consumers, leading to higher inflation.

FOMC meeting minutes

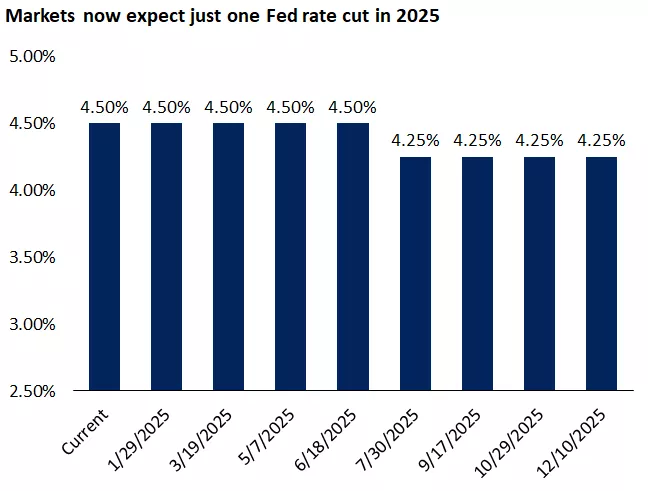

The minutes from the Federal Reserve December meeting said that officials are considering potential changes in trade and immigration policies while preparing economic forecasts. Some warned that President-elect Donald Trump’s trade policies could complicate managing inflation in the coming period. The Fed’s policymakers emphasized the need for a cautious approach in the next quarter.

They also projected a slight decrease in GDP growth and a modest increase in the unemployment rate compared to previous forecasts, based on recent data and potential policy changes from the incoming US administration. The minutes noted that real GDP continued to grow strongly in 2024, and labour market conditions have improved since early last year, although the unemployment rate remains low. Consumer price inflation is lower than a year ago but still somewhat elevated.

Some members of the Federal Open Market Committee expressed that a 25 basis point rate cut would be appropriate, stating that if upcoming US data aligns with market expectations, a gradual approach to reaching the neutral interest rate would be suitable.

NFP

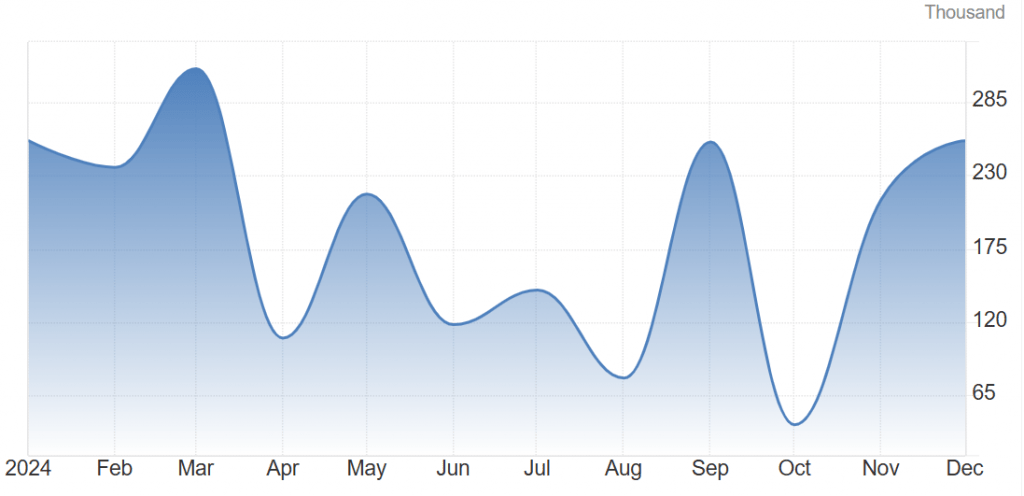

The recent US nonfarm payrolls report delivered a resounding message: the American labour market remains a force to be reckoned with. December witnessed a robust 256,000 job additions, significantly surpassing expectations and solidifying the economy’s resilience. This robust growth, particularly evident in the private sector, underscores the continued strength of the US economy despite the ongoing global economic headwinds.

While manufacturing employment contracted slightly, this was a minor blip on the radar compared to the broader picture of robust job creation. The unemployment rate unexpectedly dipped to 4.1%, further emphasizing the tightness of the labour market. This robust demand for labour is a testament to the underlying strength of the US economy and consumer confidence.

Most notably, wage growth moderated to 3.9% year-over-year. This moderation is a crucial development for the Federal Reserve. The central bank has been closely monitoring wage growth as a key indicator of inflationary pressures. While still elevated, the moderating trend suggests that the Fed’s efforts to cool the economy may be starting to bear fruit.

Trudeau’s Resignation

Prime minister, Justin Trudeau announced on Monday that he would step down as prime minister and leader of the Liberal party , to create a growing domestic political turmoil and there exists also a seriuos threat of new tariffs from the incoming Trump administration, constituting two key factors that could keep the Canadian dollar caged in 2025.

Investors, especially Loonie’s bulls, are now anticipating the potential shift in political regimes occurring in Canada after Trudeau leaves amid uncertainty which is suggested to size any upside movement of the Canadian dollar.

Cryptocurrencies

Dogecoin experienced a significant slump following accusations from French President Emmanuel Macron, who claimed that Elon Musk used his “X” social media platform to influence the German elections.

This political controversy led to a 12% weekly drop in Dogecoin’s value. Additionally, the digital assets market saw Bitcoin decline after US jobs data indicated substantial gains in non-farm payrolls, which strengthened the US dollar and resulted in a 4% drop in Bitcoin’s value.

Market Reaction

The robust employment data has had a significant impact on financial markets. The US dollar has strengthened, reflecting increased confidence in the US economy. Conversely, bond yields have risen, reflecting expectations of a continued pause in interest rate cuts and the potential for a longer period of higher interest rates. The result was a stronger dollar with sharp deterioration of US stocks.

Dow Jones Industrial Average ended last week with a decline, losing about 1.6%, impacted by the same factors that strengthened the US dollar. Similarly, the S&P 500 dropped around 72 points, or 1.6%, while the tech-heavy Nasdaq saw a 1.7% decrease, equivalent to a 400-point loss.

Gold had a slightly different story, breaking its inverse relationship with the US dollar to gain about 2.5%. This was supported by reports forecasts of increased central bank purchases and a significant uptick in industrial demand for the precious metal.

ICICI Securities expected that gold and silver would reach new record highs due to “increased central bank purchases worldwide, potential trade war fears, and a likely rise in industrial demand for gold”. The financial services firm’s report also highlighted that geopolitical tensions in the Middle East and Eastern Europe, along with central banks’ diversification of their foreign reserves.

Despite the rise in the euro following an increase in consumer price inflation within the Eurozone, the strength of the US dollar and negative reports about Trump’s tariff policies led to weekly losses for the euro.

Germany’s annual inflation rate climbed to 2.6% last month, up from 2.2% the previous month, marking levels above expectations of 2.4%. The German CPI also rose by 0.4% in December compared to a previous reading of -0.2%, which was higher than the expected 0.3%

the Upcoming week

The upcoming week is packed with significant events that the markets are eagerly awaiting. These include US consumer price inflation reports, American retail sales data, and statements from various Federal Reserve policymakers.

There are also significant releases of Q4 2024 earnings reports from major financial institutions such as JPMorgan Chase, Goldman Sachs, Wells Fargo, BlackRock, Citigroup, and Bank of New York Mellon.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations