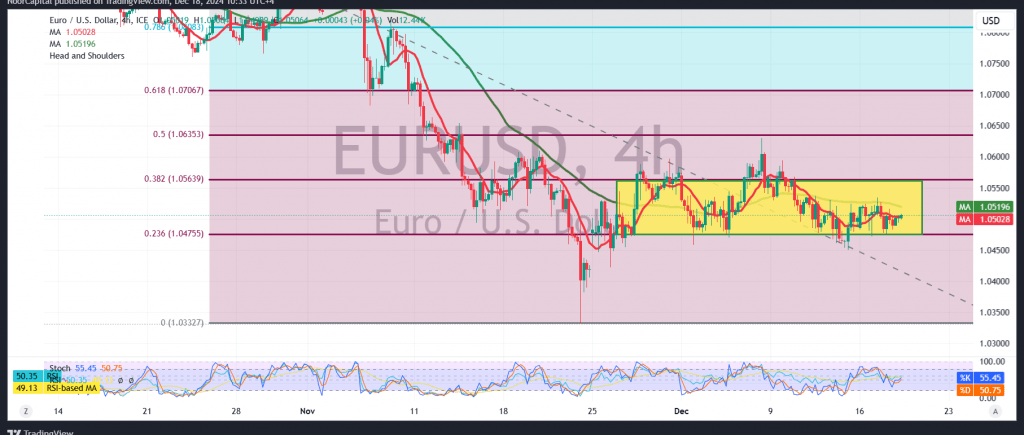

The EUR/USD pair continues to exhibit narrow sideways trading, confined between support at 1.0470 and resistance at 1.0560.

From a technical standpoint, the pair remains under pressure below the 50-day simple moving average, reinforcing the likelihood of a bearish continuation. This is further supported by the negative signals from the Stochastic indicator.

Given the stability of daily trading below the main resistance at 1.0565, near the 38.20% Fibonacci correction level, the bearish scenario remains the most probable for the day. A confirmed break below the support at 1.0470, corresponding to the 23.60% correction, would ease the path toward 1.0420 and 1.0400, respectively.

However, breaking above the resistance at 1.0560 could invalidate this bearish outlook, with the pair potentially targeting 1.0600 and then 1.0635, representing the 50.0% correction level.

Warning: High-impact economic data from the U.S., including interest rate decisions, the Federal Reserve statement, economic forecasts, and the Fed Chair’s press conference, are expected today. These events may trigger significant price volatility.

Warning: The risk level is elevated amid ongoing geopolitical tensions, leaving all scenarios possible.

Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, and multiple outcomes are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations