US crude oil futures experienced significant upward momentum, breaking the pivotal resistance level of $68.60 to achieve the anticipated targets from the previous session, reaching $70.50 per barrel.

Technical Analysis

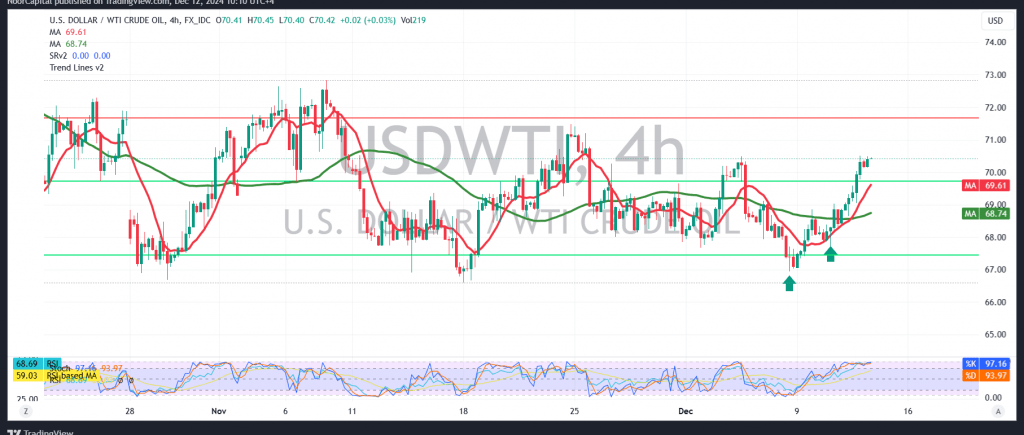

A closer examination of the 4-hour chart reveals:

- Support Levels: The price currently holds above minor support at $69.60, with the simple moving averages reinforcing the bullish momentum.

- Key Resistance Levels:

- Sustaining intraday trading above $69.60 keeps the bullish outlook intact.

- A strong breakout above the main resistance at $70.50 is essential to extend gains toward $71.10, $71.85, and potentially $72.30.

- Bearish Scenario: A close below $69.60 on the hourly chart could induce temporary downward pressure, leading to a retest of $69.10 and $68.65 before another possible rebound.

Key Events to Watch

- European Economy: ECB monetary policy updates and press conference.

- U.S. Economy: Producer Price Index (monthly and annual) and unemployment claims.

These events are likely to introduce significant price volatility.

Warnings

Traders should adopt cautious strategies as market dynamics may deviate sharply from expectations.

Elevated risk levels due to geopolitical tensions and critical economic data releases.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations