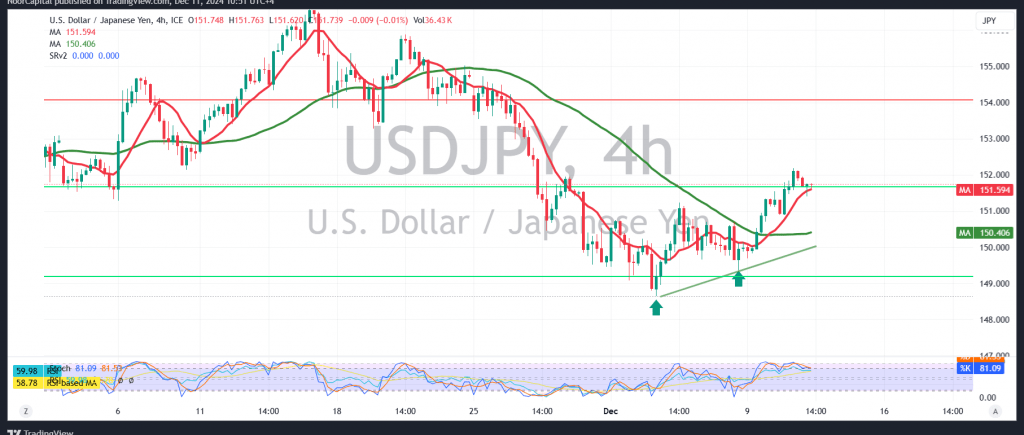

The USD/JPY pair exhibited an upward trend as anticipated, reaching the initial target of 151.95 and peaking at 152.18 during the last trading session.

Technical Analysis

The pair is currently showing mild bearish tendencies due to negative signals emerging on the Stochastic indicator, while maintaining stability above key support levels at 151.10 and 151.00.

- Bullish Scenario: The persistence of a bullish technical pattern on the 4-hour chart supports continued upward movement. If trading remains stable above 151.10, the pair is likely to target 152.30. Breaching this level would accelerate the bullish trend, paving the way toward 152.70.

- Bearish Scenario: A sustained drop below 150.00 would invalidate the bullish outlook, driving the pair back into a downward trajectory with an initial target of 150.30.

Key Events

The U.S. “Annual Consumer Price Index” and “Monthly Consumer Price Index” releases are expected today, likely resulting in significant market volatility.

Warnings:

- High risk levels persist due to geopolitical tensions and potential economic data-driven volatility.

- The expected return may not align with the elevated risks, so caution is advised during trading.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations