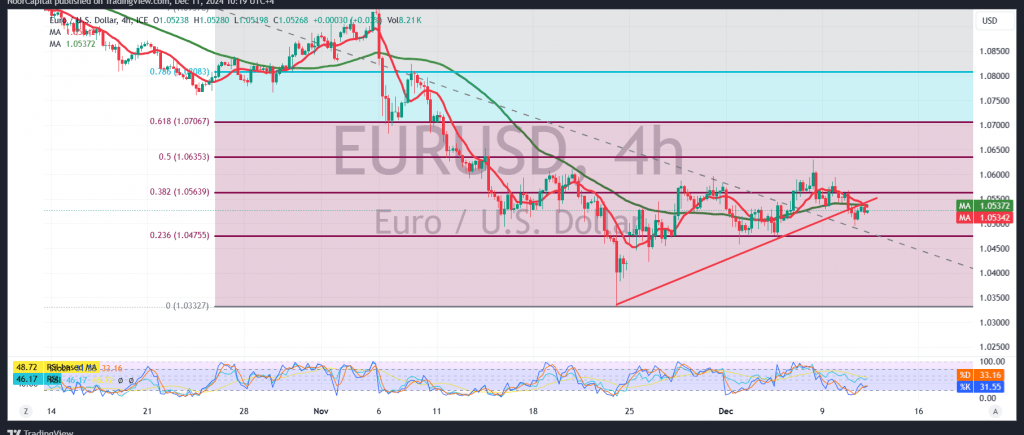

The EUR/USD pair encountered strong resistance around 1.0660, forcing it to retreat under negative pressures, marking its lowest level during the previous session at 1.0498.

Technically, the 240-minute chart reveals the return of simple moving averages exerting downward pressure on the price, coupled with bearish signals from the Stochastic indicator.

With daily trading stabilized below the pivotal resistance at 1.0560, which aligns with the 38.20% Fibonacci correction, a bearish trend is favored for the day. A decisive break below 1.0500 will ease the path toward 1.0475 as the first target, with further losses potentially extending to 1.0400, the next official station.

However, an upward break above the resistance at 1.0560 could invalidate the bearish scenario, paving the way for a recovery toward 1.0600, with additional gains targeting 1.0635 at the 50.0% Fibonacci level.

Warning: Today, we anticipate high-impact economic data from the U.S., including the “Annual Consumer Price Index” and “Monthly Consumer Price Index,” which may lead to significant market volatility.

Warning: The risk level remains high due to ongoing geopolitical tensions, and all scenarios are possible.

Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, and multiple outcomes are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations