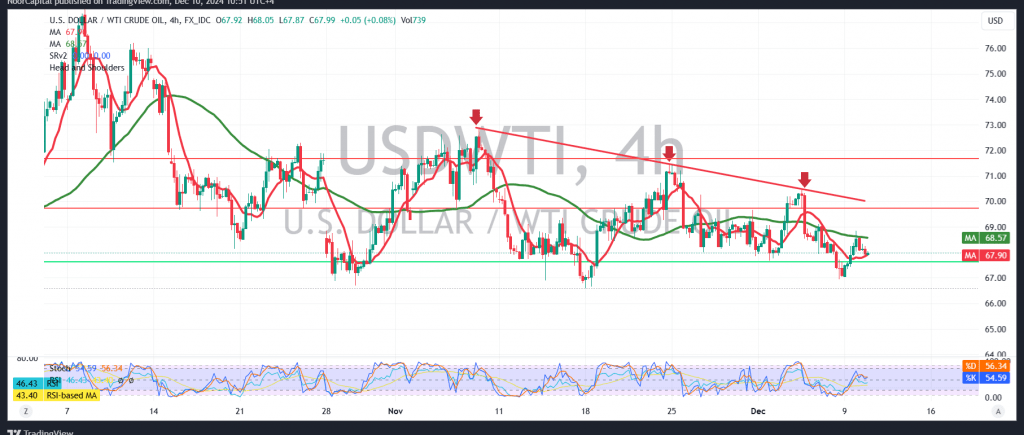

US crude oil futures attempted to move higher in the previous session, challenging the pivotal resistance level of 68.60 and reaching a peak of $68.85 per barrel.

Technically, analysis of the 240-minute chart suggests that negativity prevails due to sustained downward pressure from the simple moving averages. Additionally, the price has struggled to firmly break above and hold the critical resistance at 68.60.

With intraday trading stabilized below the main resistance at 68.60, which aligns with the 61.80% Fibonacci retracement, the bearish outlook remains dominant. A confirmed break below 67.00 is crucial to validate further declines, targeting 66.30 and 65.50 as the next levels.

However, should the price succeed in breaking and stabilizing above 68.60, it would invalidate the bearish scenario. In this case, the focus would shift to potential gains toward 69.10 and 69.70, with further extensions possibly reaching 70.40.

Warning: The risks remain high and may outweigh the anticipated returns.

Warning: Elevated risk persists due to ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations