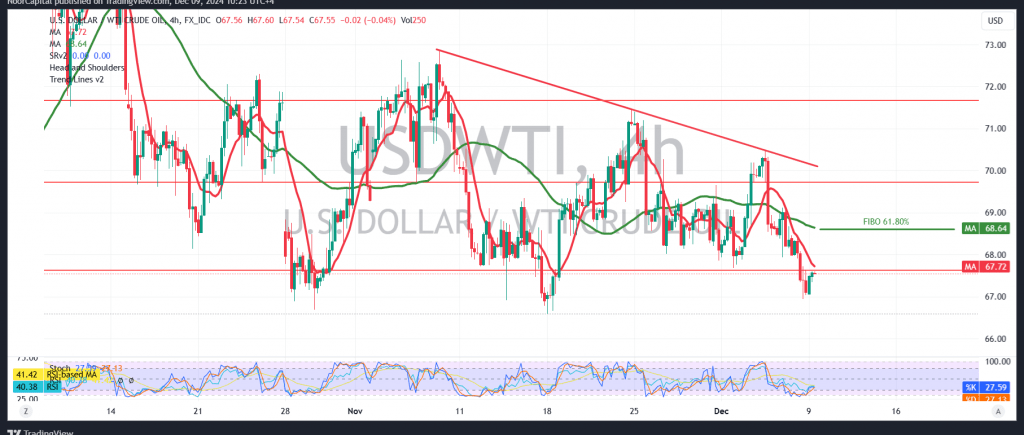

US crude oil futures prices continue their bearish trajectory, aligning with the previous negative outlook. The price reached the official target at 67.00, recording a low of $67.05 per barrel.

Technical Analysis:

- 240-Minute Chart Observations:

- The simple moving averages maintain downward pressure.

- The 14-day momentum indicator shows strong negative signals, reinforcing the bearish scenario.

Scenarios:

- Bearish Outlook:

- Intraday trading stability below the 68.60 resistance level (corresponding to the 61.80% Fibonacci correction) supports further declines.

- Key levels to watch:

- Breaking 67.00 is critical for confirming the downward move.

- Targets: 66.30, followed by 65.50.

- Bullish Reversal:

- An upward break and sustained trading above 68.60 could negate the bearish scenario.

- Targets: 69.10, with possible extensions to 69.70.

Warnings:

Risk-Reward Consideration: Evaluate carefully whether the potential gains justify the high risk involved.

Market Risks: Elevated risk levels persist due to ongoing geopolitical tensions, which may lead to unpredictable price movements.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations