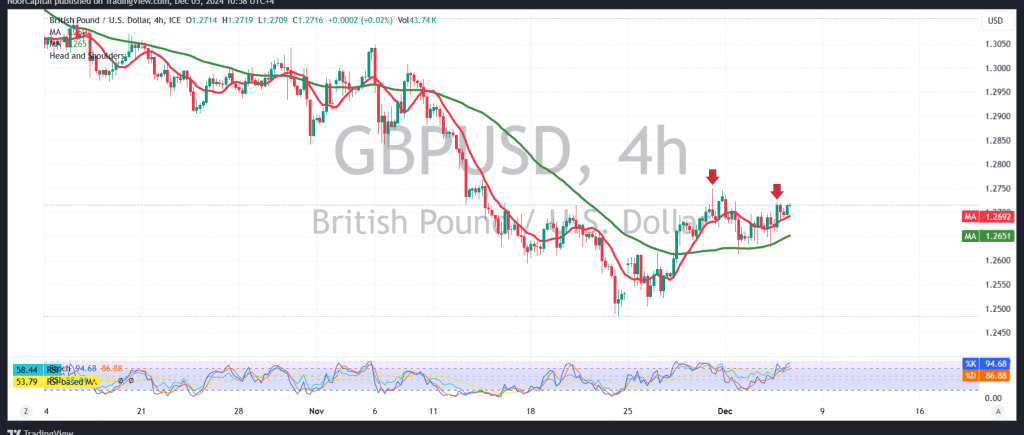

The British pound experienced negative trading against the U.S. dollar following a retest of the The technical outlook for GBP/USD remains unchanged, with the pair showing continued negative stability below the critical resistance level of 1.2730.

Technical Analysis:

- Bearish Indicators:

- The 4-hour chart reveals a bearish technical structure supporting downward momentum.

- Trading remains stable below the primary resistance level at 1.2730, reinforcing the likelihood of a bearish trend.

Scenario Analysis:

- Bearish Scenario (Most Likely):

- As long as the pair trades below 1.2730, the downward trend is expected, with targets at 1.2660 and 1.2600.

- A confirmed break below 1.2600 could accelerate bearish momentum, paving the way for a move toward 1.2570.

- Bullish Alternative:

- A sustained break above 1.2730, with at least one hourly candle closing above this level, could invalidate the bearish outlook.

- This shift would likely trigger an upward trajectory, targeting 1.2780 and extending to 1.2840.

Key Considerations:

The risk level is elevated due to geopolitical uncertainties, making robust risk management essential as all scenarios remain possible.

High-Impact Economic Data:

Today’s release of U.S. “Weekly Unemployment Claims” could introduce significant volatility, impacting GBP/USD movements.

Risk Warning:

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations