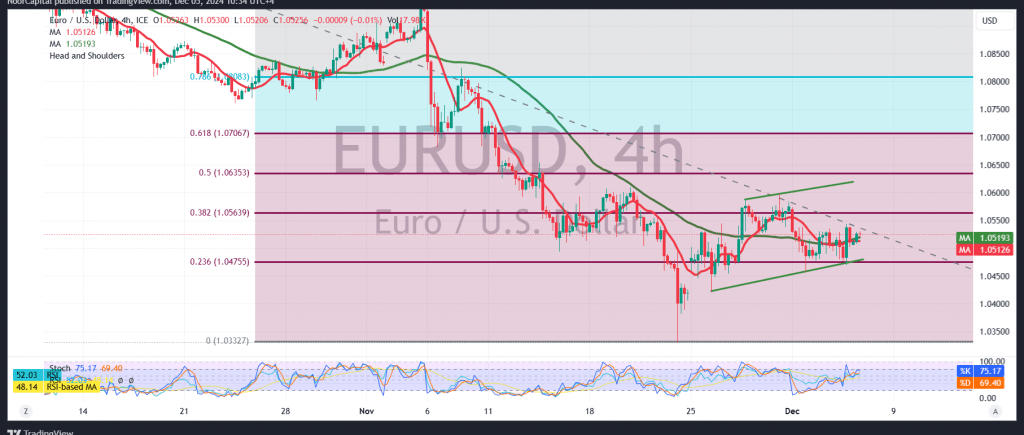

The EUR/USD pair showed a modest upward trend, benefiting from the support level of 1.0470, and reached a session high of 1.0544 during the previous trading day.

Technical Analysis:

- The pair struggled to break the critical resistance at 1.0540, as noted in the previous analysis.

- On the 4-hour chart, the Stochastic indicator continues to provide bearish signals, supported by persistent negative pressure from the simple moving averages.

Scenario Analysis:

- Bearish Case:

A continuation of the downward trend is anticipated, with trading stability below the key resistance level of 1.0560 (38.20% Fibonacci correction). The first target lies at 1.0480, and a break below this level could facilitate further declines toward 1.0440 and 1.0400. - Bullish Case:

A break above the resistance at 1.0560 could invalidate the bearish outlook, paving the way for a recovery and a retest of 1.0635, corresponding to the 50.0% Fibonacci correction.

Key Considerations:

Cautionary Note:

The risk remains elevated due to ongoing geopolitical tensions, and multiple scenarios are possible.

High-Impact Events:

The U.S. “Weekly Unemployment Claims” data release today could induce significant price volatility.

Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, and multiple outcomes are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations