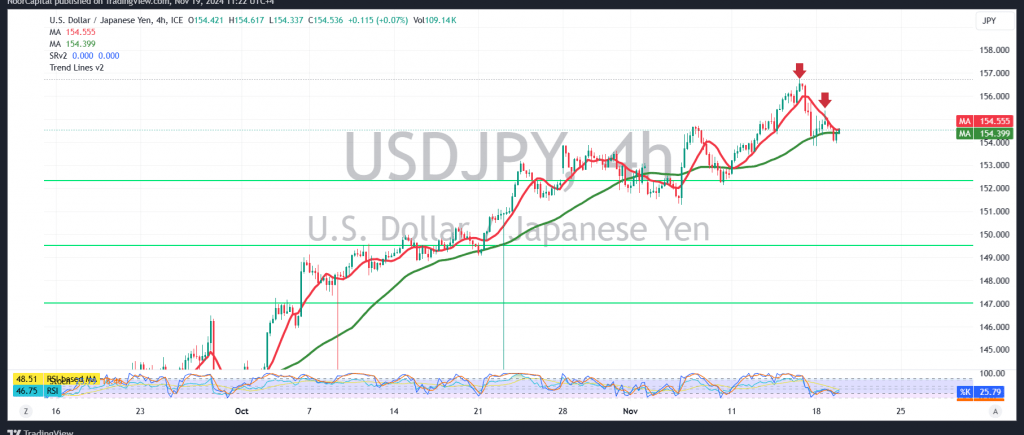

The USD/JPY pair has shown signs of a bearish trend following several sessions of upward momentum, with the pair now lacking support from the previously ascending channel.

Technical Analysis:

Currently, the pair is experiencing consistent negative pressure, trading below the 154.70 level. This downward movement is supported by:

- The simple moving averages, which exert additional pressure.

- Negative signals from the Relative Strength Index (RSI), indicating continued weakness.

Bearish Scenario:

Given these indicators, a bearish correction could extend towards 153.80. If this level is breached, it would likely accelerate the decline, paving the way for a move down to 153.10.

Bullish Reversal:

However, if the pair manages to stabilize and trade above 154.65, there is a chance of resuming the upward trend, targeting 155.35 and potentially reaching 156.10.

Warning:

The risk associated with these scenarios is significant, especially amid ongoing geopolitical tensions, requiring careful assessment before taking action.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations