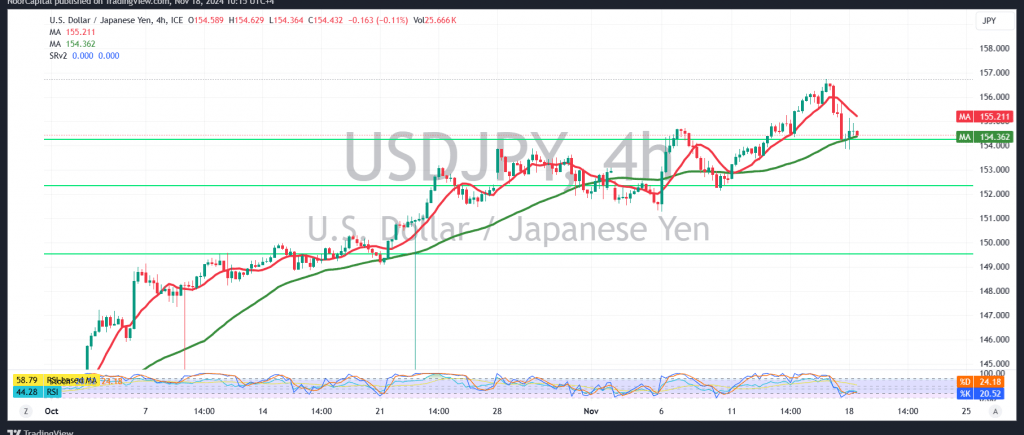

The USD/JPY pair reached the official target of 156.70 as outlined in the previous report, marking a high of 156.74.

Technically, the resistance at 156.70 has applied downward pressure on the pair, causing some bearish movements aimed at retesting the support at 154.30. Analyzing the 4-hour chart, we notice that the simple moving averages continue to favor the upward trend, and the RSI is attempting to generate positive signals.

Consequently, as long as daily trading remains above 154.00, the upward trajectory is expected to continue, with 156.20 as the next target. A breakthrough above 156.20 could further drive the pair towards 157.50.

Conversely, if the pair drops and stabilizes below 154.00, the anticipated upward scenario may be delayed, potentially leading to a retest of 153.30 before any upward recovery attempts.

Warning: The risk level is elevated and may not align with the expected return.

Warning: Heightened geopolitical tensions increase uncertainty, and multiple outcomes remain plausible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations