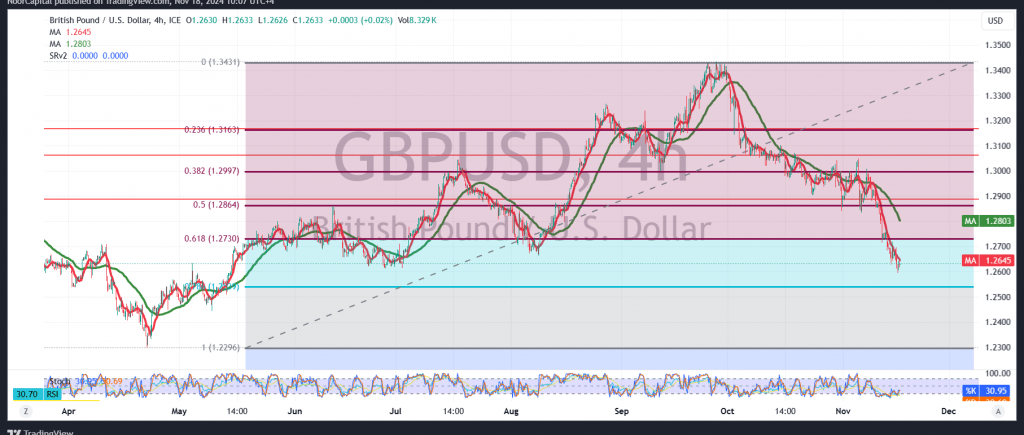

The British pound experienced significant losses against the US dollar, moving beyond the official target of 1.2660 from the previous report and hitting a low of 1.2597.

From a technical perspective, analyzing the 4-hour chart reveals that the simple moving averages continue to favor a sustained bearish trend. Furthermore, the pair remains consistently below the key resistance level of 1.2740.

As a result, we anticipate further downside movement, targeting 1.2565. A confirmed break of this level could drive the pair even lower, with additional targets at 1.2540 and 1.2485.

However, if the pair manages to close an hourly candle above 1.2740, there could be a short-term reversal, setting up an attempt to retest 1.2785.

Warning: The risk level remains elevated amid ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations