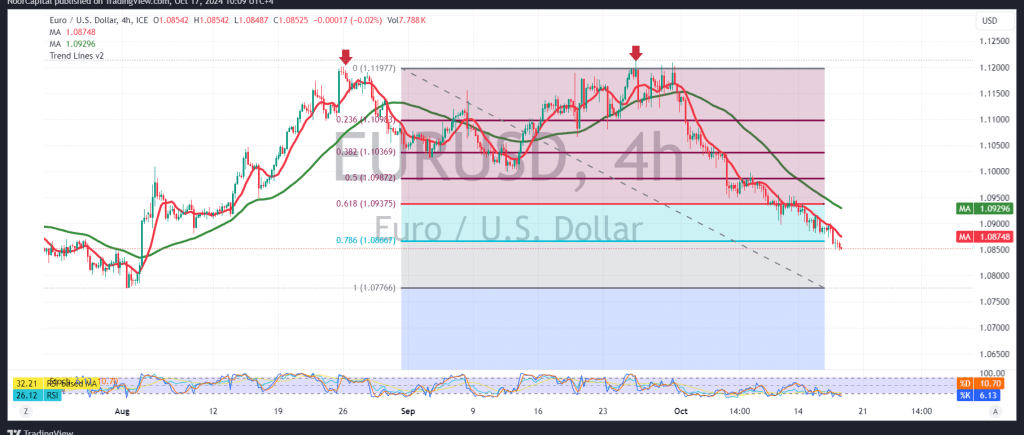

The Euro continues to decline against the US Dollar, following the expected downward trajectory as noted in the previous analysis, confirming the break of the 1.0880 level.

Technical Outlook:

Today’s analysis maintains a bearish outlook for the EUR/USD pair, with negative pressure driven by simple moving averages that support continued declines. The bearish double top pattern on the 4-hour chart reinforces this view. The next target remains at 1.0780, which is seen as a likely station unless new buying activity pushes the pair above the former support-turned-resistance at 1.0880, corresponding to the 61.80% Fibonacci retracement.

A confirmed break above 1.0940 with at least an hourly candle close could signal a short-term recovery, targeting 1.0970 and 1.1020.

Warnings:

- High-impact economic events: European Central Bank interest rates, monetary policy statements, and a press conference by the ECB President, along with key U.S. data on retail sales and unemployment benefits, are due today. This could result in heightened market volatility.

- Risk is elevated: The ongoing geopolitical tensions could lead to unpredictable movements. All scenarios are possible.

Risk Warning: The risk level remains high amid ongoing geopolitical tensions, and all scenarios are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations