Positive trading dominated the movements of the euro against the US dollar, reaching its highest level during yesterday’s trading session around 1.1214.

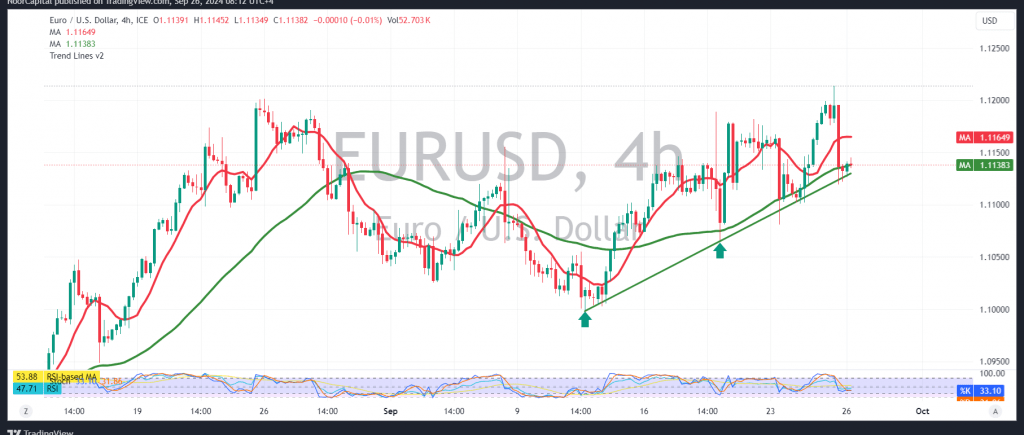

Technical Analysis: Today, we observe that the pair failed to maintain stability above the psychological resistance level of 1.1200, resulting in some negative movements. A closer look at the 240-minute chart shows the Stochastic indicator attempting to shed its negative signals, while the pair tries to stabilize above the simple moving average.

As long as daily trading remains above the strong support level of 1.1100, the upward trend is expected to stay valid and effective. A break above the 1.1200 resistance level would further reinforce and accelerate the bullish trend, potentially paving the way for a move towards 1.1250 as the first target, followed by 1.1300 as a subsequent target.

However, it’s crucial to note that a confirmed break below 1.1100 would invalidate the anticipated bullish scenario, exposing the pair to negative pressure with a likely retest of 1.1065 and 1.1030 respectively.

Important Note: Today, we anticipate high-impact economic data from the US, including the “final reading of GDP prices, unemployment claims, and a speech by Jerome Powell, Chairman of the Federal Reserve.” This may lead to significant price volatility upon the news release.

Risk Warning: The risk level remains high amid ongoing geopolitical tensions, and all scenarios are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations