Several factors dominated market activity throughout last week, including economic data, developments in the US political landscape ahead of the 2024 presidential election, escalating geopolitical tensions in the Middle East amid the ongoing war in Gaza, and updates on the monetary policies of central banks in major economies.

Economic Data

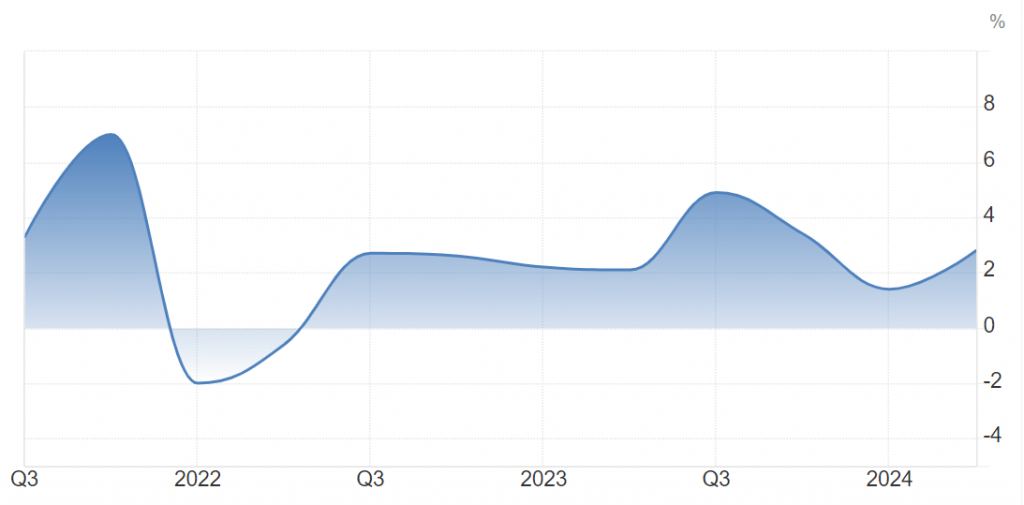

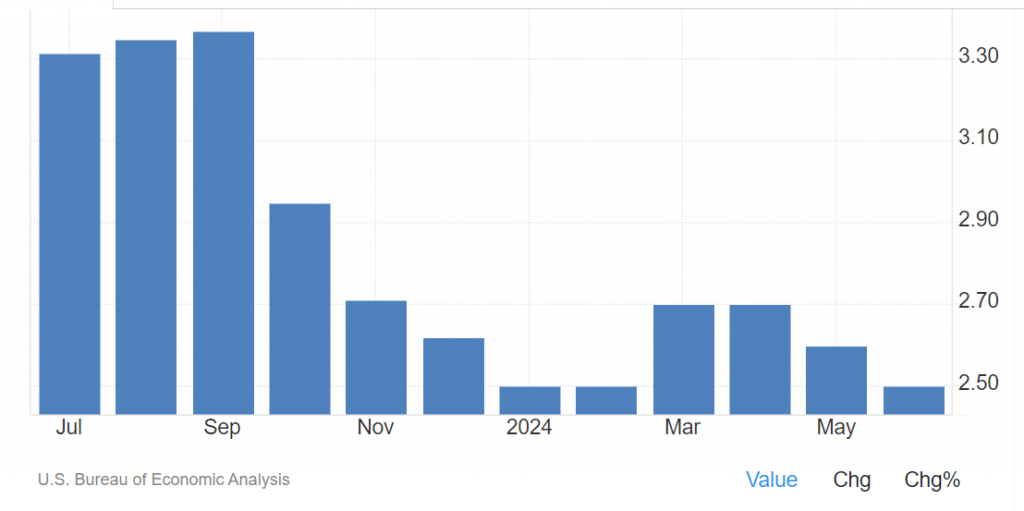

The Personal Consumption Expenditures (PCE) index, considered by the Federal Reserve to be the most reliable indicator of US inflation, rose 0.2% on a monthly basis in June, compared to a larger 0.4% increase in the previous month. This was below market expectations, which had pointed to a potential unchanged reading.

Year-over-year, the PCE index increased by 2.5% in June, compared to 2.6% in the same month last year. These figures aligned with market expectations.

Existing home sales in the United States declined by 5.4% last month compared to the previous month, according to seasonally adjusted figures. The number of units sold dropped to 3.89 million in June, compared to 4.11 million in May, according to the National Association of Realtors. This reading was below market expectations of 3.99 million units, indicating a slowdown in the housing market.

The US private sector continued to expand, as the S&P Global Composite Purchasing Managers’ Index (PMI) rose to 55, compared to 54.8 in June. However, the global manufacturing PMI declined to 49.5 from 51.6 in June, while the services PMI rose slightly from 55.3 to 56.

In the Eurozone, the S&P Global Composite PMI decreased to 50.1 in July, driven by weaker business activity in both Germany and France. This marked a halt in Eurozone growth amid a surprise decline in Germany.

Private sector activity in the Eurozone saw modest growth this month, but Germany, Europe’s largest economy, unexpectedly contracted, according to the latest Eurozone PMI. The S&P Global Composite PMI also fell to 50.1 in July, according to data released on Wednesday. While this is above the 50 level that indicates growth, it is the weakest reading since February and worse than analysts had forecast in a Bloomberg survey, which had seen the measure hold steady at 50.9 last month.

The Greenback

US dollar exhibited little to no change in value last week due to a multitude of conflicting economic, political, and geopolitical factors.

Key economic data, particularly inflation figures, exerted significant influence on the greenback. Additionally, the US political landscape leading up to the 2024 presidential election, especially with implications for the oil-rich Middle East, played a crucial role. Geopolitical tensions in the region, particularly the ongoing conflict in Gaza, further complicated the dollar’s trajectory.

Early in the week, economic growth data impacted the dollar, followed by US housing data that put additional pressure on the currency. The week culminated with the release of inflation data, which had been highly anticipated by markets and ultimately dashed any hopes of a weekly gain for the dollar.

A notable factor contributing to the dollar’s weakness was the improved risk sentiment in global financial markets following US President Joe Biden’s announcement that he would not seek re-election. This development, along with his endorsement of Vice President Kamala Harris, boosted market optimism, particularly given the perception of former President Donald Trump’s positive impact on the US economy.

Historically, there has been a positive correlation between the S&P 500 index and the likelihood of a Trump victory. Consequently, Biden’s decision increased the chances of a Trump comeback in 2024, further bolstering market sentiment.

In essence, the interplay of economic data, political developments, and geopolitical tensions created a complex environment for the US dollar last week, resulting in a relatively stagnant performance.

Tech Giants Weigh on US Stocks

US stocks experienced mixed performance last week, with a downward bias largely driven by earnings reports from tech giants. Companies such as Alphabet and Tesla, after releasing their quarterly earnings, cast a long shadow over the New York Stock Exchange.

Alphabet, Google’s parent company, and Tesla were among the hardest hit. Alphabet’s shares fell by 5% despite meeting overall earnings expectations due to a decline in YouTube advertising revenue. Tesla’s stock plunged 11% after reporting lower-than-expected earnings and declining electric vehicle sales. The broader tech industry followed suit, with companies like Microsoft, Nvidia, and Meta suffering losses of at least 5%.

These results overshadowed the tech giants that have largely driven the stock market’s gains this year. In fact, since Meta’s IPO in 2012, no single day has seen these companies lose more market value. Following the initial enthusiasm for AI stocks, some analysts have warned of a potential period of disappointment for AI-related equities. They also predict that the next two weeks will be crucial in determining the market’s direction.

Oil Prices Dip Amidst Gaza Truce Talks

Oil benchmarks declined at the close of trading on July 26, influenced by discussions surrounding a potential peace agreement aimed at ending the conflict in Gaza. This agreement would involve the return of Israeli hostages held in Gaza and a cessation of Israeli airstrikes on the territory.

In recent times, markets have been focused on efforts to broker a ceasefire in Gaza, as part of a plan announced by US President Joe Biden in May with Egypt and Qatar acting as mediators. This focus has somewhat diminished the impact of geopolitical tensions in the Middle East, which typically support global oil prices.

Reports suggest that US President Joe Biden has adopted a more assertive tone in his conversations with Israeli Prime Minister Benjamin Netanyahu to reach a settlement in Gaza. This shift in tone is attributed to Biden’s recent decision to withdraw from the presidential race, freeing him from the constraints of electoral politics.

Fed Meeting to Dominate Next Week’s Markets

The Federal Reserve’s meeting, scheduled for Tuesday and Wednesday, is set to be the most significant event shaping global financial markets next week. Anticipation surrounding the Fed’s decisions and Chairman Jerome Powell’s accompanying remarks is likely to influence market activity from the very beginning of the trading week.

While there’s a broad consensus among investors that the Fed will maintain the interest rate within the 5.25% to 5.50% range during its July meeting, the focus will be on any forward guidance provided by Powell. Many investors believe that the Federal Open Market Committee may hold off on making any changes to the interest rate until its September meeting.

US employment data will also play a crucial role in shaping market expectations. Given its importance in reflecting the health of the US labor market, these data will provide valuable insights into the Fed’s future policy direction. A deterioration in employment data could increase the likelihood of a rate cut, while stronger-than-expected data may reinforce the case for maintaining current interest rates.

Additionally, earnings reports from major US companies, including tech giant Microsoft and energy giant Exxon Mobil, will be closely watched. Furthermore, earnings from consumer-focused companies like McDonald’s and Starbucks will offer valuable insights into consumer spending patterns.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations