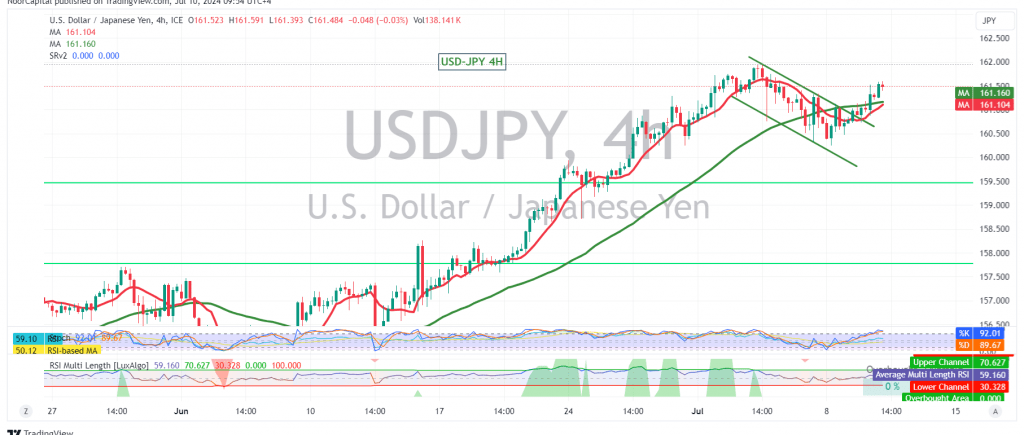

The USD/JPY pair has defied our previous downward expectation and successfully broken through the resistance level at 161.60. Technical analysis now indicates a potential bullish continuation.

Key Technical Signals:

- Support Level: The pair has established a solid base above the 160.95 support level.

- Moving Averages: Simple moving averages (SMAs) are providing positive support from below, reinforcing the bullish bias.

- Bullish Technical Formation: A bullish technical formation on the 4-hour chart further strengthens the potential for further upward movement.

Upward Potential:

The pair is poised to resume its upward trajectory, with an initial target of 161.85. A break above this level could extend the gains towards 162.20 and 162.70.

Downside Risks:

A decline below 160.95 could invalidate the bullish scenario and trigger a potential retest of 160.40 and 160.10 before the next direction is determined.

Caution:

- High Risk: The current market environment presents a high level of risk, and potential returns may not justify the risks involved.

- High-Impact Economic Data: Today’s testimony by Fed Chairman Jerome Powell could introduce significant volatility into the market.

Overall Assessment:

The technical outlook for USD/JPY has shifted towards a bullish bias, with the potential for further gains if key resistance levels are breached. However, traders should exercise caution due to the heightened risk environment and potential volatility from upcoming economic data.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations