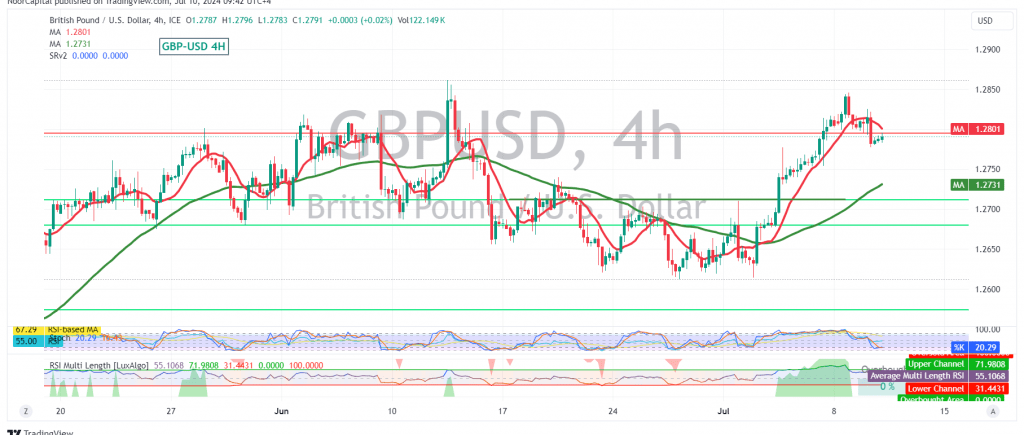

The British pound (GBP) experienced downward pressure against the US dollar (USD) in the previous session, testing the critical support level of 1.2800. However, technical analysis suggests a cautiously optimistic outlook, contingent on the pair’s ability to hold above this level.

Key Technical Signals:

- Support Level: The 1.2800 level is currently acting as a key support, with the pair attempting to regain stability above it.

- 50-Day SMA: The 50-day simple moving average (SMA) is providing positive support, potentially fueling a rebound.

Upward Potential:

A successful consolidation above 1.2800 could trigger a bullish move, initially targeting 1.2840, followed by 1.2870.

Downside Risks:

Failure to hold above 1.2800 could lead to a bearish reversal, with the potential for a retest of the 1.2720 support level, which was previously a resistance level.

Caution:

- High-Impact Economic Data: Today’s testimony by Fed Chairman Jerome Powell could introduce significant volatility into the market. Traders should exercise caution during this event.

Overall Assessment:

The technical outlook for GBP/USD is cautiously optimistic, with the potential for an upward move if the pair can maintain its position above 1.2800. However, a break below this level could trigger a bearish reversal. Traders should closely monitor price action around 1.2800 and be prepared for increased volatility due to the upcoming economic data release.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations