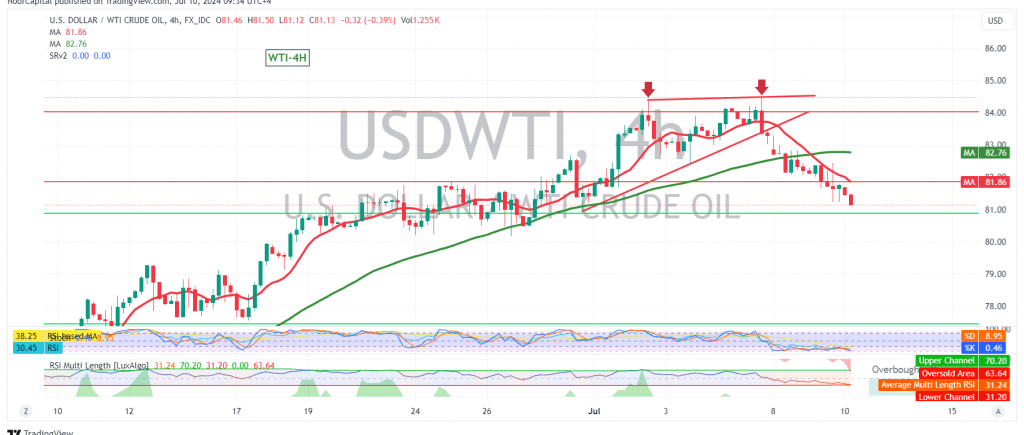

As anticipated, US crude oil futures experienced a significant decline, reaching our initial bearish target of 81.60 and currently trading around $81.15 per barrel. The technical outlook suggests the potential for further downside movement.

Key Technical Signals:

- Psychological Support Breakdown: A break below the psychological support level of 82.00 would confirm the continuation of the downward correction.

- Moving Averages: Negative pressure from the simple moving averages reinforces the bearish bias.

- Downward Targets: The primary target for this correction is 80.75. A break below this level could accelerate the decline, potentially targeting 80.30 and ultimately 79.50.

Potential Bullish Reversal:

A return of trading stability above 82.00 could invalidate the bearish scenario and potentially reignite the upward trend towards 82.85 and 83.30.

Caution:

- High-Impact Economic Data: Today’s testimony by Fed Chairman Jerome Powell could introduce significant volatility into the market. Traders should exercise caution during this event.

- Geopolitical Tensions: Ongoing geopolitical tensions further elevate the risk of heightened price fluctuations.

Overall Assessment:

The technical outlook for WTI crude oil remains bearish, with the potential for further downside movement if key support levels are breached. Traders should closely monitor price action around 82.00 and be prepared for increased volatility due to upcoming economic data and geopolitical events. A break below 80.75 would further confirm the bearish momentum, while a recovery above 82.00 could signal a potential reversal.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations