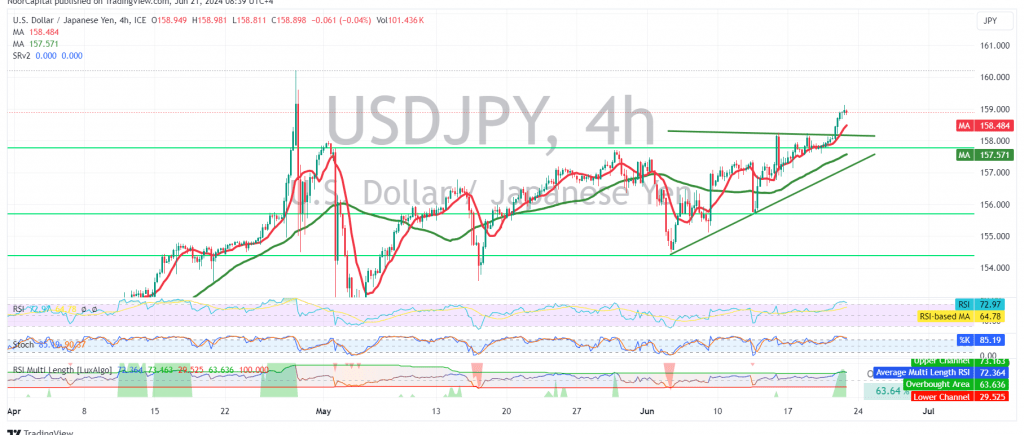

The USD/JPY pair continues its steady ascent, reaching our previously identified targets and approaching the first official target of the current upward wave at 159.30, with a peak of 159.12 during early trading today.

Technical Outlook:

On the 240-minute chart, the pair demonstrates solid stability above the crucial 158.15 support level. The simple moving averages continue to provide positive momentum, reinforcing the ongoing upward price movement.

Upward Potential:

With the current bullish momentum and stable trading above 158.15, the upward trend remains valid and effective. Our revised initial target is now 159.40, with the potential for further gains towards 159.85. The next significant target for this upward wave is located around 160.50.

Downside Risks:

However, traders should exercise caution as a drop below 158.15 could trigger a temporary pullback to retest the main support at 157.50. This would not necessarily invalidate the overall bullish trend but could provide a short-term opportunity for consolidation before further upward movement.

Key Levels:

- Support: 158.15, 157.50

- Resistance: 159.40, 159.85, 160.50

Important Note:

The release of high-impact economic data today, including the services and manufacturing PMI indices from major economies, could induce significant price volatility. Traders are advised to remain vigilant and closely monitor market reactions to these news releases.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations