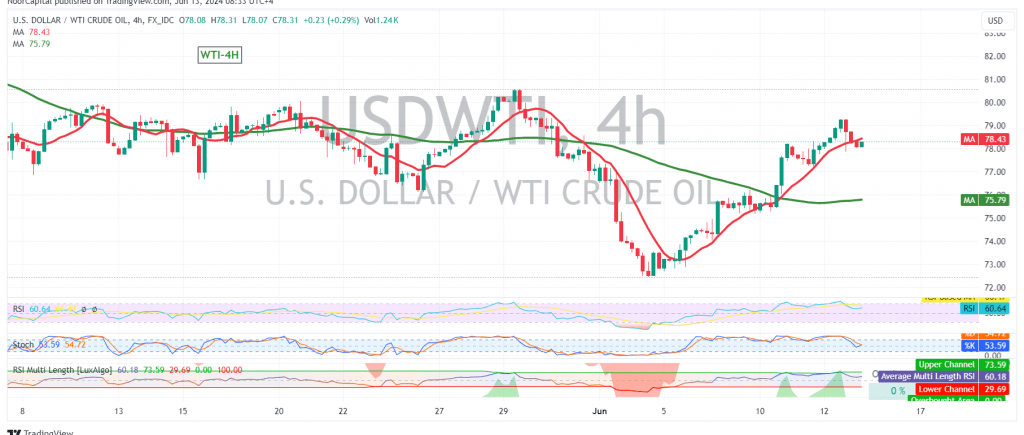

WTI crude oil futures prices experienced notable gains yesterday, reaching our previously identified target of 78.80 and peaking at $79.28 per barrel.

Technical Outlook

We maintain a cautiously bullish outlook, supported by the positive influence of the 50-day simple moving average and the price holding above the crucial 77.60 support level. These factors suggest the potential for further upward movement.

Upside Targets

A break above 79.00 would strengthen the bullish momentum, opening the door for a move towards 79.85 and potentially 80.40.

Downside Risks

However, traders should remain cautious as a break below 77.60 could trigger a reversal, potentially leading to a decline towards 77.00 and even 76.30.

Important Note

The release of high-impact U.S. economic data today, including annual producer prices and basic monthly/annual producer prices excluding energy and food, could induce significant price volatility. Additionally, ongoing geopolitical tensions further elevate the risk level, potentially resulting in sharp price fluctuations.

Key Levels:

- Support: 77.60

- Resistance: 79.00

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations