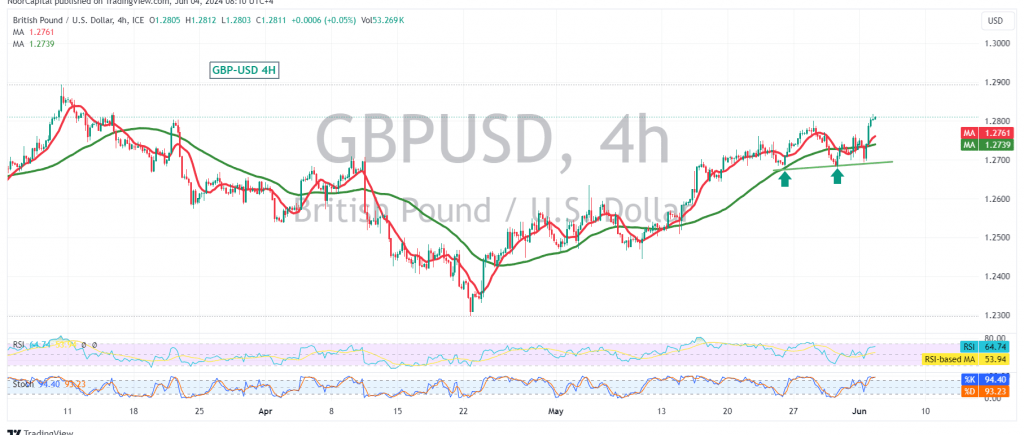

The British pound experienced a significant surge against the U.S. dollar, successfully defending the crucial psychological support level of 1.2700 and reaching an intraday high of 1.2818. The pair is currently consolidating near this peak, signaling a potential continuation of the upward momentum.

Technical indicators reinforce the bullish outlook for GBP/USD. The price’s stability above the 1.2700 support, coupled with the continuous positive signals from the simple moving averages, suggests a strong foundation for further gains.

The upward bias is expected to remain in play today, with the potential for a decisive break above the 1.2855 resistance level. This breach could trigger a surge in buying pressure, propelling the pair towards 1.2900 and potentially even 1.2935.

However, traders should remain vigilant as a drop below 1.2700 could invalidate the bullish scenario and put the pair under downward pressure. In this case, a retest of the 1.2630 level is possible before any further attempts to rise.

Caution is advised as the U.S. economy is set to release high-impact economic data, including job vacancies and labor turnover rate figures. These announcements could introduce significant volatility into the market.

In conclusion, the GBP/USD pair is exhibiting strong bullish momentum, with the potential for further gains if it can maintain its position above key support levels. However, traders should be mindful of the potential for volatility due to upcoming economic data releases and adjust their strategies accordingly.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations