WTI crude oil experienced mixed trading yesterday, oscillating between gains and losses while approaching the previously identified target of 80.75. The commodity reached an intraday high of $80.60 per barrel before encountering resistance.

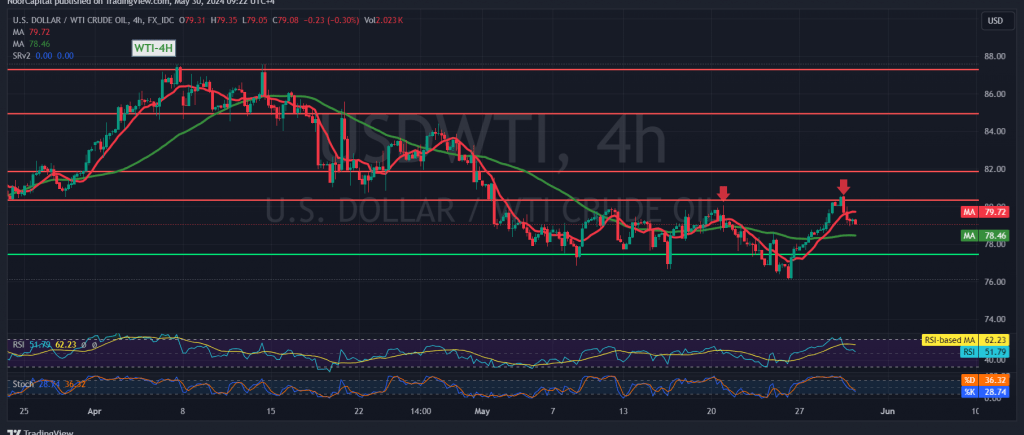

Technical analysis reveals a shift in momentum. The price failed to sustain above the $80.00 level and broke below the 79.60 support, which also served as the 23.6% Fibonacci retracement level on the 240-minute timeframe chart. Additionally, the price is now trading below the 50-day simple moving average, which is acting as resistance.

These developments suggest that further downside movement is possible. The immediate targets for a potential correction are 78.50 and 78.00, with the possibility of further losses extending towards 77.60.

However, a decisive move above the previously broken support at 79.60 could invalidate the bearish scenario and reignite the upward trend. This could propel oil prices towards 80.10 and potentially even 81.10.

Traders should exercise caution today, as high-impact economic data releases from the U.S. economy, such as unemployment benefits and the preliminary reading of quarterly GDP, are expected. These announcements could introduce significant volatility into the market.

Furthermore, ongoing geopolitical tensions continue to pose a risk of heightened price fluctuations in the oil market. Traders are advised to remain vigilant and adapt their strategies accordingly to navigate the potential market volatility.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations