After losses during the past trading session, Bitcoin is making an attempt to recover. After plunging over 6% on Wednesday and having its worst monthly performance in April since late 2022, it has bounced back from the lows set on Wednesday, currently trading at $590,111 as of this writing. The world’s most well-known cryptocurrency saw a sharp decline on Wednesday due to a mix of bets regarding the Federal Reserve’s interest rate decision and profit-taking.

Ahead of the Federal Reserve’s announcement on interest rates, investors—especially whales—withdrew their money from cryptocurrency. The most popular cryptocurrency in the world had a value decline of about 16% in April as investors booked gains on a spectacular rise that saw the price soar past $70,000.

Wave of Selling

Bitcoin has fallen to its lowest point since late February, with a 5.6% drop. Ethereum also experienced a 3.6% drop, down 3.6% at $2,857. Despite being 22% below its all-time high of $73,803, the price has increased by 35% this year and doubled from January due to billions of dollars invested in recently established exchange-traded funds.

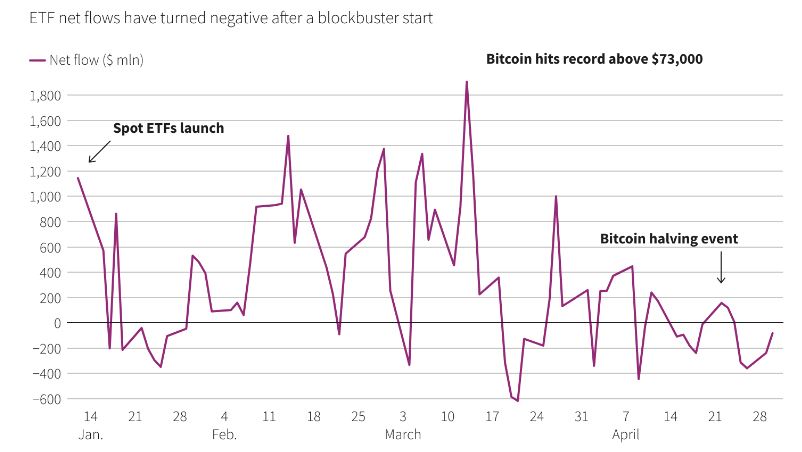

The main causes of the current decline are increased profit-taking by investors who entered the market during the downturns of 2022 and 2023, as well as ETF investors who saw a notable increase in share price after joining the market in the first few weeks of 2024. In US premarket trading, stocks linked to cryptocurrencies also dropped, with Coinbase experiencing a 4.6% decline and Riot and Marathon Digital experiencing 4.2-4.3% drops.

Impact of FOMC Decision

Although the Fed’s decision to hold off on raising rates wasn’t a surprise, the market was shaken by the lack of a firm commitment to further rate decreases. Investors worry that a more aggressive Fed position may reduce risk appetite and constrain liquidity, which would hurt cryptocurrencies like Bitcoin.

The Federal Open Market Committee (FOMC) is not anticipated to alter interest rate stance soon on the macro level, but investors are beginning to believe that the central bank might not lower rates at all this year, which would be devastating for interest rate-sensitive assets like cryptocurrencies, emerging market stocks and bonds, and even commodities.

Investors have made the appropriate response. Since their launch in January, the top ten U.S. spot bitcoin exchange-traded funds (ETFs) have seen their greatest weekly withdrawal. This week’s outflows have reached $496 million, mostly because, according to LSEG statistics, flows into BlackRock’s iShares Bitcoin Trust, the largest in terms of holdings, have halted.

Smaller altcoins have also suffered, despite the fact that they occasionally stand to gain from flaws in the two major tokens. Solana’s sol token, along with meme coins dogecoin and Shiba Inu, which were also partially popularized in 2021 by Tesla owner Elon Musk, have dropped over a quarter of their value in the previous seven days.

The halving event for Bitcoin that occurred last month did not significantly boost its value. Since the halving on April 20, the price of bitcoin has decreased by almost 15%. A modification to the cryptocurrency’s core technology intended to slow down the creation of new bitcoins is what attracted a lot of investors to the market in the lead-up to the event.

A new phase in the bitcoin downturn is about to begin. In addition to May being a month of seasonal weakness for bitcoin, the recent price decline highlights $55,700 and $51,000–$52,000. Nevertheless, there is ample chance to either quicken or stop the decline in the monthly jobs data, NFP, on Friday.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations