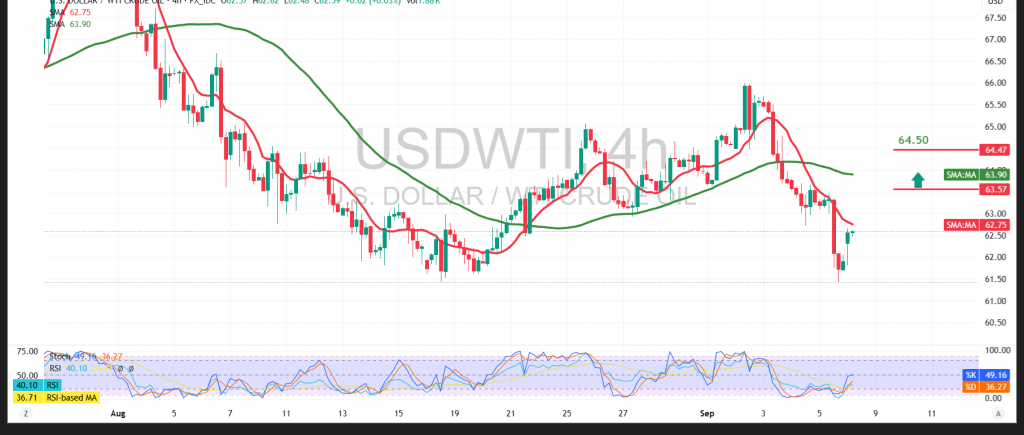

US crude oil futures (WTI) rebounded from the pivotal support at 61.60, with stability above this level reinforcing the intraday bullish wave.

Technical Outlook – 4-hour timeframe:

Holding above 61.60 provided the foundation for a solid rebound, with the Relative Strength Index (RSI) confirming renewed momentum after recovering from oversold conditions. This highlights the strength of the current upward move. However, the 50-period simple moving average (SMA) remains a strong resistance barrier. A confirmed break above 63.50 would be required to unlock further gains and pave the way toward the next resistance levels on the chart.

Conversely, a decisive move below 61.90 would restore bearish pressure and increase the likelihood of a retest of previous support zones.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 61.55 | R1: 63.55 |

| S2: 60.50 | R2: 64.50 |

| S3: 59.55 | R3: 65.50 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations