The global economic narrative is dominated by a high-stakes question: can the Federal Reserve navigate a soft landing? The data presents a contradictory picture. On one hand, the U.S. labor market is showing clear signs of cooling, with recent reports indicating softer job gains and a rise in initial jobless claims.

On the other hand, inflation, while off its peak, remains elevated. This dilemma places policymakers at a critical juncture. The market’s anticipation of a rate-cutting cycle to stimulate the economy is strong, yet this move risks reigniting price pressures. This article argues that the Fed’s imminent decision to cut rates is a calculated risk, betting that the slowdown in the labor market is a more pressing concern than the current level of inflation. The true test lies in whether this policy pivot can achieve its goal without unleashing a new wave of price hikes.

The Dual Reality of Inflation and Employment

Source: FactSet

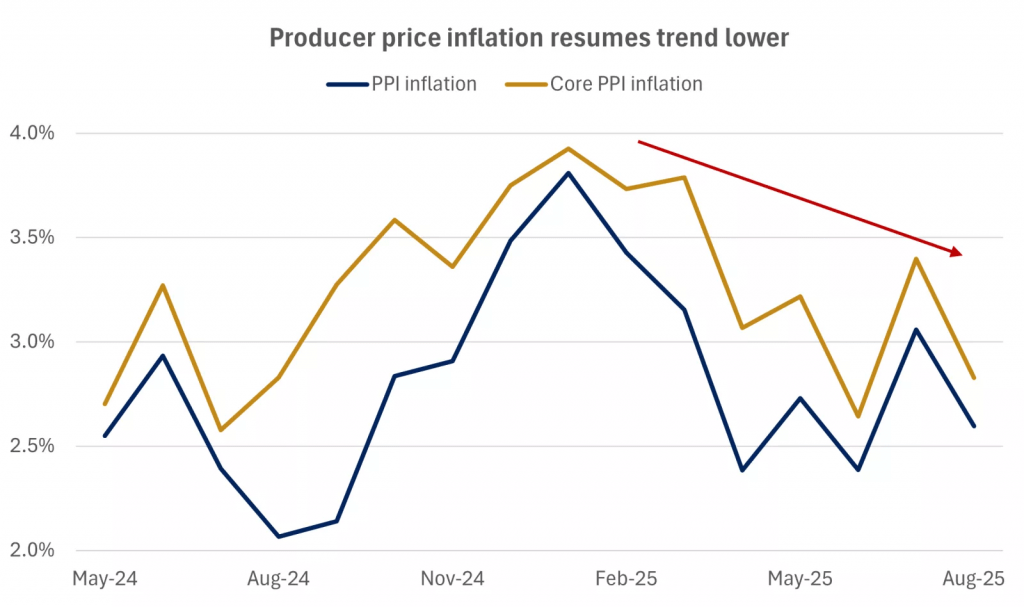

The recent inflation reports delivered a mixed verdict. The Consumer Price Index (CPI) for August came in at 2.9% annualized, roughly in line with expectations. While still above the Fed’s 2.0% target, it was not a significant spike. Simultaneously, the Producer Price Index (PPI) resumed its downward trend, falling to 2.6%. This divergence suggests that while some costs are being passed on to consumers, wholesale price pressures are easing, which could eventually filter through to the CPI.

Source: FactSet

This nuanced inflation picture is contrasted by a more definitive trend in the labor market. The Bureau of Labor Statistics’ quarterly census of employment and wages revealed nearly a million fewer jobs than previously reported for the 12-month period through March. This significant downward revision, combined with initial jobless claims hitting a four-year high, paints a clear picture of a softening labor market. For the Fed, which has a dual mandate to manage both inflation and employment, this weakening labor data likely tips the scales toward a more accommodative monetary policy, despite inflation remaining above its target.

The U.S. Dollar and Treasury Yields: A Tale of Two Expectations

The market’s anticipation of a rate cut is already having a tangible effect on key financial instruments. The U.S. dollar, which tends to strengthen in a high-interest-rate environment, has seen its rally stall and even retreat against major currencies. This is a direct result of the market pricing in a more dovish Fed. A weaker dollar could, in theory, boost U.S. exports but also makes imports more expensive, potentially adding to inflationary pressures down the line.

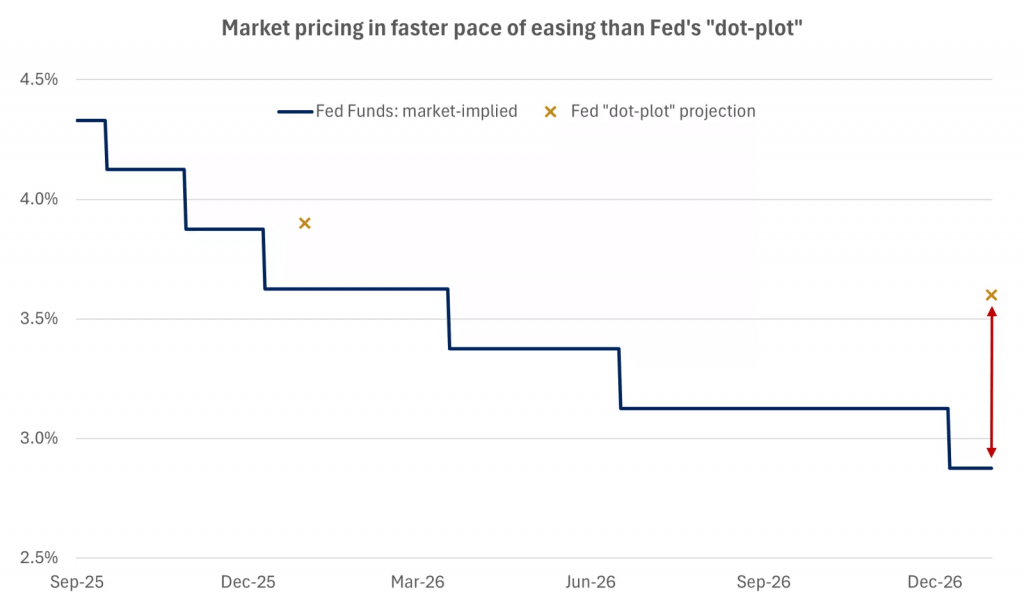

Simultaneously, Treasury yields have responded in a predictable manner. The benchmark 10-year Treasury yield briefly fell to 4.0%, matching its yearly low. This drop in yields reflects investor confidence that a rate-cutting cycle will lower borrowing costs across the board, which is seen as supportive of the broader economy. However, the market’s pace of anticipated easing is faster than the Fed’s own projections. This disconnect will be a key point of focus at the upcoming Federal Open Market Committee (FOMC) meeting, where the “dot plot”—the Fed’s summary of its own rate projections—will be updated. Any deviation from market expectations could trigger significant volatility in both currency and bond markets.

Source: Source: U.S. Federal Reserve, CME FedWatch

Gold, Oil, and Global Geopolitics

While U.S. economic data sets the stage, global factors add layers of complexity. In this climate of uncertainty, gold has maintained its traditional role as a safe-haven asset. Its recent performance suggests that some investors are hedging against potential economic shocks and a less aggressive U.S. dollar.

Meanwhile, the energy market is grappling with heightened geopolitical risks. Crude oil prices have been trending upward, largely due to ongoing tensions in Eastern Europe. Recent drone attacks on Russian energy infrastructure have created supply-side concerns, which could contribute to global inflationary pressures regardless of the Fed’s actions. This adds a critical, unpredictable variable for policymakers to consider.

Leaders like Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde must factor these external shocks into their decisions, underscoring the delicate balance required to manage their respective economies.

A Prudent Approach for Investors and Traders

The road ahead is paved with both opportunity and risk. As the Fed prepares to embark on its rate-cutting journey, investors and traders should exercise a healthy dose of caution. The market’s aggressive pricing for multiple rate cuts may not be fully justified by the Fed’s own, potentially more conservative, outlook.

Instead of making speculative bets on the pace of easing, a focus on fundamentals is paramount. The current environment calls for vigilance and a well-informed strategy. The key to navigating this landscape is to remain fully informed, understand the implications of both economic data and geopolitical events, and adhere to a reasonable level of caution. The true story of this economic cycle will be told not in a single meeting, but in the long-term ripple effects of policy decisions, and those who remain diligent will be best positioned to weather the coming shifts.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations