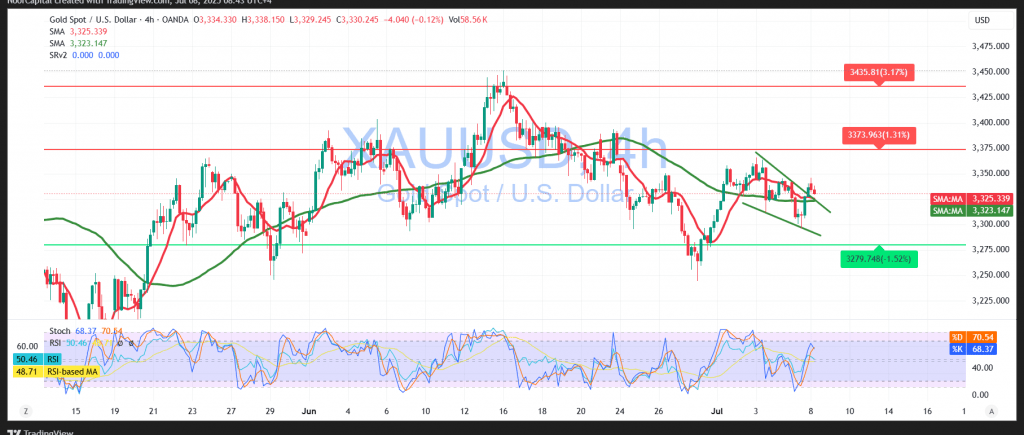

Gold prices recorded a strong session of positive movement, rebounding sharply after finding firm support at the key $3295 level. The recovery led to an intraday high of $3345 per ounce, highlighting a technical bounce from oversold territory.

Technical Outlook – 4-Hour Timeframe

The $3345 zone is currently acting as a significant resistance level, triggering some minor declines due to profit-taking. Despite this, the short-term structure remains constructive:

- The simple moving averages are aligning beneath the price, offering dynamic support and helping maintain the upward momentum.

- The Relative Strength Index (RSI) has exited oversold territory and is gradually trending higher, signaling a restoration of buying strength.

Probable Scenario

As long as $3295–$3300 holds as support, the bias remains bullish, with the next immediate resistance seen at:

- $3352, followed by

- $3375 as a potential secondary upside target

A confirmed break above $3352 would be a catalyst for further gains and could extend the bullish wave.

Alternative Scenario

Should gold break below $3295, the bullish setup would be invalidated, reintroducing downward pressure with a potential retest of $3275.

Warning

Risk levels remain high amid ongoing global trade and geopolitical tensions. Market volatility may surge unexpectedly, and traders should remain cautious of sudden directional shifts.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations