The Bank of Canada is expected to maintain a 5% interest rate at its upcoming meeting, with a possible first rate cut in June. This approach will allow the Bank to monitor GDP figures and their impact on the interest rate’s outlook, as economic analysts believe the Canadian economy is slowing down and aligning with the Central Bank of Canada’s expectations.

Recent Canadian data

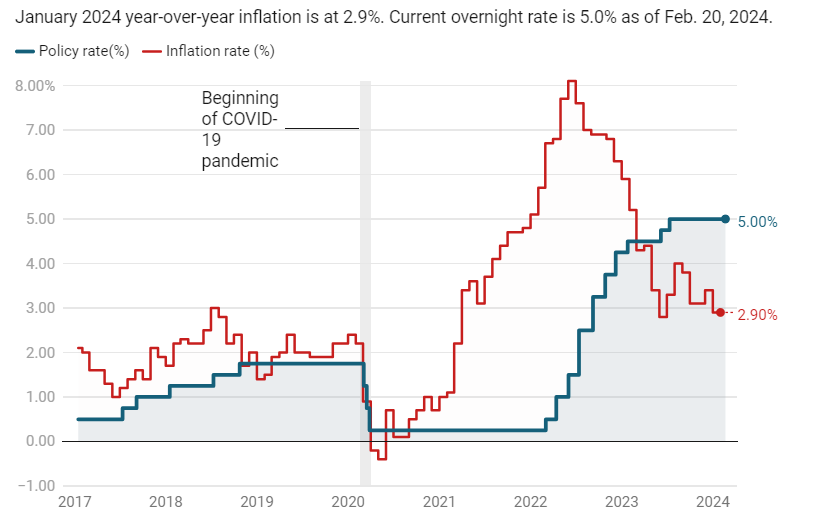

Canada’s annual inflation rate reached 2.9% in January, falling short of the Bank of Canada’s 2% target for 2025. The rate was slightly higher than 3.4% in December. The fourth quarter of 2023’s GDP was higher than Bank of Canada’s expectations of no growth and analysts’ expectations of 0.8% expansion. The index remained unchanged in December, falling short of the growth target of 0.2%. The growth was driven by higher exports but lower imports.

Economists suggest that the Canadian central bank should reconsider its inflation approach due to the significant impact of the housing sector on inflation, as over half of total inflation in Canada comes from housing costs, which is now the most significant factor preventing the bank from achieving its 2% inflation target.

Adjusting the budget is key to interest rate cut

Canadian Prime Minister Justin Trudeau should adjust spending rates in his next budget to reduce interest rates and reduce the pressure on the cost of living, which negatively affects his voting percentages. Trudeau has increased support for public health and social services programs over the past eight years, but spending has risen during the COVID-19 pandemic, resulting in Canada’s largest budget deficit since World War II.

BoC Governor Tiff Macklem has recently warned that federal and provincial government spending may slow interest rate cuts. Finance Minister Chrystia Freeland has promised lower interest rates and meeting fiscal targets.

Canadian Dollar’s Performance after US ISM PMI figures:

The USD/CAD pair was 0.01% on Tuesday, at 1.3590 versus previous closing at 1.35924. The Canadian Dollar, initially, climbed against the US Dollar on Tuesday before falling back once more after the US ISM Services Purchasing Managers Index (PMI) and US Factory Orders both missed forecasts.

Market hopes for an accelerated path toward Federal Reserve (Fed) rate cuts are pinning back into the high end as US economic figures tease a steepening economic contraction in the US.

February’s US ISM Services PMI declined to 52.6 versus the forecast of 53.0, 53.4 previously. ISM Services Prices Paid also fell to 58.6 from the previous 64.0. US Factory Orders in January slid to -3.6% MoM, missing the -2.9% forecast, and the previous month’s print saw a downside revision to -0.3% from 0.2%.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations