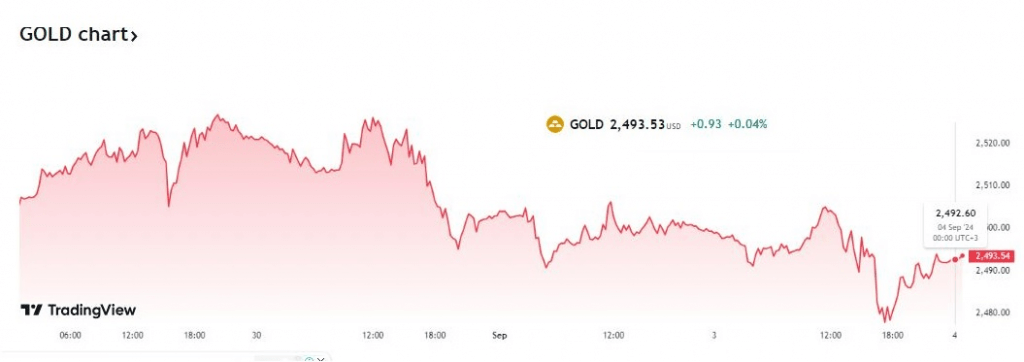

Gold traded below 2,500 per ounce on Tuesday, as the precious metal, which was formerly associated with stability and prosperity, has been steadily declining. Recent weeks have seen a sharp decline in gold prices, mostly due to the US dollar’s steadfast growth. In the financial markets, the inverse relationship between gold and the US dollar is a well-known phenomenon. Gold loses relative appeal to investors as the value of the dollar increases, which lowers demand and drives down price.

The general scene of the economy and the attitude of the market are reflected in the drop in gold prices. The future of precious metals is still unknown, but given their historical performance as an inflation hedge and store of value, they might still have a place in a well-rounded investment portfolio. Investors will need to weigh the benefits and hazards of gold carefully in order to make wise decisions as the economy changes.

The Dollar’s Dominance

There have been several causes that have contributed to the US dollar’s rise. Interest rates have increased as a result of the Federal Reserve’s continuous monetary tightening, which is intended to reduce inflation. This lessens the allure of holding gold and other non-interest bearing assets. Furthermore, the US economy’s ability to withstand global economic difficulties has increased the dollar’s allure as a safe-haven currency.

Economic Data, Market Sentiment

The Federal Reserve’s policy decisions and market sentiment have been greatly impacted by the release of economic statistics, especially US employment data. The dollar has strengthened and gold prices have been pressured by anticipation of more interest rate hikes spurred by strong labor market statistics.

Investor Uncertainty and Volatility

The market’s uncertainty regarding the future path of interest rates and the overall economic outlook has contributed to increased volatility in gold prices. Investors are grappling with conflicting signals, as some economic indicators suggest a slowing economy, while others point to continued resilience. This uncertainty has led to a more cautious stance among gold investors, who are hesitant to commit to large positions.

Outlook for Gold

Despite the recent decline, gold’s allure as a safe-haven asset remains intact. Geopolitical tensions, inflationary pressures, and potential economic downturns could provide a catalyst for a rebound in gold prices. However, the continued strength of the US dollar and the Federal Reserve’s commitment to maintaining price stability pose significant headwinds.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations