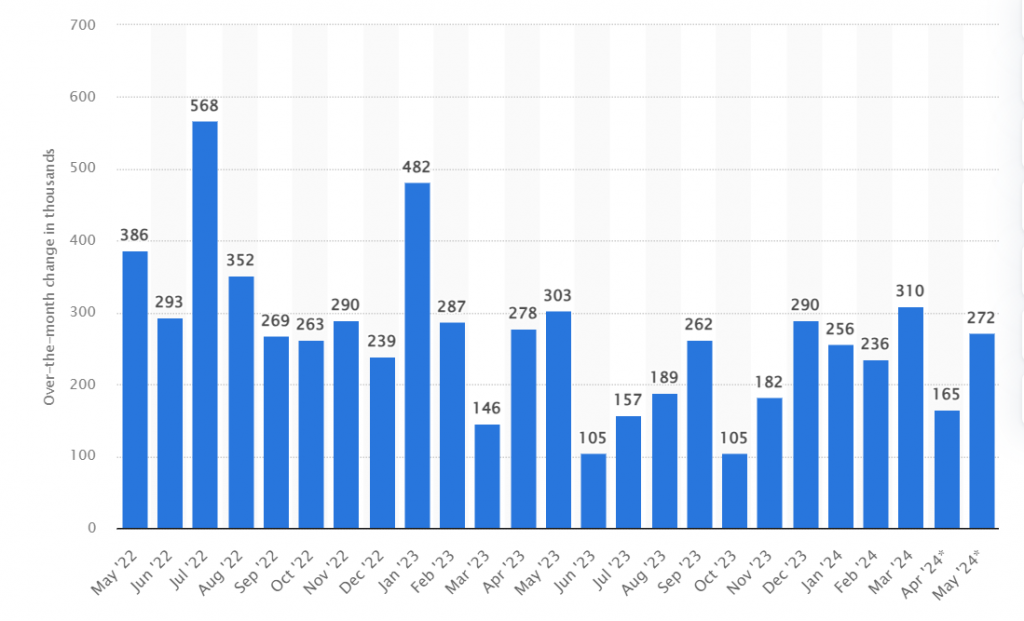

The most important US labour data will be released later on Friday, amid expectations of a significant decline in job growth in the United States, with a stability in the unemployment rate, in addition to a limited decline in wage growth.

On the first Friday of every month, the employment data is issued, led by the index of change in US Non-Farm Payrolls, which sets the tone of the markets throughout the month after shedding light on the conditions of the US labour market, which paints a clear picture of the performance of the world’s largest economies.

The importance of US employment data also lies in the fact that it is not only data that determines the strength of the US economy’s performance, but it is also data that sheds light on one of two basic tasks that the Fed must successfully accomplish in order to enhance the performance of the US economy. They are price stability and maximum employment in the country.

Fed, Labour Market

Employment print in the first week of July is becoming more important as it comes after a speech by Jerome Powell, Chairman of the Fed, and FOMC meeting minutes, increasing the interest of investors in the financial markets in it, given that it is one of the factors that determine the extent of the success of the central bank in accomplishing one of the basic tasks assigned to it.

The Fed kept the interest rate unchanged at its June 11-12 meeting, avoiding reducing it amid its continued battle against inflation. The central bank and its president expressed a state of satisfaction with the results of the monetary authorities’ efforts to reduce inflation towards the official target set at 2.00. %.

Thus, the interest rate continues to operate in the range of 5.25% – 5.50% (higher for longer), which is the rate that the Central Bank has adopted since last July when it raised interest to this level, which indicates its highest level in about 23 years.

Regarding the labour market, a number of members also suggested that there are some new developments in the product market and the labour market in the United States that shed light on what supports their view that inflationary pressures are declining, according to the results of the Fed’s meeting that appeared last Wednesday.

According to FPMC minutes, “When looking at the employment data that appeared recently, some participants noted that although the high rate of job growth remains strong, the current improvement is consistent with the required balance in the labour market greater than it was in the past due to immigration”.

Fed Chair Jerome Powell noted that the risks of moving too early or too late are now neutralized this year, as inflation has begun to fall while the “labour market has retained its strength,” at a forum organized by the European Central Bank, in Portugal this week. It should be noted that Powell in this forum adopted an optimistic rhetoric after the Fed’s rhetoric since last year focused on concerns that prices will return to sharp rises again, which gives more importance to employment data, which represents an essential factor in the Fed’s fulfillment of its bilateral mandate, which includes: maintaining price stability and maximize employment.

Employment Data Scenarios

Markets expect two forecast scenarios for US employment data; One is positive, while the other indicates negative possibilities for the most important US data throughout the month.

These scenarios are based on a number of preliminary employment indicators through which a clear picture of what US employment data may be like can be well sketched.

The Positive Scenario

The scenario of improvement in US employment data is supported by some preliminary indicators that we refer to below:

The US Challenger Job Cuts Index declined to 48,786 jobs eliminated last June, compared to the previous reading, which recorded 63,816 jobs eliminated the previous month.

The JOLTS job opportunities index rose to 8.14 million job opportunities last April compared to the previous reading, which recorded 7.919 million job opportunities, which was higher than market expectations that indicated 7.910 million job opportunities.

The Consumer Confidence Index issued by the University of Michigan rose to 68.2 points last June, compared to the previous reading, which recorded 65.6 points, which was higher than market expectations, which indicated 65.8 points.

The Negative Scenario

The APD jobs data increased by 192,000 jobs last April, compared to the previous reading, which recorded 206,000 jobs. Despite the decline in the reading compared to the previous one, the index confirmed the continuation of job growth to levels higher than market expectations, which indicated 175,000 jobs.

The employment component of the US services PMI issued by the Institute for Supply Studies rose to 48.5 points last April, compared to the previous reading, which recorded 48 points.

The employment component of the US manufacturing Purchasing Managers’ Index issued by the Institute for Supply Studies also rose to 47.4 points last April, compared to the previous reading, which recorded 45.9 points.

The total number of beneficiaries of US unemployment benefits also increased, with no change, remaining at the level of 1,858 million beneficiaries in the week ending June 21, compared to 1,832 beneficiaries the previous week.

The reading of the weekly unemployment benefits claims index in the United States recorded its highest level since August 2023, settling at 239,000 claims, compared to 236,000, the same number of one million that was recorded the previous week.

With the negative scenario dominating the scene, the expected decline in US employment data may lead the Fed to see that it has largely succeeded in making progress in the battle against inflation, which may spark optimism in the markets and work in favor of risk assets.

If job growth exceeds expectations, we may see a recovery in the US dollar at the expense of US stocks and gold.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations