Analysts predict that a second Donald Trump presidency after the election on November 5th would be generally negative for the oil market, albeit it would probably have a limited impact.

Even while Trump seems to have a more pro-oil and gas agenda than a Democratic contender, it would take a year or so for legislative reforms like loosening regulatory restrictions to become apparent in the development of domestic supply.

Even if Trump were to reverse President Biden’s approach to fossil fuels it wouldn’t necessarily lead to much greater liquids production, which is already at an all-time high. “Broader market conditions look more binding on constraining US oil and gas production growth than regulatory factors according to analysts.

In an industry that is undergoing a phase of consolidation, it is thought that a potential Trump government would be less inclined to oppose any significant mergers and acquisitions. If sanctions are reinstated on other oil-producing nations, such as Iran and, perhaps to a lesser extent, Venezuela, there may be a quicker impact on the physical oil markets under the incoming administration.

Close US ties with Saudi Arabia could allow Trump to encourage the Saudis and the OPEC+ group to release more oil on the market. Energy policies under expected Democratic Kamala Harris would likely be similar to those of the Biden administration, “or slightly left of Biden,” including support for ending production on federal lands and eventually restricting exports.

Analysts predict Harris would not pursue the concept of outlawing hydraulic fracturing, even though she has previously shown her support for it. The idea “would be extremely costly to the US economy in terms of stymieing the lion’s share of on-land oil and gas activity today.”

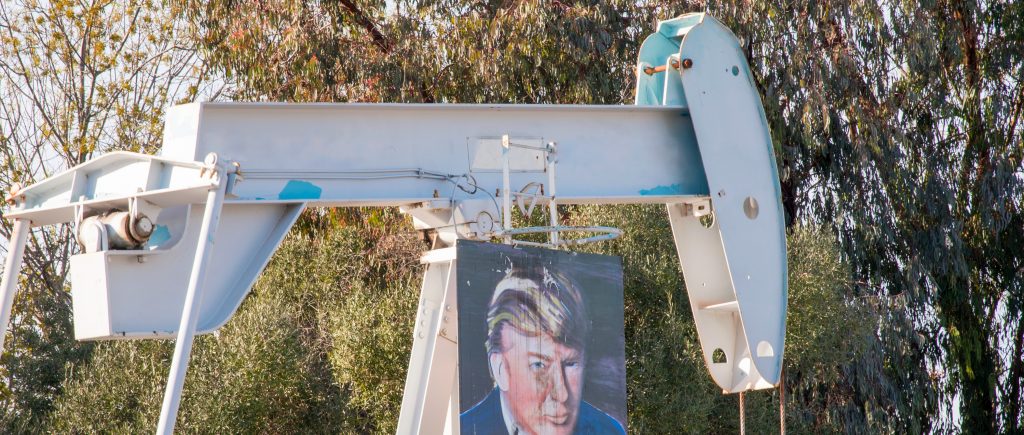

“Drill, baby, drill, we will!” During his July 19 speech at the Republican National Convention, Donald Trump thundered this statement after accepting his party’s nomination for president. He became more sympathetic to the issue when he was greeted with thunderous applause. He promised to increase domestic fossil fuel output to “levels that nobody’s ever seen before,” making America so “energy dominant” that it “will supply the rest of the world.”

Strong proponents of oil and gas lend support to Donald Trump’s promise to strengthen environmental agencies while promoting fossil resources. Last Thursday, as he received the Republican presidential nomination, Donald Trump reminded the opulent group of oil tycoons who were supporting him of why they should choose him.

During his prime-time speech, Trump declared, “We have more liquid gold under our feet than any other country by far, we are a nation that has the opportunity to make an absolute fortune with its energy.” Donald Trump emphasized his dedication to domestic oil development by leading party delegates at the party’s Milwaukee convention in boisterous chanting of “drill, baby, drill” as he claimed the Republican presidential nomination on Thursday night.

Trump’s GOP base finds great resonance with this message, but it ignores the reality that big oil companies in the nation have few CEOs who are eager to significantly increase output. Instead, driven by severe losses from the collapse of energy prices during the pandemic, they have adopted stringent budgetary discipline and a focus on shareholder returns.

It is worth mentioning that the energy market remains vulnerable to threats associated to weather, cyber, and geopolitics. “The hurricane season is far from over; violence is still occurring in Gaza, the West Bank, Lebanon, Syria, and Yemen, and tensions in the Middle East remain high. But there has also been increasing momentum to advocate for a ceasefire, which may materialize this summer.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations