Market expectations are pointing toward a fresh decline in both headline and core Personal Consumption Expenditures (PCE) figures for the United States, set for release on Friday.

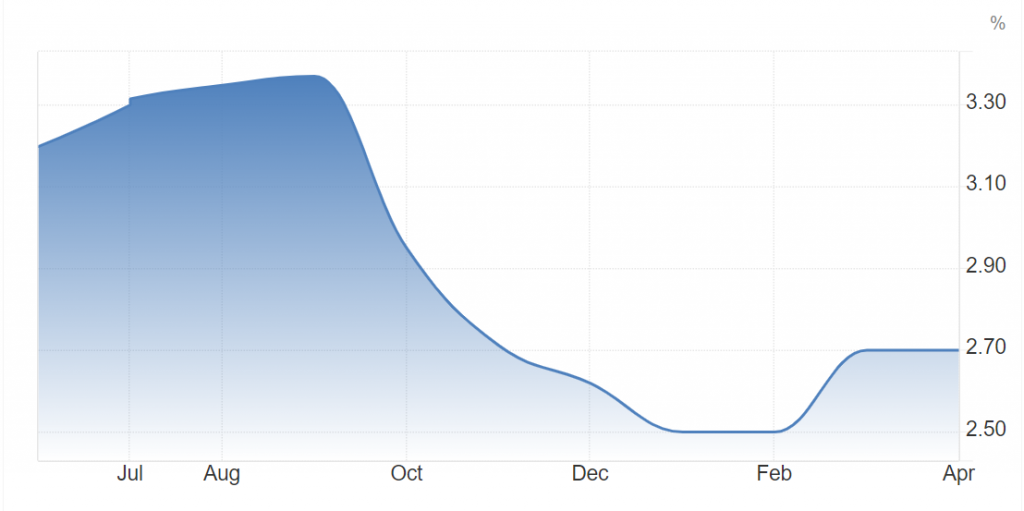

Current projections suggest a possible drop in the headline PCE index to 2.6% for May, down from the previous month’s reading of 2.7%. The core PCE index, which excludes food and energy prices, is also forecast to edge lower to 2.6% from April’s 2.8%. These figures, if realized, could send a positive signal to markets, indicating that the Fed may be closer to implementing a rate cut.

The PCE series is considered the Federal Reserve’s most closely watched and preferred gauge for tracking price growth within the US economy.

If these expectations materialize, they would mark the lowest readings since March 2021. It would also bring them in line with other recent US inflation data, including the Consumer Price Index (CPI) and Purchasing Managers’ Index (PMI) readings, which have collectively indicated that price pressures in the country are easing noticeably.

Inflation and Rate Expectations

Atlanta Fed President Raphael Bostic stated on Thursday that “given all the circumstances, I think we may have one rate cut in the fourth quarter of this year. There are plausible scenarios that could involve more rate cuts, no rate cuts, even a rate hike. All those are still on the table. And I’ll let the data and the economic circumstances guide us to which of those scenarios becomes most likely.”

These comments have added to the uncertainty surrounding the future path of federal interest rates, keeping all options on the table for Fed policy moves. This further underscores the importance of the upcoming PCE inflation data release, as investors seek more clarity on the economic outlook.

The Federal Open Market Committee (FOMC) has downgraded its official rate hike projections to one cut by the end of 2024, based on committee members’ votes for the future path of interest rates.

Weaker-than-expected growth data and a retreat in key measures of inflationary pressures have fueled expectations that the Fed is on track to cut rates once before the end of this year, a shift from earlier expectations of at least two cuts by year-end. Current projections suggest that the central bank could make this move in November, rather than the previously favored September timeframe.

Fed Governor Michelle Bowman said last Tuesday that she sees keeping rates on hold “for a while” as a way to help control inflation. However, she reiterated her willingness to raise rates if necessary.

On the same day, Fed Governor Lisa Cook said the central bank is on track to cut rates if the US economy performs in line with her expectations, but she did not provide any specific details about her timing expectations.

“Our monetary policy is well-positioned to take whatever actions are necessary in response to any changes in the outlook,” she added, emphasizing that “with substantial progress on bringing inflation down while labor market conditions gradually ease, it will be appropriate at some point to reduce the level of our policy rate (cut rates) to achieve the desired balance for the economy.”

“The timing of that will depend on how the economy evolves and what those implications are for the outlook and the balance of risks,” she concluded.

It is worth noting that Fed policymakers had been pulling back on their support for rate cuts since inflation resumed its upward trajectory in the early months of this year, which has negatively impacted recent rate cut expectations.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations