During the trading week of July 7–11, financial markets experienced a mix of volatility and relative stability for most major assets, driven by developments in U.S. trade policies, financial legislation, and strong economic data. The U.S. Dollar Index (DXY) showed continued strength, rising from 96.80 to 97.50, supported by robust U.S. job openings data (7.769 million in May) and cautious remarks from Federal Reserve Chair Jerome Powell, indicating a data-dependent approach with a low likelihood of an interest rate cut in July.

Oil prices (West Texas Intermediate and Brent) declined significantly due to demand concerns following U.S. tariff announcements on July 9, which included extending the tariff deadline to August 1 and imposing a 50% tariff on copper and 35% on Canada. Gold maintained stability above $3,300, while silver saw slight upward volatility, supported by its dual role as an industrial metal and safe-haven asset.

U.S. copper prices surged to record highs due to the new tariff, causing disruptions in global supply chains. Major currencies (euro, British pound, Canadian dollar, Swiss franc, and yen) showed mixed performance: the euro held strong due to U.S. tariff exemptions, while the Japanese yen weakened significantly due to the Bank of Japan’s monetary policy.

Bitcoin approached a record high above $118,000, driven by optimism around pro-business policies. U.S. Treasury yields rose to 4.42%, impacting interest-rate-sensitive assets. U.S. stocks saw mild downward volatility (S&P 500 down 0.3%), while European stocks outperformed relatively, supported by stable capital flows.

The July 9 developments, including the U.S. tariff extension and new announcements, prompted potential strategic responses from Canada, the EU, and Japan, with long-term implications for global trade.

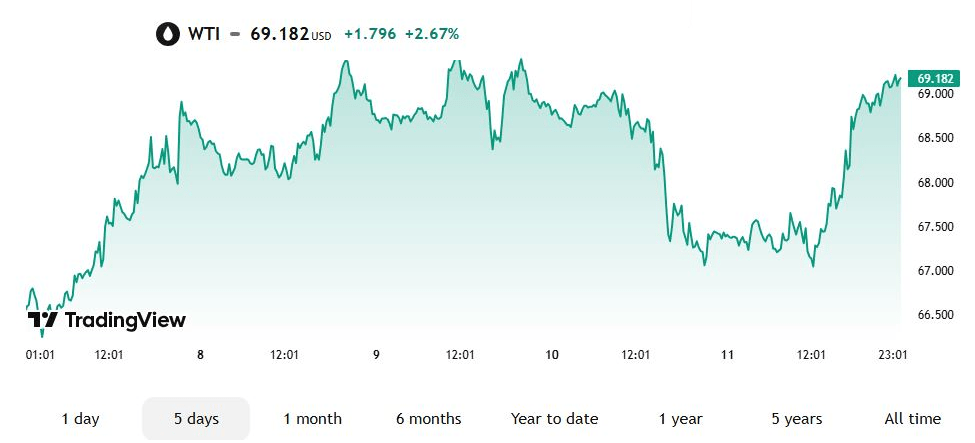

Oil Performance:

Oil prices experienced sharp volatility during the week. West Texas Intermediate (WTI) fell to $66.50 per barrel on Thursday and Friday before closing at $68.69, while Brent dropped from $68.77 at the start of Friday’s trading but closed higher at $70.58. The primary driver was U.S. President Donald Trump’s July 9 announcement of a 50% tariff on imported copper and an extended tariff deadline to August 1, which heightened trade war fears and reduced expectations for industrial oil demand.

Source: TradingView

The stronger U.S. dollar (DXY at 97.50) increased oil costs for foreign buyers, further pressuring prices. Increased OPEC+ production and expectations of a global growth slowdown in late 2025 due to trade tensions reinforced the downward trend. These factors made oil one of the most volatile assets, with uncertainty expected to persist until the new tariff deadline.

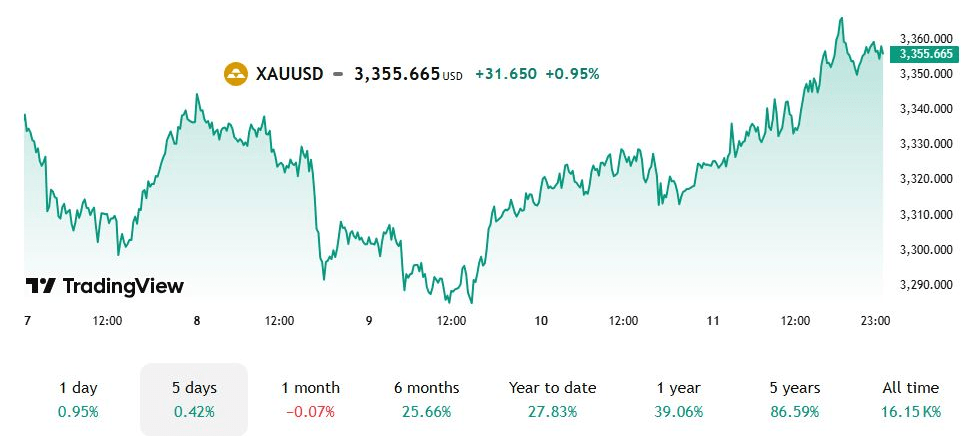

Gold and Silver:

Gold maintained relative stability, trading in a narrow range between $3,320 and $3,350, closing at $3,350 (+0.9%), supported by demand for safe-haven assets amid escalating U.S.-China trade tensions and Middle East geopolitical conflicts, including Israel-Iran tensions. However, rising U.S. Treasury yields to 4.42% after a July 9 auction limited gains, as higher yields reduce the appeal of non-yielding assets like gold.

Source: TradingView

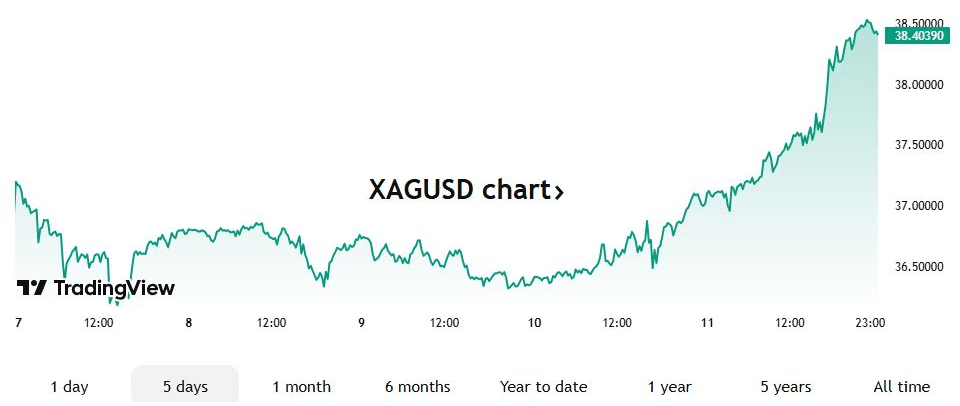

The European Central Bank’s revaluation of gold reserves (down €29.7 billion) also influenced market dynamics. Silver prices rose 3.7% to $38.38, supported by its dual role as a safe-haven and industrial metal, but faced pressures from the strong dollar and industrial demand concerns due to U.S. tariff disruptions. Silver saw slight upward volatility, reflecting sensitivity to both geopolitical and economic factors.

Silver in a week – Source: TradingView

Copper:

U.S. copper prices soared to record highs following the July 9 announcement of a 50% tariff on imported copper, effective August 1. According to the White House, this caused potential disruptions in global supply chains, increasing uncertainty in global copper markets, particularly for exporting countries like Chile and Peru. The EU benefited from U.S. tariff exemptions, stabilizing regional demand in industries like automotive and construction. However, concerns over a global industrial slowdown due to trade tensions led to mixed copper outlooks, making it one of the week’s most volatile assets.

U.S. Dollar:

The U.S. Dollar Index (DXY) showed sustained strength, rising from 96.80 to 97.50, supported by strong job openings data (7.769 million in May, announced July 3), indicating U.S. economic resilience. Jerome Powell’s statements, emphasizing a data-dependent approach with a low likelihood of a July rate cut (federal funds rate at 4.3%), bolstered dollar confidence.

U.S. tariff-related announcements on July 9, including 35% on Canada and 50% on Brazil, strengthened the dollar by signaling pro-business policies, reinforcing expectations of sustained economic growth. Inflation expectations from U.S. tariffs also drove higher Treasury yields, enhancing the dollar’s appeal against currencies like the yen and Canadian dollar.

Other Currencies:

The euro (EUR/USD) rose 0.16% to around 1.1750, supported by revised PMI data from Germany and France, reflecting eurozone economic resilience. U.S. tariff exemptions for the EU boosted capital flows to European assets, supporting the euro, which gained 14% against the dollar in 2025. The Canadian dollar weakened due to the 35% tariff on Canada, threatening its oil and copper exports and straining加拿大’s trade-dependent economy.

The British pound (GBP/USD) fell 0.33% to 1.3600, impacted by weak U.K. economic growth and anticipation of Bank of England Governor Andrew Bailey’s July 15 speech, which could signal interest rate moves. The Swiss franc (USD/CHF) saw volatility, rising to 0.7955 (+0.39%) on July 3 but closing at 0.7922, with limited support from safe-haven demand. The Japanese yen (USD/JPY) weakened significantly to 146.54 by July 9, driven by the Bank of Japan’s monetary policy (with a projected 47-basis-point rate hike in 2025) and U.S. tariff impacts on Japanese exports.

Bitcoin

(BTC/USD) rose to $117,500 (+1.1%), supported by pro-business policy optimism and a slight decline in Treasury yields post-July 9 auction.

Fiscal and Trade Policies:

OBBBA Law:

On July 4, a law supported by President Donald Trump was signed, extending provisions of the 2017 Tax Cuts and Jobs Act, raising the state and local tax (SALT) deduction to $40,000, and introducing new tax breaks on tips, overtime wages, and Social Security. The law is expected to cost $4.5 trillion over a decade, with $1.2 trillion in spending cuts, including work requirements for assistance programs and the termination of renewable energy credits, leading to a $3.3 trillion deficit by 2034, per the Congressional Budget Office.

The reinstatement of 100% bonus depreciation for qualifying equipment supports corporate growth, potentially boosting economic activity in 2026–2027. However, the focus on high-income household tax breaks may limit stimulative effects, as these households tend to save rather than spend, reducing the impact on overall economic growth.

U.S. Tariff Developments:

On July 9, the U.S. extended the tariff deadline to August 1, announcing new tariffs on over 20 countries, including 35% on Canada, 50% on Brazil, and 15–20% on most others. Goods compliant with the USMCA remained exempt, partially mitigating the impact on Canada. Vietnam successfully reduced its tariff from 46% to 20% through a trade agreement, signaling negotiation flexibility.

These U.S. tariffs raised inflation concerns, as supply chains may not fully absorb additional costs, potentially increasing consumer prices in the coming months. However, inflationary effects may be temporary, with expectations of easing trade tensions if negotiations succeed.

Responses:

Canada:

Canada responded to the 35% tariff by repealing its digital services tax to resume USMCA talks, reflecting a negotiating approach to avoid escalating tensions. Canada may consider retaliatory tariffs on U.S. goods like energy or autos, as in 2018, to defend its economic interests. It will also seek to diversify export markets, particularly toward Asia, to reduce reliance on the U.S., with expectations that the Bank of Canada may cut interest rates to support growth amid trade pressures.

European Union:

The EU benefited from U.S. tariff exemptions, boosting capital flows to equities and the euro, with the STOXX index up 8% in 2025 compared to 6% for the S&P 500. European Commission President Ursula von der Leyen emphasized pursuing “mutually beneficial” trade agreements, signaling a diplomatic approach to secure a comprehensive U.S. trade deal. If negotiations fail, the EU may impose counter-tariffs on U.S. goods like whiskey or cars, while strengthening trade ties with China and ASEAN to mitigate risks.

Japan:

Japanese Prime Minister Shigeru Ishiba called the 25% tariff “regrettable,” focusing on protecting Japan’s politically sensitive rice market. As an export-dependent economy, Japan faces significant risks from U.S. tariffs, exacerbating yen weakness (USD/JPY at 146.54). Japan is likely to pursue bilateral negotiations with the U.S. to ease tariffs while expanding export markets in Asia, particularly in technology and automotive sectors. The Bank of Japan may intervene in currency markets if yen weakness persists, with a projected slight rate hike (~47 basis points in 2025) to support the currency.

Monetary Policy:

Monetary policymakers’ statements influenced market dynamics. Jerome Powell reaffirmed the Federal Reserve’s restrictive stance, with PCE inflation at 2.3%, signaling rates will remain at 4.3% until fall, with expected cuts to 3–3.5% by 2026. Strong eurozone PMI data supported the euro, while the Bank of Japan’s accommodative policy weakened the yen. Expectations of Bank of England Governor Andrew Bailey’s speech impacted the pound, reflecting U.K. uncertainty.

To Cut or Not to Cut

The Federal Reserve faces a pivotal decision at its July 30, 2025, meeting, with the Federal Open Market Committee (FOMC) divided over adjusting the federal funds rate, as revealed in the June meeting minutes. Some members argue that inflation, at 2.7% per the core PCE measure in May, is tame enough for a rate cut to ease borrowing costs and boost the economy, especially as tariff-driven price pressures may be temporary. Others, wary of inflation exceeding the Fed’s 2% target and spurred by President Trump’s unpredictable tariff policies, advocate holding rates steady to avoid reigniting high inflation seen post-pandemic. With a resilient job market providing leeway, only a few of the FOMC’s 12 voting members support an immediate cut, leading markets to anticipate no change until at least September. The FOMC is comfortable remaining in wait-and-see mode as policymakers weigh tariffs’ potential to disrupt both inflation and employment.

Equities and Treasury Bonds:

U.S. equities saw mild downward volatility, with the S&P 500 down 0.3% to 6,259.75 and the Dow Jones down 1.0% to 44,371.51, due to U.S. tariff concerns on July 9. European equities outperformed, with the MSCI EAFE up 0.3%, supported by U.S. tariff exemptions.

U.S. 10-year Treasury yields rose to 4.42% after a July 9 auction, driven by strong economic data and inflation expectations from U.S. tariffs, impacting interest-rate-sensitive assets like gold and currencies.

The July 9 tariff extension and OBBBA law pushed markets toward volatility, with a strong U.S. dollar, rising copper prices, and declining oil prices. Gold remained stable, while European equities outperformed U.S. counterparts. Canada, the EU, and Japan face trade challenges, with strategies ranging from diplomatic negotiations to retaliatory tariffs, shaping global trade dynamics until the August 1 deadline. Markets are expected to remain volatile pending trade negotiation outcomes and additional economic data, such as inflation and retail sales, in the coming week.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations