Last week, the market’s attention was squarely fixed on a slew of US economic indicators, aimed at deciphering clues regarding future interest rate trajectories and the Federal Reserve’s timeline for ending its monetary tightening stance and initiating quantitative easing.

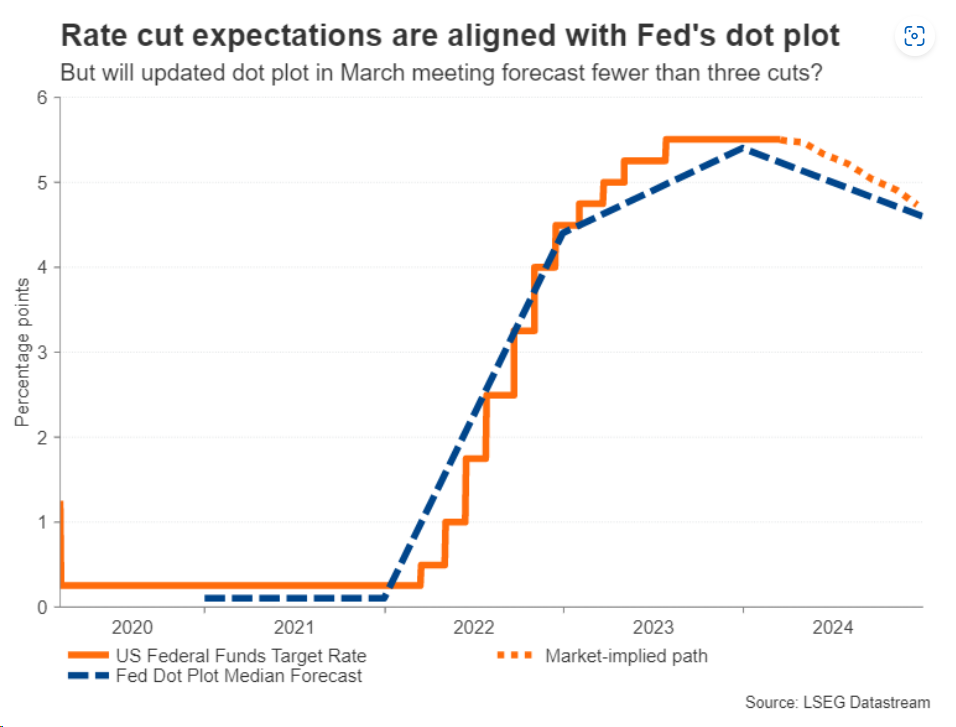

However, the latest US data, particularly the Consumer Price Index, US producer prices, and retail sales, stirred up uncertainty, sparking speculation that the Federal Reserve might postpone its rate cut until year-end rather than in June, as previously anticipated. Expectations also point towards interest rates holding steady at 5.50% during the upcoming March 20 meeting.

In response to expectations of a delayed interest rate cut, the US dollar strengthened, pushing the US dollar index – a gauge of the dollar’s strength against six major currencies – higher to 103.44 points at the close of trading last Friday, up from 103.38 points. During the day’s trading, the index hit its peak at 103.49 points, compared to its low of 103.30 points.

With the dollar’s traditional inverse correlation with gold, gold futures saw a decline in Friday’s trading, settling at $2,161 per ounce, down from $2,166 per ounce. Similarly, the spot price of gold dipped by 0.28% to $2,155 per ounce. On a different note, Bitcoin staged a robust recovery, climbing by 4.71% to reach $68,309 by the end of Friday’s session, up from $65,245.

On Friday, US stocks experienced a downturn, primarily driven by a retreat in technology giants that had spearheaded this year’s market rally. Investors closely analyzed interest rate expectations in anticipation of the upcoming Federal Reserve meeting.

Preliminary data revealed declines across major indices:

- The Standard & Poor’s 500 index slipped by 33.06 points, equivalent to 0.64 percent, closing at 5,117.42 points.

- The Nasdaq Composite index recorded a loss of 152.66 points, or 0.96 percent, settling at 15,975.86 points.

- Meanwhile, the Dow Jones Industrial Average retreated by 185.58 points, a decrease of 0.48 percent, concluding at 38,720.08 points.

The market sentiment reflected investor caution as they awaited insights from the Federal Reserve meeting scheduled for the following week, highlighting the ongoing impact of interest rate deliberations on market dynamics.

US data and inflation

In the United States, the Consumer Price Index for February surpassed market expectations, matching January’s inflation uptick, casting doubt on the possibility of an imminent interest rate cut by the Federal Reserve.

Figures released by the US Bureau of Labor Statistics on Tuesday revealed a 3.2% year-on-year increase in the US annual inflation rate. Additionally, the Consumer Price Index for February showed a similar 3.2% rise year-on-year, contrary to both forecasts and the previous reading, both of which stood at 3.1%.

On a monthly basis, the Consumer Price Index edged up by 0.4%, aligning with market expectations and surpassing the previous reading of 0.3%. Excluding food and energy prices, the core Consumer Price Index dropped from 3.9% in January to 3.8% in February, slightly higher than the anticipated 3.7%.

Furthermore, US producer price data witnessed an upward trajectory that exceeded expectations on Thursday, prompting a market reaction characterized by a decline in risk assets and a strengthening of the US dollar.

The US producer price index climbed by 0.6% in February, outstripping the previous month’s 0.3% reading and market forecasts, which suggested no change. On an annual basis, the index rose by 1.6% last month, compared to a smaller increase of 1.00% in the same period last year, surpassing market expectations of a 1.1% rise.

Meanwhile, the core producer price index, excluding food and energy prices, increased by 0.3% in February, compared to January’s 0.5% rise. The annual reading of the index also surpassed market expectations, reaching 2.00% compared to the anticipated 1.9%.

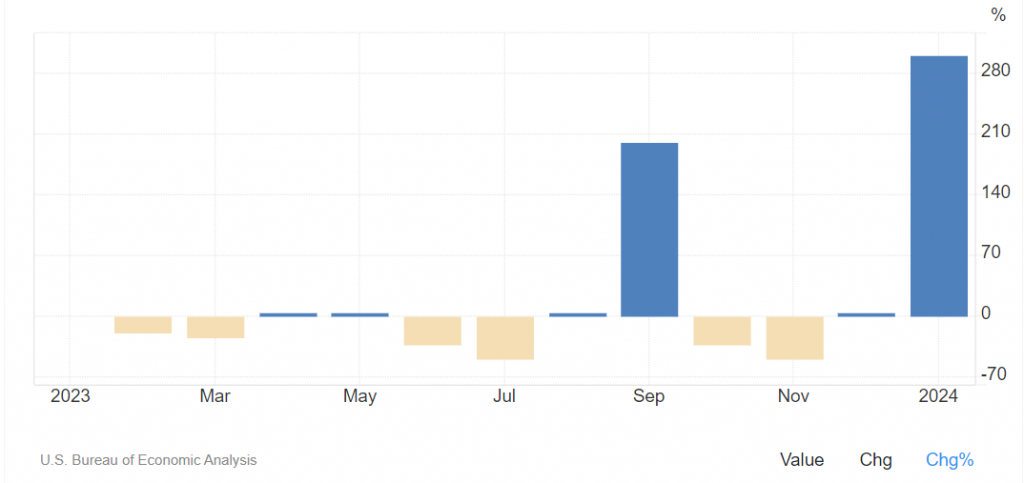

Retail sales in the United States rebounded by 0.6% in February, following a -1.1% decline in the previous month. Despite this improvement, the reading fell short of market expectations, which had anticipated a 0.8% increase.

US retail sales excluding automobile sales rose by 0.3% last month, compared to the prior reading, which saw a -0.8% decline, also failing to meet market expectations.

These data suggest that prevailing economic conditions may prompt the Federal Reserve to maintain interest rates at current levels during the March meeting. The Fed may delay any rate hikes until June to mitigate the risk of further inflation stemming from sustained consumer spending.

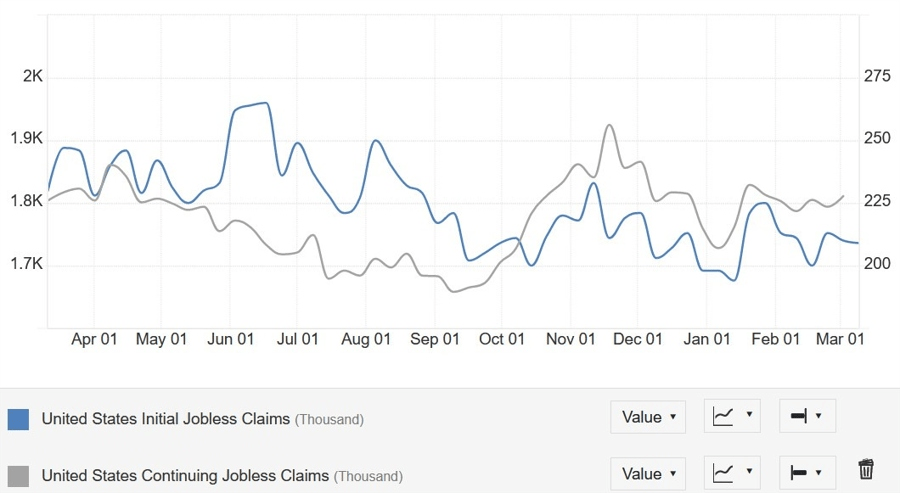

The latest US jobless claims data delivered a positive surprise, surpassing expectations and revealing significant revisions to the continuing claims figures due to the annual revisions by the Bureau of Labor Statistics (BLS) and the introduction of a new model for seasonal adjustment:

- Initial Claims came in at 209K, beating expectations of 218K and slightly below the previous figure of 210K after revisions (previously reported as 217K).

- Continuing Claims stood at 1811K, exceeding the anticipated 1900K and showing improvement from the prior reading of 1794K, following revisions (previously reported as 1906K).

These figures indicate a stronger-than-expected resilience in the US labor market, providing a positive outlook amidst ongoing economic uncertainties.

Europe

In the bustling world of European markets, the STOXX Europe 600 Index continued its winning streak, posting a modest 0.31% gain and notching up its eighth straight week of positive performance. Investors were buoyed by upbeat corporate earnings and growing anticipation of a potential move by the European Central Bank (ECB) to lower borrowing costs come June.

Across the continent, it was a scene of green arrows as France’s CAC 40 Index leaped by 1.70%, Italy’s FTSE MIB edged up by 1.61%, and Germany’s DAX showed a respectable increase of 0.69%. Even the UK’s FTSE 100 Index joined the party, recording a solid gain of 0.94%.

The bond market also had its own tale to tell as the yield spread between German and Italian benchmark 10-year sovereign bonds tightened noticeably. This shift reflected growing confidence in Italy’s economic direction and a surge in demand for high-yield debt, fueled by expectations of a potential reduction in borrowing costs later this year.

Turning our attention to the UK, the labor market painted a mixed picture. The unemployment rate unexpectedly ticked upwards from 3.8% to 3.9% in the three months through January, while wage growth, sans bonuses, softened to 6.1%, marking its lowest level since mid-2022.

Yet, amidst these fluctuations, there were glimmers of hope in the economic landscape. The UK economy hinted at a possible rebound from the recession that clouded the latter part of 2023. January saw a 0.2% uptick in gross domestic product (GDP), fueled largely by an expansion in the retail and wholesale sectors. However, over the three months through January, GDP slipped by a marginal 0.1%.

Bank of England (BoE) Governor Andrew Bailey added his voice to the chorus, speaking at a Bank of Italy symposium. He suggested that the UK was teetering on the brink of full employment, noting an “unusual” scenario of disinflation alongside full employment. Bailey expressed tempered concerns regarding a potential wage-inflation spiral, signaling a cautious optimism about the economic landscape ahead.

Asia

In the dynamic realm of Asian markets, Japan’s stocks experienced a downturn over the week, with both the Nikkei 225 Index and the broader TOPIX Index posting losses of 2.5% and 2.1%, respectively. This decline coincided with rising speculation about the Bank of Japan (BoJ) potentially phasing out its negative interest rate policy in the near future.

The chatter gained traction following the announcement of the highest average wage hikes for members of Japan’s labor unions since the early 1990s. The BoJ, steadfast in its commitment to anchoring monetary policy adjustments to the achievement of its 2% inflation target, closely monitors indicators such as inflation coupled with wage growth. This has led many economists to converge on expectations of a possible interest rate hike in March or April.

The BoJ’s prolonged ultra-accommodative stance has exerted downward pressure on the yen, providing a boost to Japan’s major exporters, whose revenues largely stem from overseas markets. Consequently, the yen weakened throughout the week, reaching the upper range of JPY 148 against the USD, up from around JPY 147 at the previous week’s close.

Meanwhile, the yield on the 10-year Japanese government bond climbed to 0.79% from its previous level of 0.73%, marking its highest point in approximately three months. This uptick in bond yields reflects market anticipation of potential adjustments to the BoJ’s monetary policy settings.

Chinese stocks saw a surge as recent government interventions aimed at stabilizing the market sparked a renewed sense of confidence among investors, despite lingering concerns over the economy. The Shanghai Composite Index edged up by 0.28%, while the CSI 300, representing blue-chip stocks, saw a notable increase of 0.71%. Over in Hong Kong, the benchmark Hang Seng Index witnessed a robust rally, climbing by 2.25%, as reported by FactSet.

In terms of economic indicators, China’s consumer price index exhibited a stronger-than-expected rise of 0.7% in February compared to the same period last year. This marked a reversal from January’s 0.8% decline and marked the first positive reading since August 2023. The upturn was attributed to increases in food and services prices, fueled by heightened consumption during the weeklong Lunar New Year holiday.

However, the producer price index painted a different picture, registering a larger-than-anticipated decline of 2.7% year-on-year in February. This acceleration from January’s 2.5% drop marked the 17th consecutive monthly decline, marking the longest streak of decreases since 2016, according to Bloomberg. Despite these figures, investors remained cautious about calling an end to deflation concerns, as China continues to grapple with sluggish domestic demand.

Oil

Oil prices closed Friday’s trading session with mixed performances, as Brent crude oil rose by 0.11% to $85.22 per barrel, while West Texas Intermediate crude fell by 0.10% to $80.97 per barrel.

The International Energy Agency revised its global oil demand forecast, anticipating a growth of 1.3 million barrels per day for the current year, up by approximately 110,000 barrels per day compared to its previous estimate.

Moreover, oil prices received a boost from a sudden decline in US oil inventories, with gasoline inventories dropping for the sixth consecutive week by 5.7 million barrels to 234.1 million barrels. Additionally, oil inventories decreased by 1.5 million barrels, surpassing expectations of a 1.4 million barrel decline.

On the supply side, oil benefited from the decision of the People’s Bank of China to maintain the one-year interest rate on loans at 2.5%, disappointing both the market and economists who had anticipated further stimulus measures to bolster economic growth.

The Week Ahead: Key Central Bank Decisions and Market Expectations

Next week, spanning from March 17th to 22nd, will be marked by pivotal interest rate decisions from major central banks worldwide, including the US Federal Reserve, the Bank of England, the Bank of Japan, and others. Market participants eagerly anticipate these decisions, which will offer crucial insights into monetary policy trajectories and economic outlooks.

US Federal Reserve Meeting:

The Federal Reserve’s meeting on interest rates is the focal point of the week, with markets pricing in a 99% likelihood of the Fed maintaining the interest rate unchanged at 5.50%. Attention will shift to the accompanying commentary by Fed Chair Jerome Powell, where market participants will scrutinize remarks on the US economic landscape, expectations for interest rate adjustments, and signals for future monetary policy directions.

Bank of England Decision:

Market expectations suggest that the Bank of England will hold the interest rate steady at 5.25% during its upcoming meeting on Thursday. Contrary to predictions for rate cuts by the Federal Reserve and the European Central Bank, markets anticipate the Bank of England to defer any potential rate adjustments until August, signaling a cautious approach to policy changes amidst evolving economic conditions.

Bank of Japan’s Policy Shift:

In Japan, the Bank of Japan is anticipated to depart from its long-standing negative interest rate policy and announce its first interest rate hike since February 2007. This significant shift underscores the central bank’s response to changing economic dynamics and marks a notable departure from its previous monetary stance.

Reserve Bank of Australia:

The Reserve Bank of Australia is expected to maintain its interest rate unchanged at 4.35%, representing its highest level in 12 years. While no policy adjustments are anticipated, market participants will closely monitor the central bank’s commentary for insights into Australia’s economic outlook and future policy intentions.

As global markets await these critical central bank decisions, volatility is expected to ensue, with developments in monetary policy shaping investor sentiment and influencing asset valuations. Stay tuned for updates and analysis as the week unfolds, navigating the intricacies of central bank decisions and their implications for global markets.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations