U.S. Dollar: Under Pressure from Debt and Trade

The U.S. dollar continued its decline for the third consecutive trading day, with the U.S. Dollar Index (DXY) dropping to 99.58 points on Wednesday, May 21, 2025, compared to the previous day’s close of 100.12 points, recording a high of 99.99 points and a low of 99.40 points during the session. By May 23, 2025, the index fell further to 99.24, down 0.66%, and was on track for a 1.6% weekly decline, its worst since February.

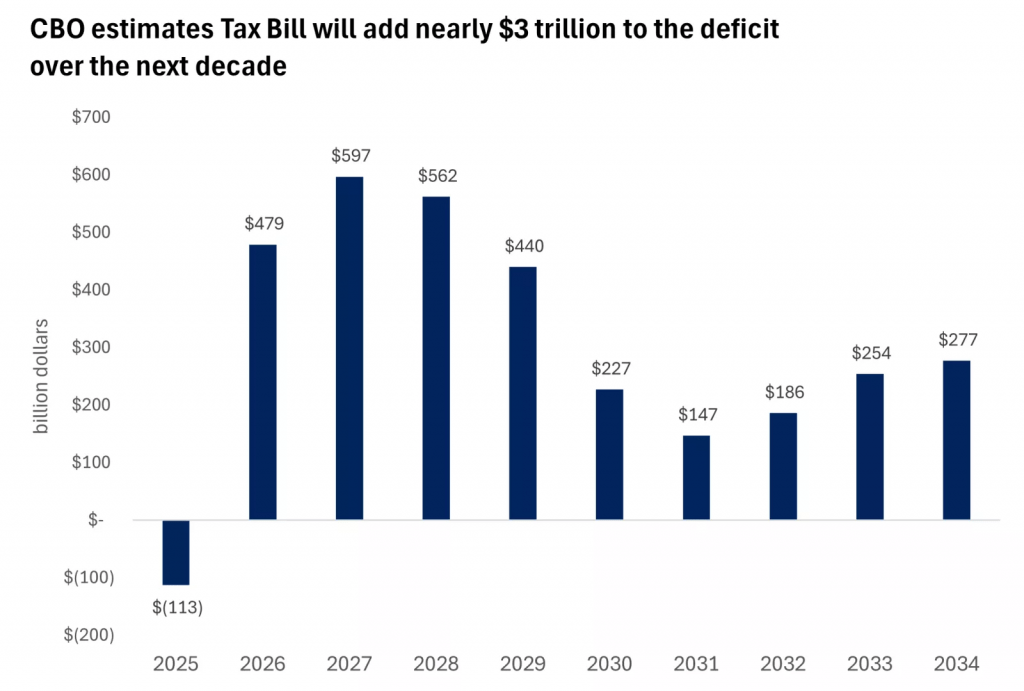

Source: Congressional Budget Office

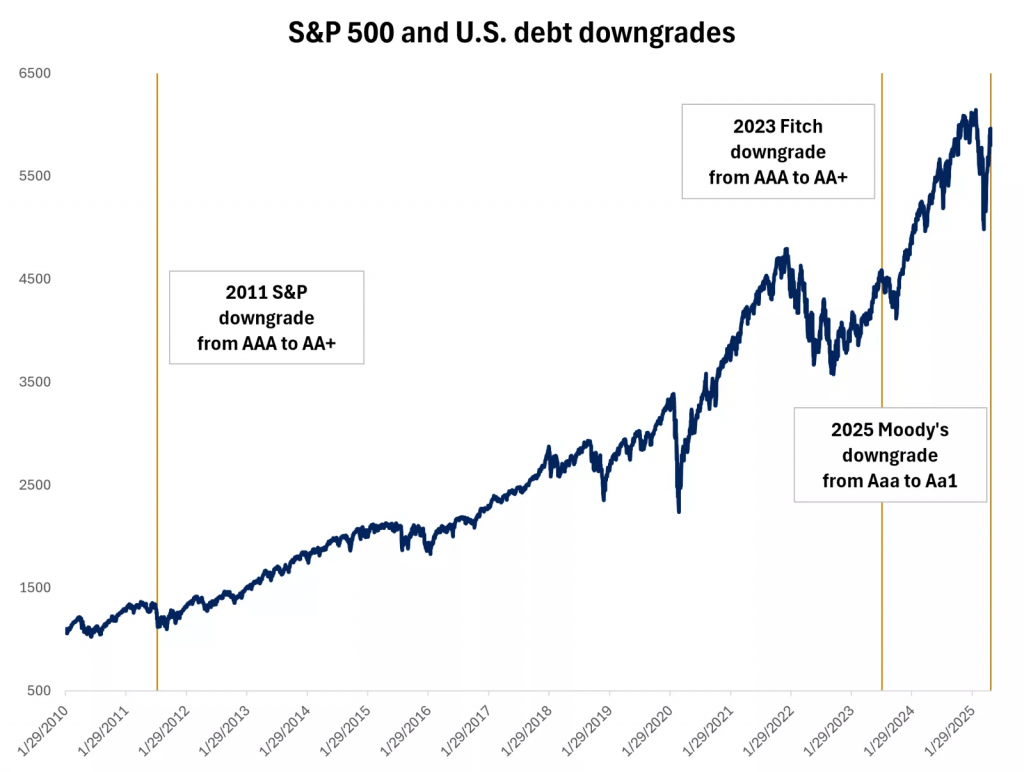

The House’s approval of Trump’s tax bill, projected to add $3.8 trillion to the $36.2 trillion national debt, sparked fiscal concerns, exacerbated by Moody’s downgrade citing unsustainable deficits.

Source: Bloomberg

Trump’s tariff threats, including a 50% levy on EU goods and a 25% tax on non-U.S.-made iPhones, weakened the dollar by fueling trade war fears and risk-off sentiment. Additionally, investor concerns about Trump who faced difficulty convincing a hardline faction of the Republican Party to support the tax cut bill intensified pressures on the dollar.

Historically, the 1970s stagflation saw the dollar weaken by 5-10% against major currencies, a scenario that could repeat if inflation accelerates. Investors shifted to safe-haven currencies like the yen, bolstered by Japan’s 3.6% core CPI in April, and the euro, supported by Germany’s 0.4% Q1 GDP growth. To hedge, investors are encouraged to diversify into yen or euro, limiting dollar exposure to 20-30% of forex portfolios.

Crude Oil: Sharp Volatility Amid Supply Shifts and Geopolitical Tensions

Crude oil futures experienced significant volatility, falling to $60.75 per barrel on May 22, 2025, from $61.29, marking a second consecutive session decline. On Wednesday, May 21, 2025, U.S. crude futures dropped to $61.29 per barrel, compared to the previous day’s close of $62.21, after an early session spike to $64.14 driven by fears of geopolitical tensions in the Middle East, with reports of potential Israeli preparations for an attack on Iran. Brent crude futures also declined to $65.26 per barrel, against the previous day’s close of $65.52. Baker Hughes reported a drop in U.S. oil rigs to 465, down eight, and gas rigs to 98, down two, signaling reduced drilling activity, which could tighten supply and push prices higher, as seen in past rig declines.

However, an unexpected increase in U.S. oil inventories, exceeding market expectations of a significant drawdown, dampened optimism and contributed to price declines. OPEC+ plans to increase output by 411,000 barrels per day in July, following a similar April hike, risking oversupply and capping gains. Investors should monitor OPEC+ decisions and Middle East developments, considering energy ETFs with diversified exposure to hedge volatility, while avoiding over-leveraged oil futures.

Bitcoin: Resilient Yet Vulnerable to Profit-Taking

Bitcoin fell to $109,110 on May 23, 2025, down 1.6% from its record high of $111,953.60, driven by profit-taking after $670 million in transfers to Coinbase. Despite this, Bitcoin is set for an 8% weekly gain and an 18% monthly rise, fueled by U.S. regulatory progress, including the Senate’s advancement of the GENIUS Act for stablecoin regulation and $934.7 million in Bitcoin ETF inflows. However, Trump’s tariff threats dented sentiment, with S&P 500 futures falling 1.3% and altcoins like Ethereum (-2.8%) and Dogecoin (-3.5%) declining. Bitcoin’s resilience stems from institutional adoption, with banks like JPMorgan exploring stablecoins. Investors should hold 5-10% in crypto for diversification, monitoring support at $106,000 and potential resistance at $120,000, while avoiding speculative meme coins like $TRUMP, down 5.6% post-event attended by the US president last week.

U.S. Stocks: Bracing for Stagflation Headwinds

U.S. equities faced pressure, with the S&P 500 down 0.04% and Nasdaq up 0.15% on May 22, 2025, but broader declines followed Trump’s tariff announcements. The Dow Jones fell 260 points (0.7%) on May 23, reflecting fears of trade disruptions and inflation eroding corporate profits. The tax bill’s corporate tax cuts offer short-term relief, but stagflation could trigger a 15-20% correction, as seen in the 1970s when inflation crushed demand. High-valuation tech stocks, like Tesla (trading at $345 despite a $75 core valuation per Morgan Stanley), are at risk. Investors tend to adopt the advice to cap equity exposure at 50-60%, favoring defensive sectors like utilities and healthcare, and use dollar-cost averaging to mitigate volatility.

Gold: Shining as a Safe Haven

Gold continued its rally for the third consecutive session, with futures rising to $3,316 per ounce on Wednesday, May 21, 2025, compared to the previous day’s close of $3,292, recording a session low of $3,287 and a high of $3,327. By May 23, 2025, gold surged 2% to $3,359, with a 5% weekly gain, driven by safe-haven demand amid dollar weakness and trade tensions. The dollar’s weakness, battered by successive shocks—including the credit rating downgrade, concerns over managing the escalating debt, and Trump’s inflationary fiscal policies—bolstered gold’s appeal. Historically, gold doubled during the 1970s stagflation, and with current geopolitical risks (e.g., Middle East tensions) and fiscal concerns, it could climb past $3,500. The DXY’s decline and Treasury yield volatility—10-year yields at 4.509%—further enhanced gold’s appeal as a hedge. Investors tend to allocate 5-10% of portfolios to gold, using ETFs like GLD for liquidity, while monitoring Middle East developments and Fed rate decisions for further upside cues.

Sterling: Buoyed by Robust Retail Sales

The pound sterling continued its ascent on Wednesday, May 21, 2025, with the GBP/USD pair rising to 1.3419, compared to the previous day’s close of 1.3392, recording a session low of 1.3380 and a high of 1.3468. By May 23, 2025, the pair reached 1.3538, a three-year high, up 0.8%, driven by UK retail sales rising 1.2% in April, exceeding 0.2% forecasts. Annual sales jumped 5%, signaling consumer resilience despite global trade concerns. UK annual inflation rose to 3.5% in April 2025, up from 2.6% in April 2024, surpassing market expectations of 3.3%, while the core CPI recorded 3.8%, compared to 3.8% the previous year. The dollar’s weakness, amid concerns over the U.S.’s ability to manage its debt, further lifted sterling, reducing Bank of England rate-cut prospects. Investors also tend to consider 10-15% portfolio exposure to GBP, using currency ETFs to capitalize on its strength, while watching BoE policy meetings, as well as policy related statements for rate guidance.

Euro: Resilient Despite Trade Threats

The euro continued its rise from the start of trading on Wednesday, May 21, 2025, with the EUR/USD pair climbing to 1.1325, compared to the previous day’s close of 1.1283, recording a session low of 1.1280 and a high of 1.1362. By May 23, 2025, the pair rose 0.5% to 1.1338, bolstered by Germany’s 0.4% Q1 GDP growth, doubling estimates, driven by 3.2% export growth. The euro benefited from the dollar’s weakness, impacted by concerns over the U.S. fiscal deficit amid Trump administration negotiations with Republican congressional members to pass a tax relief bill.

Statements by ECB Governing Council member Martins Kazaks, suggesting a potential pause in rate cuts soon at the ECB’s 2% inflation target and emphasizing the analysis of alternative scenarios amid trade uncertainty, also supported the euro. However, Trump’s 50% EU tariff threat and ECB rate-cut expectations for June weakened the euro against the yen (EUR/JPY at 161.00, a one-month low). The EU’s trade surplus with the U.S. makes it vulnerable to tariffs, but growth surprises provide support. Investors are expected to consider holding 10-15% in euro-denominated assets, favoring European bonds over equities, and monitor ECB policy and U.S. trade developments.

Amid a Real Storm

Federal Reserve Chair Jerome Powell faces a delicate balance: tightening risks jobs, while easing could spike inflation (projected above 2% through 2027). May’s Jobless Claims fell to 227,000, but upcoming data like Core PCE will be critical. Consumers should pay off high-interest debt, save in 4% yield accounts, and avoid panic buying. Investors must diversify, favoring gold, short-term bonds, and safe-haven currencies, while limiting equity and dollar exposure. Coordinated U.S. fiscal restraint and global trade alignment are essential to avert a 1970s-style stagflation crisis, ensuring markets avoid a deeper swamp.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations