Due to the parity of factors that affected the trading environment over the preceding period, the price movement of practically all traded assets closed last week’s trading on the global financial markets with a moderate change.

These factors started with investors’ focus on the statements and comments by Federal Reserve Chair, Jerome Powell during an interview on “60 Minutes” TV program. Then, before the end of the week, their interest shifted to reviewed inflation data in the United States on Friday. The week was quiet amid an economic calendar that did not witness many remarkable economic data, except for the US Jobless Claims, which reflected the continued improvement of the US labour market conditions.

The trading week, which was relatively quiet, witnessed a slew of comments and statements by officials from the world’s major central banks. In particular, monetary policy officials at the Federal Reserve, in the United States, the head of the Canadian Central Bank, officials of the European Central Bank, in Frankfurt, and the President as well as the Deputy Head of the Bank of Japan.

Economic Data

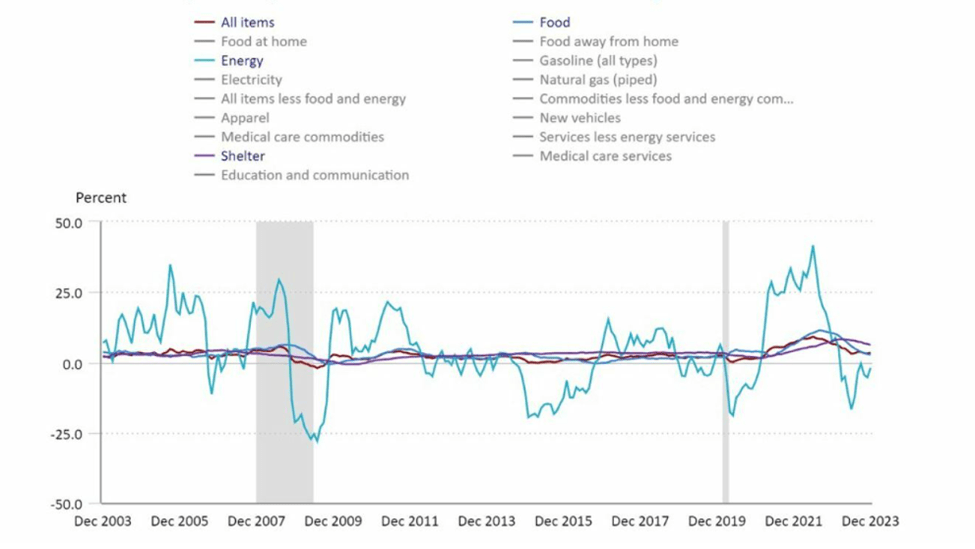

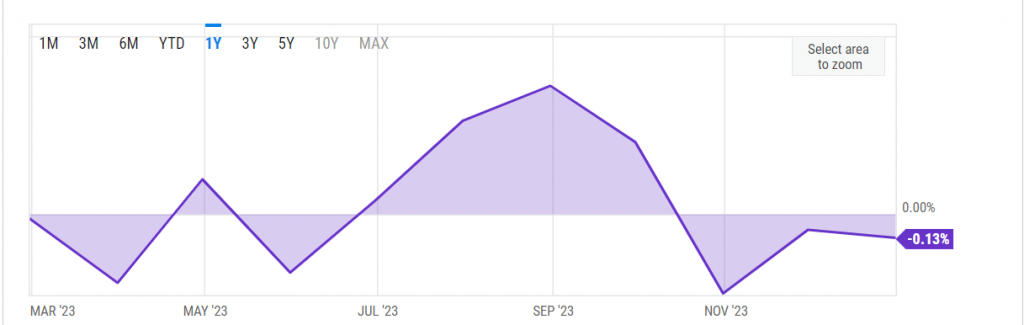

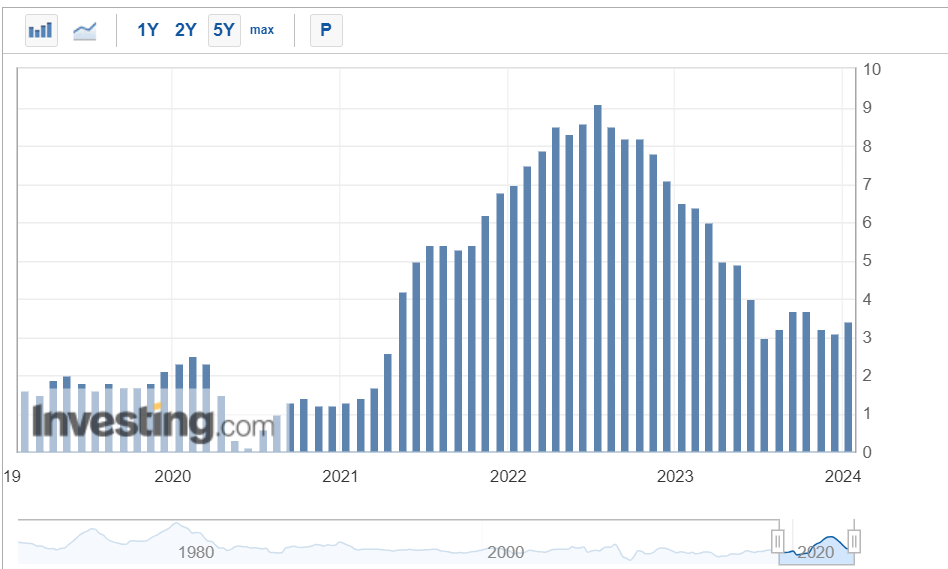

Revisions of Consumer Price Index data from the US Bureau of Labour Statistics, for December, were published on Friday indicated a rise (on a monthly basis) of only 0.2% instead of the 0.3% reported earlier, while the core CPI, which excludes food and energy prices, remained flat at 0.3% for December, in line with initial reports.

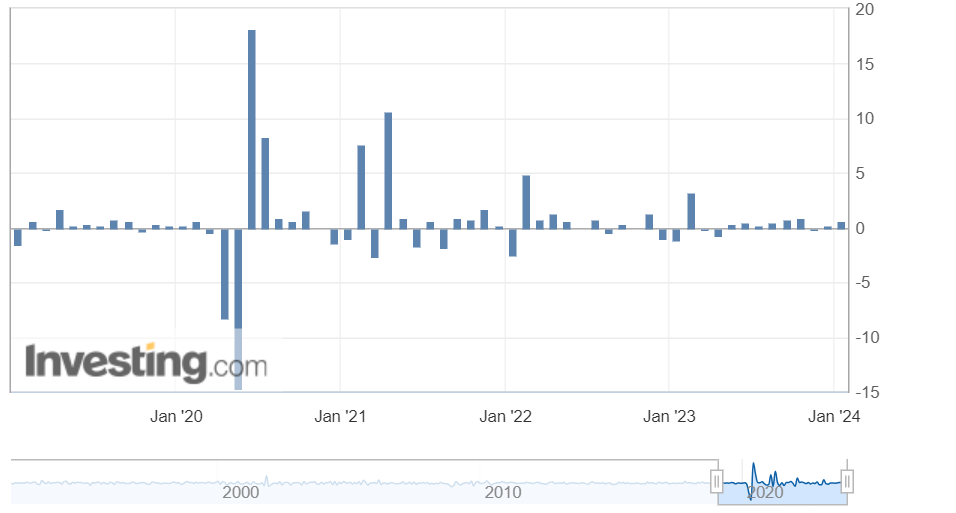

US Jobless Claims data showed an improvement in labour market conditions, reflected in readings of US unemployment benefits claims and the number of beneficiaries in the United States.

The weekly claims for unemployment benefits recorded an increase of 218,000 claims in the week ending February 3rd, compared to the previous reading, which recorded 227,000 claims, which was lower than market expectations, which indicated 220,000.

The index of total beneficiaries of unemployment benefits in the United States also decreased to 1.871 million beneficiaries in the week ending January 26, compared to the previous reading, which recorded 1.894 million beneficiaries.

Inflation indicators moved in the direction that supported the cautious stance by policymakers regarding interest rates cut by the Federal Reserve, which relatively consolidated the US dollar’s standing in terms of its price action over the past week, as the recent data shed light on the continued success of the Federal Reserve in achieving the two basic tasks assigned to it by the US administration; They are focus their endeavors to stabilize prices by controlling inflation, and simultaneously maximize employment.

Geopolitical Tensions and Gold Prices

Geopolitical tensions in the Middle East had a noticeable impact on the price action across almost all financial assets last week, in the aftermath of statements by the Israeli administration, specifically Prime Minister Benjamin Netanyahu last Wednesday, who declared his rejection of what he called the “deceptive” conditions set by the Hamas to release the Israeli hostages it holds in Gaza, warning that accepting those conditions could lead Israel to face “another massacre.”

Netanyahu also pledged, in a press conference on Wednesday, to continue the military attack against Gaza until his country achieves “absolute victory.”

Over the past week, the US dollar was able to maintain the upward trend, but amid weak upward momentum that kept the US currency barely at the levels of the previous week.

At the same time, gold was supposed to achieve weekly gains due to these tensions. But the precious metal did not do so due to the pressure from the US currency on gold futures.

In light of the statements that have added pressure on the US currency and the escalation of tensions in the Middle East, the US dollar was eventually able to consolidate by the end of the week, with the Dollar Index, which measures the performance of the US currency against a basket of major currencies, settling at the same closing level recorded in the previous week around 104.00.

But gold prices declined at the end of the week under pressure from surging Treasury bond yields, which benefited greatly on the back of expectations that Fed will not cut interest rates very soon.

Statements by Jerome Powell, Other Policymakers

Did the Fed win its battle to combat inflation? This was the main question of an of the Powell’s interview during his appearance on CBS TV, “60 Minutes” was aired on Sunday, and the Federal Reserve Chair replied that he did not hold that view.

Powell added: “I will not go that far, and what I can say is that inflation has actually fallen over the past year… We are making good progress, but the job has not been done yet.” Powell thus hinted again at not cutting the interest rate next March.

During the past week, the slew of statements by Federal Reserve officials was less inclined towards quantitative easing, and last Thursday, Susan Collins, President of the Federal Reserve in Boston, as well as her colleagues Thomas Barkin, Neil Kashkari, and others mentioned many reasons that suggest one thing: the US Central Bank is not in a rush regarding the decision to ease and cut interest rates.

Bank of Canada Governor Tiff Macklem said last Wednesday that more time is needed to ease price pressures through monetary policy, while warning that the biggest driver of prices – housing costs – cannot be tamed by borrowing costs. “We see that monetary policy is working to reduce inflation… and we need to give it more time to ease the remaining price pressures”, added Macklem.

European Central Bank’s Isabel Schnabel stressed in an interview with the Financial Times the need for the central bank to be patient regarding lowering interest rates, as inflation could worsen again and recent data confirm fears that the final stage of reducing the price growth rate could be the most difficult.

Although the European Central Bank has kept interest rates at record levels since September, the debate on easing monetary policy is intensifying and markets believe that the ECB may begin to reverse course this spring in light of easing price pressures.

At the Bank of Japan, Kazuo Ueda confirmed that accommodative monetary conditions in Japan will continue even after abandoning the negative interest rate policy, which is the last remaining one in the world.

“Even if we eliminate negative rates, accommodative financial conditions are likely to continue,” based on the bank’s economic forecasts, Ueda said. Ueda’s latest statements came in the context of a series of statements by bank officials to reassure the market that any end to negative rates would not herald a change in the central bank’s monetary policy. BoJ Deputy Governor, Shinichi Uchida, said on Thursday that it is difficult to imagine the bank raising the base interest rate continuously and quickly, even after the end of the negative interest policy.

Corporate Earnings Season

Positive corporate profits and enhanced optimism about artificial intelligence (AI) have helped the S&P 500 Index record 10 historic levels, so far this year, and the performance of the index’s, Q4 2023, earnings season improved, with the percentage of positive earnings surprises that came higher than the ten-year average, and this has led to a significant surge in fourth-quarter profits and year-on-year growth for the second consecutive quarter.

67% of the companies listed on the index announced their results for the fourth quarter, while 75% of them announced actual profits higher than Wall Street expectations. The growth rate of mixed profits for the fourth quarter was 2.9%, compared to 1.6% last week and 1.5% at the end of the fourth quarter.

Also Read: S&P 500 sets a new record high as Tech stocks lead Nasdaq’s rally

The positive profit surprises announced by companies in multiple sectors, led by the financial and industrial sectors, were the largest contributors to the increase in the index’s total profits, which jumped, for the second day, Friday, to above 5,000 points, recording a new record, and seven of the 11 sectors on the index recorded growth. in profits year-on-year, while four sectors recorded a year-on-year decline.

Nvidia shares rose by 3.6 percent, to reach a record level, after news on the establishment of a new business unit focused on designing custom chips for cloud computing companies and other applications, including advanced artificial intelligence processors.

The Wall Street Journal reported, on Thursday, that OpenAI CEO, Sam Altman, is engaged in negotiations with investors, including UAE entities, to raise funding for a technological initiative on the chip industry and expanding the ability to employ artificial intelligence, within the framework of a project valued at between $5. To seven trillion dollars.

Crude Oil’s Performance

Crude oil prices achieved weekly gains in the trading week ending on February 9, benefiting from the geopolitical tensions in the Middle East that escalated last week due to repeated air strikes in which drones were used against US military bases as well as other bases belonging to US allies in the Middle East region, which meant disruption of oil supplies from the Gulf countries to the world.

The largest US military base in Syria was attacked by a drone, killing at least six members of a pro-US Kurdish-led coalition.

The Syrian Democratic Forces said that its military academy in the “Al-Omar” oil fieldو Deir ez-Zor Governorate, eastern Syria, was targeted by an air strike with a drone in the early hours, Monday morning, which affected oil futures until the end of Tuesday’s trading.

Despite the increase in US oil inventories confirmed by reports from the Energy Information Administration, the administration said that crude oil output rates may decline to levels lower than market expectations, but crude oil futures may give up some of their gains due to news headlines that indicated talks aimed at reaching a prolonged ceasefire in Gaza.

The US Energy Information Administration expected that crude oil production may decline to $170,000 per barrel per day, compared to previous estimates of US production that indicated 290,000 barrels.

Also Read: EIA Raises Forecast for Global Oil Demand Growth

The Week Ahead

Markets are awaiting developments in the Middle East as well as the escalation of fears that are linked to geopolitical tensions in the Middle East amid the Israeli government’s announcement of its intention to bomb the Palestinian city of Rafah.

These fears escalate after Egypt announced that it may “suspend the 1979 Peace Treaty” if the Israeli army bombs Rafah, given that the city constitutes shelter for hundreds of thousands of displaced Palestinians from all over the Gaza Strip.

Last weekend, the United States warned that any Israeli attack on Rafah could lead to disaster.

On the data front, the markets are awaiting US Retail Sales, inflation readings, namely the CPI and PPI readings, which are of key importance regarding their to their impact on the Fed’s decision in the coming period because they are closely related to the battle that the Fed is still waging to achieve price stability, one crucial part of Fed’s twofold mission and mandate.

Consumer price inflation data in the United States will be released next Tuesday, which will shed light on the extent of the progress the Federal Reserve has achieved in reducing prices.

Markets also await Retail Sales that are strongly linked to inflation data, as they shed light on the movement of consumer spending and consumer demand in the country, through which price trends can be identified.

At the end of the week, the PPI data will be released, which, no doubt, has a significant impact on price action no less than the impact of the CPI. A fresh batch of corporate earnings, result reports also will be published over next week, which should also influence price action. Among the most important companies listed on the American Stock Exchange are the Dow Jones Industrial Average, beverage giant Coca-Cola, and IT leader Cisco.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations