This week, global stock markets continued their upward trajectory, driven primarily by robust performance in tech stocks as well as positive sentiment surrounding China’s economic stimulus measures. Major US indices, including the S&P 500 and the Dow Jones Industrial Average, reached fresh all-time highs, extending their winning streaks to six consecutive weeks.

Economic Factors, Market Sentiment

The broader market rally was also supported by several economic factors. The US economy’s continued strength and the anticipation of further interest rate cuts contributed to positive investor sentiment. The numbers: Retail sales increased 0.4% in September, with strength in a broad range of categories that overcame weak gas and auto spending, the US Commerce Department said Wednesday. Economists polled by the Wall Street Journal had forecast a 0.3% gain.

Additionally, the easing of geopolitical tensions and the positive impact of China’s stimulus measures boosted global market confidence after some concerns about probable global slowdown. The previous trading week’s market witnessed a rollercoaster ride, with contrasting sector performances and global events impacting investor sentiment. While the Dow Jones surged after a sell-off, the Nasdaq lagged behind due to a major blow to the global semiconductor industry.

European shares rallied on Friday, buoyed by a tech stock rebound and positive corporate earnings. The Europe-wide STOXX 600 index climbed 0.3% by 0840 GMT, with the tech sector leading the charge after a turbulent week. The index appeared set for its second consecutive weekly gain, bolstered by the European Central Bank’s (ECB) recent rate cut and corporate optimism.

Currency and Commodity Markets

The US dollar weakened slightly against a basket of currencies, reflecting improved risk appetite. However, it remained on track for its third consecutive weekly gain. Oil prices experienced a decline, influenced by concerns about Chinese demand and mixed sentiment regarding the Middle East conflict.

The Pound Sterling (GBP) continued its downward trajectory on Thursday, struggling to maintain its position above the 1.3000 level against the US Dollar (USD). This decline was primarily driven by a combination of factors, including stronger-than-expected US economic data and growing optimism about a Donald Trump victory in the upcoming US presidential election.

US Economic Indicators Support the Dollar

The US Retail Sales for September surpassed market expectations, rising by 0.4% month-over-month. Additionally, Initial Jobless Claims fell to 241K, indicating a resilient labor market. These positive economic indicators strengthened the US Dollar and reduced expectations for significant interest rate cuts by the Federal Reserve (Fed).

Trump Optimism Fuels the Dollar

The increasing likelihood of a Trump victory in the US presidential election also contributed to the US Dollar’s appreciation. Investors anticipate that a Trump administration would implement policies that could benefit the US economy and currency, such as looser financial conditions, higher import tariffs, and tax cuts.

Pound Sterling Under Pressure

The Pound Sterling faced additional pressure due to slowing UK inflation, which has increased expectations for the Bank of England (BoE) to adopt a more dovish monetary policy. The UK Consumer Price Index (CPI) fell to 1.7% in September, below the BoE’s target of 2%. This deceleration in inflation has led to bets on interest rate cuts in the coming months.

From a technical perspective, the Pound Sterling’s near-term outlook appears bearish. The GBP/USD pair has broken below key support levels and is facing downward pressure from both the 20-day and 50-day Exponential Moving Averages (EMAs). The Relative Strength Index (RSI) has also fallen below 40, indicating a bearish momentum.

The Pound Sterling is currently under pressure due to a confluence of factors, including stronger US economic data, rising Trump expectations, and slowing UK inflation. If these trends continue, the GBP/USD pair could face further downside. Additionally, geopolitical tensions and global economic uncertainties could also impact the Pound Sterling’s performance.

Gold Breaks Record High

Gold surged past the $2,700 mark for the first time on Friday, extending a rally fueled by expectations of further monetary easing, particularly in the United States, and strong safe-haven demand.

Gold prices surged to a fresh all-time high, surpassing the $2,700 mark. This surge was driven by increased safe-haven demand amid global uncertainties, including geopolitical tensions and economic volatility. Investors sought refuge in gold as a hedge against potential risks.

Back to the stock market, it has evidently continued upward momentum is a testament to the positive economic factors and investor sentiment driving the market. While there are challenges and uncertainties ahead, the overall outlook remains optimistic. Investors should closely monitor economic indicators, geopolitical developments, and corporate earnings to make informed decisions.

Chip Shock: ASML’s Forecast Dampens the Industry

Disappointing 2025 forecasts from Dutch chip giant ASML sent shockwaves through the market. The company’s revised net sales projections and weak bookings triggered a $420 billion decline in the value of global semiconductor stocks. Notably, chipmakers like NVIDIA and AMD were adversely affected. This setback, coupled with concerns about export restrictions and longer recovery timelines, paints a concerning picture for the industry.

Geopolitical Tensions Keep Oil Jittery

Rising tensions in the Middle East cast a shadow over oil markets. Despite initial surges in the wake of the Israel-Lebanon conflict, prices quickly retreated, mirroring post-conflict trends and performance patterns observed earlier this year. This highlights the growing resilience of modern-day oil markets, which are increasingly reliant on non-OPEC production to manage geopolitical storms. However, the potential for disruption remains, as energy infrastructure could become a target in a further escalation.

Tech Stocks Shine

Tech-related stocks, particularly megacap momentum stocks, significantly boosted the Nasdaq Composite. This sector’s strength was fueled by positive earnings reports, such as Netflix’s robust subscriber growth, and the overall optimistic outlook for the tech industry.

Mixed Earnings Landscape

While Netflix’s success was a standout, other companies reported mixed results. Procter & Gamble, for example, experienced a decline in sales due to slowing demand. This highlights the ongoing challenges facing certain sectors despite the overall market uptrend.

Retail Earnings Kick Off, Financials Shine

Following a robust showing from the banking sector, earnings season for retail stocks has begun. This positive start paves the way for upcoming tech earnings, which are expected to bolster US indices. Meanwhile, the Financials sector emerged as the week’s top performer, fueled by positive earnings surprises and the possibility of a November rate cut. Additionally, Utilities continued their year-to-date outperformance, benefiting from their defensive nature and AI-related power demand.

Alpha Picks: Data-Driven Approach Outperforms

In this volatile market environment, Alpha Picks, a data-driven stock selection service, offers a compelling alternative. Utilizing a quantitative model, Alpha Picks identifies “Robust Buy” rated stocks with high growth potential and attractive valuations. This approach has yielded impressive results, with the Alpha Picks portfolio delivering a 158% total return compared to the S&P 500’s 54% since its launch in July 2022. Alpha Picks’ portfolio boasts superior revenue and earnings growth rates compared to the S&P 500, making it a potentially lucrative option for investors.

Previous Trading Week in Numbers:

• The Dow Jones: Up 300 points

• Global Semiconductor Stocks: Down $420 billion in market value

• Alpha Picks’ Total Return: 158% (vs. S&P 500’s 54%)

• US Dollar: Gained against major currencies

This week’s market was a microcosm of the ongoing tug-of-war between positive earnings reports, geopolitical tensions, and sector-specific challenges. While the semiconductor industry faces headwinds, the data-driven approach of Alpha Picks offers a promising avenue for investors seeking robust returns. As the November jobs report looms and broader economic trends unfold, market volatility is likely to continue.

Additional Analysis:

Geopolitical Risks: The ongoing tensions in the Middle East and other regions could escalate, further impacting oil prices and global markets. Investors should closely monitor developments in these areas.

Technological Advancements: The rapid pace of technological innovation, particularly in AI and automation, presents both opportunities and risks for various industries. Investors need to stay updated on these trends to identify potential winners and losers.

Economic Indicators: Beyond the jobs report, other key economic indicators such as inflation, consumer confidence, and retail sales will also be closely watched by investors.

Regulatory Environment: Changes in regulatory policies, both domestically and internationally, can significantly impact markets. Investors should pay attention to developments in areas such as trade, taxation, and environmental regulations.

Historic Market Run: Can the Bull Market Continue?

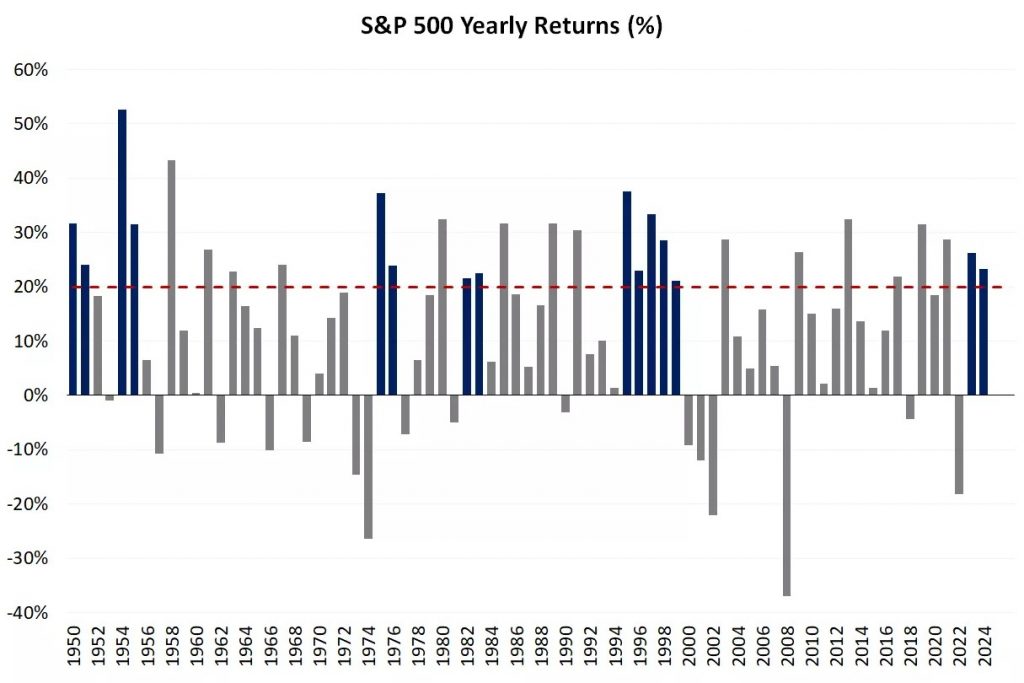

The stock market’s impressive performance in 2024 has raised expectations for continued gains. If the S&P 500 can sustain its current trajectory, it would mark the second consecutive year with a return exceeding 20%, a feat achieved only five times in the past 75 years. While historical precedent suggests that such a streak is rare, current economic conditions offer support for further growth.

A Year of Record-Breaking Returns

The S&P 500 has rallied over 12% since early August, extending its year-to-date return to nearly 23%. If this momentum continues, it would make 2024 the second consecutive year of 20% or more returns. This remarkable performance is primarily driven by a combination of economic growth, favorable interest rate policy, and rising corporate profits.

Historical Perspective: A Rare Feat

Since 1950, there have been only five instances of the stock market following a 20%-plus annual gain with another 20% year. Two of these occurred in the 1950s, and the most impressive periods were in 1950-51 and 1954-55, with gains of 32% and 24%, respectively.

While 20%-plus yearly gains are common, back-to-back rallies of this magnitude are exceptional. This highlights the significance of the current market’s performance and the need for caution.

The Quest for a Three-peat

Achieving a three-peat of 20% returns is even rarer. In the last 75 years, there was only one instance of this happening, during the tech bubble of the late 1990s. Excluding that period, the market saw gains in three out of four instances following two consecutive 20% returns, with an average return of 6%.

Recipe for Success: Economic Fundamentals

The key to continued market performance lies in the underlying economic fundamentals. A robust economy, favorable interest rates, and rising corporate profits are essential ingredients for sustained growth. While the current economic conditions may not be as robust as in some past periods, they offer a supportive environment for further gains.

Challenges and Opportunities

While the outlook for the stock market appears positive, it’s essential to acknowledge potential challenges. Global geopolitical tensions, trade disputes, and economic uncertainties could impact market sentiment. However, the current favorable conditions, including easing interest rates and accelerating corporate earnings, provide a solid foundation for continued growth.

The stock market’s impressive performance in 2024 has raised expectations for a continued bull run. While historical data suggests that such a streak is rare, the current economic fundamentals offer a supportive environment for further gains. Investors should remain cautious and monitor developments closely, but the overall outlook for the market appears promising.

Looking Ahead: Key Events and Trends

The upcoming jobs report will be pivotal in shaping labor market narratives and potentially influencing future Fed decisions. Declining interest rates continue to favuor growth stocks, particularly in Technology and Financials, despite broader macroeconomic uncertainties. However, with concerns about antitrust scrutiny and weakening tech hardware demand, a potential rotation towards value stocks cannot be ruled out. The cryptocurrency market also saw a surge, with Bitcoin leading the charge on significant ETF inflows. However, regulatory hurdles remain a significant headwind for the sector.

The Week Ahead

Highlights on the economic agenda will include:

Bank of Canada interest rate decision and retail sales data. The IMF meets on Monday, while traders and analysts are also awaiting further comments from European Central Bank President Christine Lagarde on Wednesday, and comments from New Zealand’s Reserve Bank Governor Orr and Bank of England Governor Andrew Bailey on the same day. S&P Global Manufacturing, Composite and Services PMIs are due on Thursday, while the University of Michigan Consumer Sentiment Index is due on Friday.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations