The week ending June 1, 2025, was marked by significant volatility across global markets, driven by escalating U.S.-China trade tensions, cooling inflation data in Europe and the U.S., and policy uncertainties impacting currencies, commodities, and equities. From European markets rallying on ECB rate cut expectations to Japan’s bond market turmoil signaling global risks, here’s a comprehensive recap of the key developments shaping the economic landscape.

European Equities Gain Amid ECB Rate Cut Hopes

European equity indices closed the week on a positive note, with the German DAX up 0.6%, France’s CAC 40 rising 0.2%, and the U.K.’s FTSE 100 advancing 0.5% on Friday. The DAX led monthly gains, surging over 7% to record highs, as investors shifted away from U.S. assets amid fiscal concerns and easing global trade tensions. Cooling inflation data bolstered expectations for an eighth consecutive ECB rate cut on June 5, with Spain’s EU-harmonised inflation dropping to its lowest since October 2024, and German retail sales declining 1.1% in April.

Markets anticipate the ECB deposit rate will fall to 2.00% from 2.25%, offering potential relief to the Eurozone’s fragile economy, though U.S. trade policy volatility remains a concern.

U.S.-China Trade Tensions Escalate

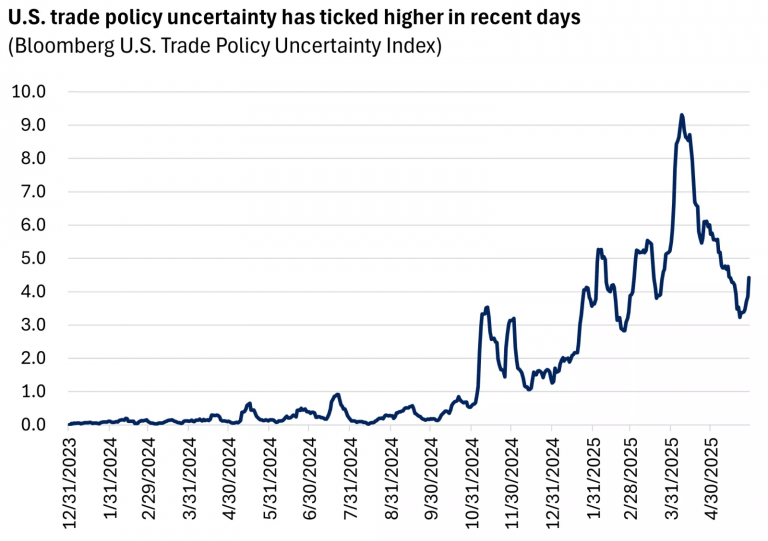

U.S.-China trade negotiations hit a rough patch, intensifying global market uncertainty. Following a May 12 agreement in Switzerland that paused tariff hikes for 90 days, progress stalled, with U.S. Treasury Secretary Scott Bessent urging a direct call between Presidents Trump and Xi Jinping to break the deadlock. Trump accused China of violating the agreement, stating on social media, “China, perhaps not surprisingly to some, has totally violated its agreement with US.”

The U.S. tightened tech restrictions, while China held firm on rare earth export controls, frustrating U.S. expectations. A U.S. Federal Appeals Court reinstated Trump’s “Liberation Day” tariffs (imposed April 2) on Thursday, overturning a prior ruling, with appeal responses due by June 5 and 9, 2025, potentially escalating to the Supreme Court. This legal saga has disrupted business planning, impacting global demand forecasts and adding pressure on European exporters.

Bloomberg U.S. Trade Policy Uncertainty Index)

U.S. Inflation Cools, Fed Faces Policy Pressure

U.S. inflation data offered some respite, with the April PCE price index rising 2.1% year-over-year (down from 2.3%), and the core PCE easing to 2.5% from 2.6%. Monthly increases were modest at 0.1%, signaling disinflation amid the Fed’s tight monetary stance. However, inflation-adjusted personal spending grew only 0.1% (down from 0.7% in March), despite a personal income surge driven by Social Security payments. San Francisco Fed President Mary Daly called the data a “relief” but warned of potential inflationary risks.

Trump pressured Fed Chair Jerome Powell for rate cuts during a May 29 meeting, but Powell emphasized a data-driven approach. FOMC minutes project slower growth, higher unemployment, and tariff-driven inflation spikes in 2025, raising stagflation concerns. Markets expect 52 basis points of rate cuts by year-end, with rates likely steady until September 2025.

Gold and Oil Prices Under Pressure

Gold prices fell below $3,300, with the XAU/USD pair at $3,289 (down 0.84%) on Friday, as the US Dollar Index (DXY) rose 0.11% to 99.44, reflecting a rebound amid trade tensions. Despite softer U.S. Treasury yields (10-year at 4.40%, real yields at 2.086%), gold struggled due to reduced dollar short positions and strong U.S. economic growth (Q2 GDPNow at 3.8%). Oil prices edged up slightly—Brent at $63.59 (+0.4%) and WTI at $61.22 (+0.5%)—but posted a second consecutive weekly loss of 1.5%. Expectations of an OPEC+ output hike in July, potentially exceeding the planned 411,000 bpd, combined with a 2.2 million bpd global oil surplus, fueled bearish sentiment, with prices possibly sliding to the high $50s by year-end.

Japan’s JGB Market Signals Global Risks

Japan’s government bond (JGB) market faced significant turmoil, with super-long bond yields hitting historic highs in May. The 20-year yield peaked at 2.555%, the 30-year at 3.14%, and the 40-year at 3.6%, driven by weak auction demand (May 20 20-year bid-to-cover ratio at 2.5, May 28 40-year at 2.21). Japan’s debt-to-GDP ratio (over 260%) and the BoJ’s reduced bond purchases (down ¥21 trillion since November 2023) heightened fiscal sustainability fears.

The yen gained 9% in 2025, trading at 144.345, but rising yields threaten the yen carry trade and Japan’s export competitiveness, potentially impacting US Treasury yields and emerging markets. BoJ Governor Kazuo Ueda warned of broader financial spillovers, with a 30-year JGB auction and quantitative tightening review scheduled for June.

Currency Dynamics Reflect Diverging Policies

The US Dollar faced mixed pressures, with the DXY falling to 99.31 on Thursday before rebounding to 99.44 on Friday. The Euro rose to 1.1368, capitalizing on earlier dollar weakness, while the Canadian Dollar surged, driven by Canada’s 2.2% Q1 GDP growth, though consumer spending and unemployment concerns linger. The Bank of Canada is likely to hold rates steady, while the Fed’s potential rate cuts (projected at 52 basis points by December) contrast with the ECB’s expected easing, highlighting diverging monetary policies. The yen’s strength, driven by safe-haven flows, adds complexity to global currency dynamics, with potential MOF interventions looming.

U.S. Stocks Decline, Corporate Movers Mixed

U.S. stock markets ended the week lower, reflecting trade tension fears—Dow Jones at 42,213 (down 0.1%), S&P 500 at 5,892 (down 0.4%), and Nasdaq at 19,032 (down 0.8%). In Europe, corporate developments were mixed: Sanofi and Regeneron shares fell after disappointing Itepekimab trial results, while M&G surged after Dai-Ichi Life Holdings announced a 15% stake acquisition. These movements underscore the uneven impact of macroeconomic pressures on individual sectors, with trade uncertainty weighing on broader market sentiment.

Looking Ahead: Key Events and Market Drivers

The coming week will be pivotal, with the ECB’s June 5 meeting expected to confirm a rate cut, potentially boosting European equities, though trade risks persist. The OPEC+ meeting will clarify output plans, likely pressuring oil prices further. U.S. economic data, including May nonfarm payrolls and ISM PMI, will guide Fed policy expectations, while the tariff appeal process (June 5-9) could escalate to the Supreme Court, impacting global demand. Japan’s JGB market developments, including a 30-year auction, will remain a focal point for global bond yield and currency dynamics, as markets navigate this interconnected web of economic and geopolitical challenges.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations