Global financial markets faced a turbulent week from August 4-8, 2025, marked by a fragile rebound overshadowed by escalating trade tensions, mixed economic signals, and shifts in central bank policy. U.S. stocks staged a recovery, with the tech sector leading gains, while European and Asian equities showed resilience despite trade-related pressures.

The week’s narrative was defined by stark contrasts: gold surged to new records on safe-haven demand, while crude oil prices tumbled amid oversupply concerns. The U.S. dollar weakened, providing a lift to other currencies as markets adopted a cautious stance.

Speculation about the Federal Reserve’s future leadership also added another layer of uncertainty, with a new nomination potentially signaling a shift toward more dovish policies. The nomination of Steven Miran is believed to signal a potential shift toward more accommodative monetary policies, especially as he is a known supporter of the current administration’s tariff policies. However, his influence remains limited pending his Senate confirmation.

This development also adds to the speculation about the future leadership of the Fed, with Christopher Waller’s name being put forward as a potential successor to Chairman Jerome Powell in May 2026.

Key Asset Performance: Divergence and Volatility

The week’s trading painted a picture of divergence across major asset classes.

Currencies: The U.S. Dollar Index (DXY) fell 0.5% to close near 98.26, influenced by tariff uncertainties and heightened expectations for future Federal Reserve rate cuts. This weakness benefited other major currencies, with the EUR/USD and GBP/USD pairs both seeing gains.

Precious Metals: Gold was a clear winner, surging 2.1% to $3,398. It even hit a new record of $3,487 on August 8, driven by an influx of safe-haven capital stemming from fears of trade wars and inflation. Silver followed a similar path, rising 2.5% to $38.34.

Commodities: In stark contrast, crude oil (WTI) tumbled 4.2% to $63.35 a barrel, and Brent crude fell to $66.60. The decline was triggered by concerns over global oversupply, exacerbated by increased output from OPEC+ and tariffs on imports from India.

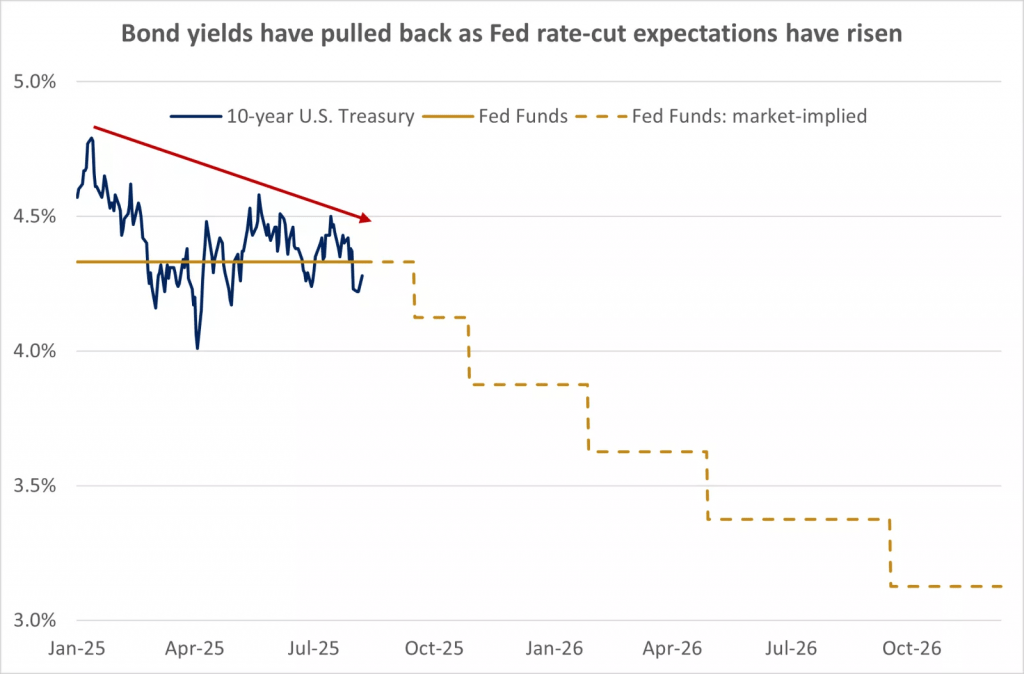

Bonds: U.S. Treasury yields experienced notable fluctuations. The 10-year Treasury note yield climbed to 4.346% early in the week before settling at 4.22% by Friday’s close, reflecting a pivot from safe havens to riskier assets. This upward movement in yields amplified concerns about higher government debt costs.

Source: Federal Reserve Bank of St. Louis, CME FedWatch.

Stock Markets: A Mixed and Uneven Recovery

Stock markets worldwide reflected a mixed recovery laced with volatility. In the U.S., major indices recovered from earlier losses but ended the week unevenly. The Dow Jones rose 1.3%, the S&P 500 gained 2.4%, and the Nasdaq climbed 3.9%, largely fueled by strong performance from tech giants like Nvidia and AMD.

European and Asian markets also showed resilience but faced pressure from trade tensions. The Stoxx 600 rose 0.8%, and the FTSE 100 gained 0.7%, though the DAX fell later in the week on poor earnings reports. Asian indices were mostly higher, with the Nikkei 225 up 2% for the week.

A key driver of market activity was the second-quarter earnings season. With 90% of S&P 500 companies reporting, results were largely positive, with two-thirds of companies beating earnings estimates. Notably, Palantir’s shares soared after reporting blockbuster results, with revenue surpassing $1 billion for the first time. However, not all companies fared well. Toyota and Crocs were hit by significant profit forecast cuts and revenue drops, respectively, citing the impact of new tariffs.

Monetary Policy and Tariffs Shape the Outlook

This past week, central banks and government policy announcements signaled a potential shift toward easing and protectionism.

Central Bank Actions: The Bank of England cut its key interest rate by 25 basis points to 4%, citing easing inflation but warning of future risks. While the Federal Reserve did not have a meeting, market sentiment solidified around a likely rate cut in September, with a 95% probability priced in.

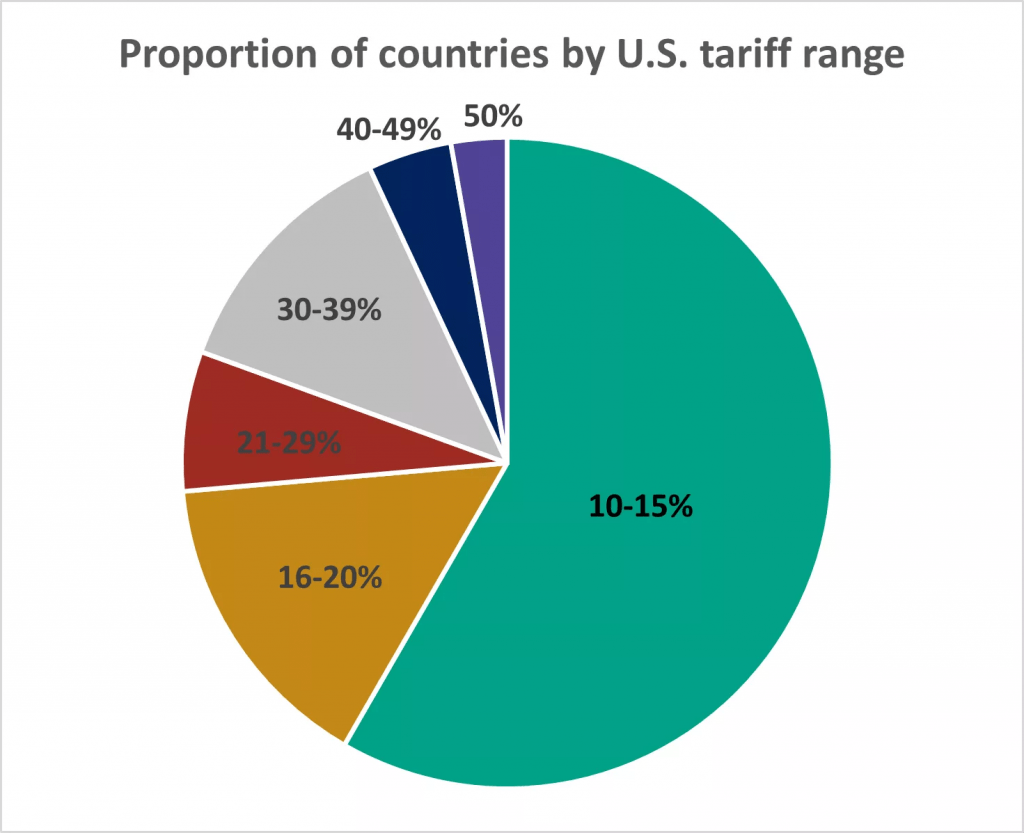

Source: WhiteHouse.gov

Escalating Tariffs: President Trump announced a new 100% tariff on imported semiconductors, though with exemptions for companies that move production to the U.S. Additionally, tariffs on a range of goods from over 60 countries officially took effect, with rates as high as 50% for Brazil and a new 50% tariff set to be imposed on India. According to Bloomberg Economics, these new tariffs would raise the average U.S. tariff to 15.2%, the steepest duties since the Great Depression.

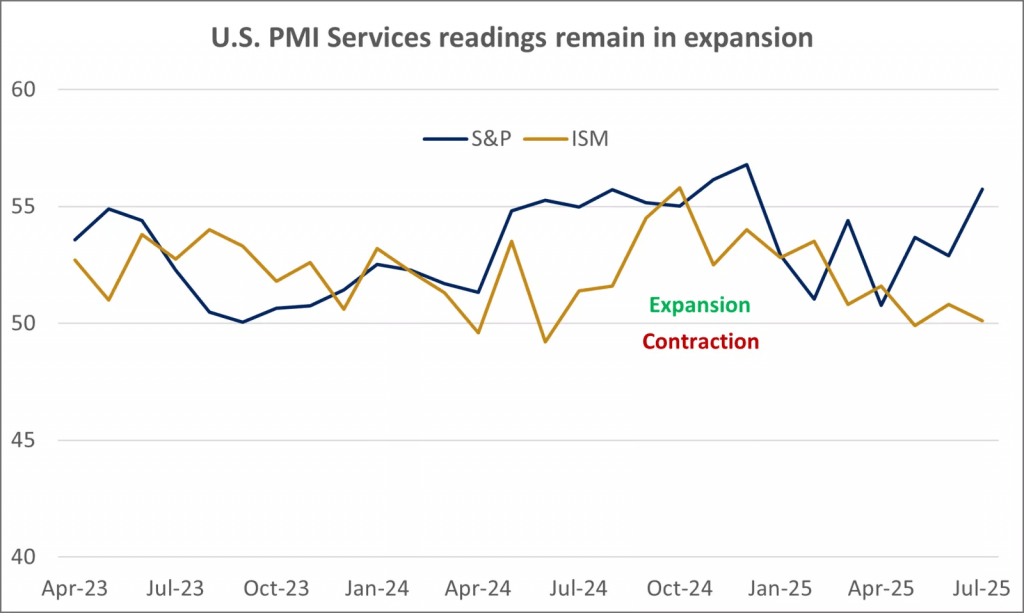

Economic Data: U.S. economic data was a mixed bag. The S&P U.S. Services Purchasing Managers’ Index (PMI) rose to a year-high of 55.7, indicating expansion. However, the Institute for Supply Management (ISM) Services PMI fell to 50.1, missing estimates and suggesting slower growth. The U.S. labor market also showed signs of softening, with July jobs added falling short of expectations and revisions to prior months indicating a slower pace of hiring.

Source: FactSet

The week concluded with markets looking ahead to highly anticipated talks between US President Trump and Russian President Putin on August 15, which could significantly impact global energy markets. Investors will also be watching for new economic data, including the latest inflation and retail sales reports, for further clues on the direction of the economy and central bank policy.

Cryptocurrencies: The cryptocurrency market saw a moderate stabilization last week, supported by modest gains. Bitcoin jumped 3% to reach nearly $114,000, while Ethereum rose 1% to approach $3,532. This recovery was primarily driven by a U.S. executive order that allows for the inclusion of cryptocurrencies in 401(k) retirement plans, potentially unlocking trillions of dollars in investment. While this development signals growing institutional acceptance, the risks associated with extreme volatility remain, especially when considering retirement savings.

Key Events Awaiting Investors in the Week Ahead

Financial markets are poised for a pivotal week filled with key events that could set the tone for major assets. Investors and traders will be closely monitoring several critical developments. At the forefront is the release of crucial U.S. economic data, specifically the Consumer Price Index (CPI) and retail sales figures.

These reports will offer vital clues about the health of the American economy and the early impact of recent tariffs on consumer spending. In addition, the highly anticipated summit between President Trump and President Putin, scheduled for August 15, is a major focal point. Any progress on peace talks regarding Ukraine could ease geopolitical tensions, directly influencing oil and other commodity prices, while a failure to reach an agreement could trigger further volatility.

Finally, remarks from Federal Reserve officials will be under the radar as investors search for additional signals on the timing and scope of potential interest rate cuts, especially amid growing expectations for a cut in September.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations