Financial markets ended the week on a positive note, encouraged less by the expected quarter-point interest rate cut and more by the broader message coming from the Federal Reserve. Investors focused on signals that policymakers are becoming increasingly attentive to economic risks, particularly in the labor market, while remaining confident that inflation pressures will continue to ease.

Source: Haver Analytics

Although the central bank appears ready to pause further rate cuts early next year, its leadership emphasized flexibility. Officials made clear they would respond if employment conditions weaken further, and updated forecasts suggest growing confidence that inflation can cool without derailing economic growth. Most policymakers now anticipate lower interest rates ahead, with room for one or two additional cuts that could leave benchmark rates in the 3%–3.5% range and reduce the drag that high borrowing costs have imposed on the economy.

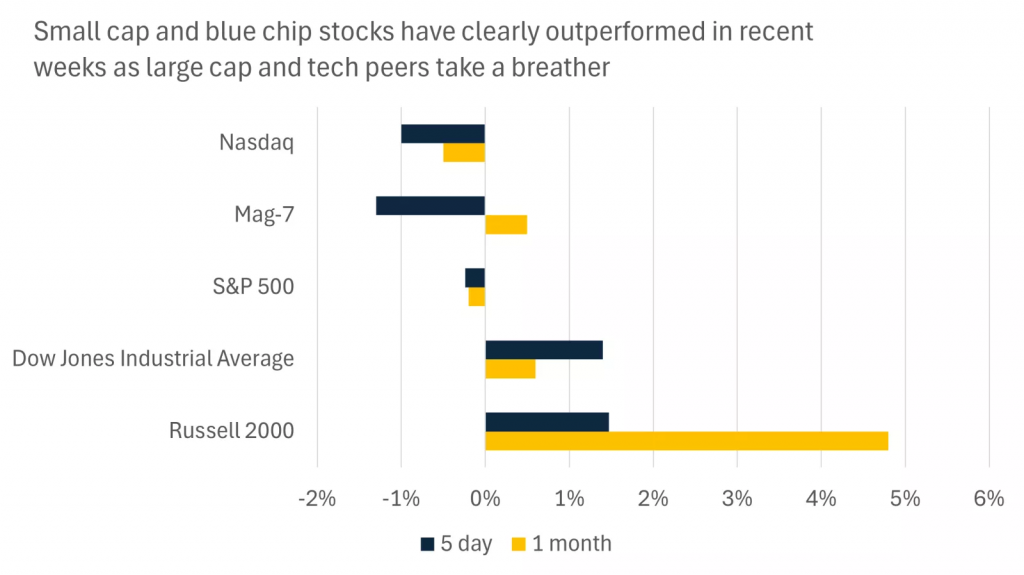

Markets welcomed this tone. Bond investors pushed yields lower at the short end of the curve, pricing in additional easing next year, while the dollar softened. Equity markets also benefited, particularly smaller companies, which tend to be more sensitive to interest rates. These stocks outperformed as investors rotated toward lower-valued segments, while some large technology names paused following mixed earnings and questions around near-term returns on heavy AI spending.

The Fed’s announcement that it will purchase Treasury bills to support short-term market liquidity added to the positive sentiment. While officials framed this as a technical measure rather than a new stimulus program, some investors interpreted it as another sign of supportive policy conditions.

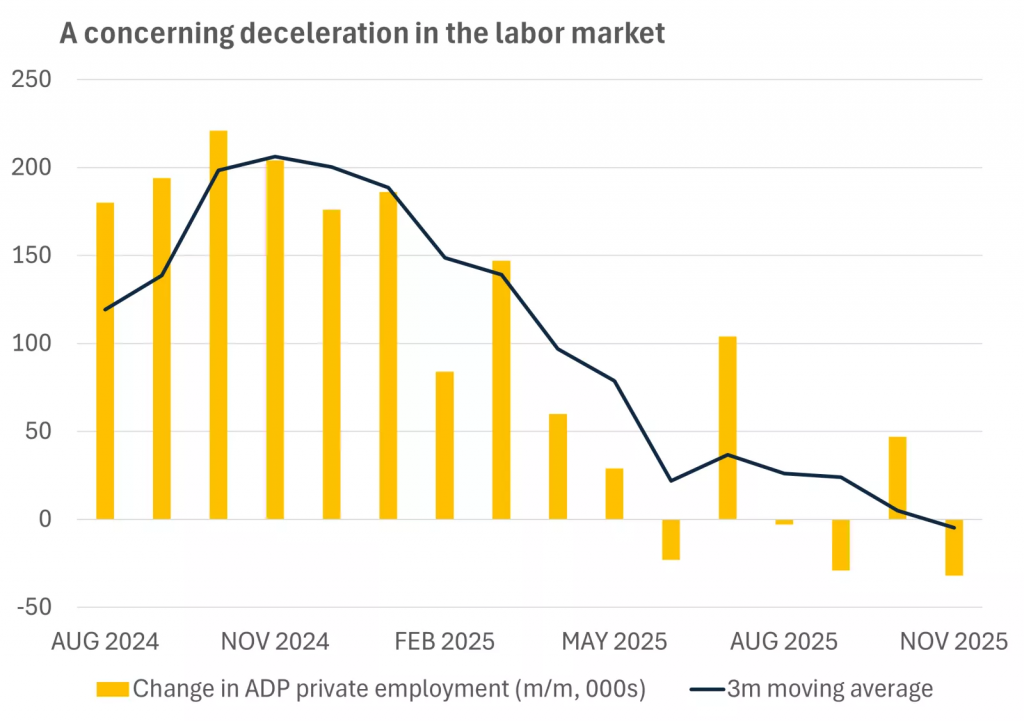

Looking ahead to 2026, the easing cycle appears closer to its end than its beginning, but modest room for further cuts remains. A soft labor market could justify additional action, particularly if job growth continues to slow and consumer spending shows signs of strain. At the same time, policymakers are wary of moving too aggressively, with inflation still above target and lingering concerns that excessive easing could reignite price pressures.

For investors, the shifting landscape carries important implications. Returns on cash and very short-term instruments have already declined and are likely to fall further, especially after accounting for inflation. As a result, holding large cash balances may offer little real return in the year ahead.

Those seeking income may consider longer-maturity fixed-income investments, though expectations for large gains in government bonds remain limited. Yields are likely to stay within a broad range as easing nears its conclusion and fiscal concerns persist.

Investors with longer time horizons and greater risk tolerance may find opportunities in equities. Diversification is becoming increasingly important as market leadership broadens beyond a narrow group of mega-cap stocks. Large companies remain well positioned to benefit from long-term innovation trends, while mid-sized firms could gain from steadier growth and lower interest rates. International and emerging-market equities also stand out for their attractive valuations and solid earnings prospects.

As monetary policy transitions into a new phase, markets appear less focused on the size of the latest rate cut and more on what comes next. The message from policymakers has reassured investors that support remains available if conditions worsen—an outlook that continues to shape portfolios as the new year approaches.

EUR/USD and JPY Dynamics

Euro vs. Dollar (EUR/USD): A Policy Standoff

The EUR/USD pair saw extremely constrained movement, posting a minor gain of less than 0.1% on Friday as the Euro successfully clawed back early-session losses. The primary driver of this tight range is the fundamental divergence between U.S. and European monetary policy expectations:

Euro Support: The Euro gained a relative edge because the market largely views the European Central Bank (ECB) as having completed its rate-cutting cycle. This effectively makes the ECB’s policy stance comparatively “tighter” than the Fed’s expected path for 2026.

Dollar Constraint: However, the U.S. Dollar’s inherent strength, fueled by rising Treasury yields and hawkish comments from some Federal Reserve officials, prevented any substantial Euro rally. The net result is a market balancing the ECB’s relative rigidity against the powerful momentum of the Dollar, keeping the pair’s gains marginal.

Japanese Yen (JPY): A Surge on Dovish Dollar and Domestic Data

The Japanese Yen saw notable strength, gaining approximately 0.6% against the Dollar in Friday’s Asian session. The Yen’s advance was supported by two key factors:

Weakening Dollar: The general retreat in the U.S. Dollar following the Fed’s cautious rate-cut language boosted all low-yielding currencies, including the Yen.

Domestic Strength: Economic data provided a local tailwind, with Japan’s fourth-quarter BSI Large Manufacturing Confidence Index rising to 4.7 points (from 3.8 in Q3), hitting its highest level in a year and signaling improved corporate sentiment.

Rate Hike Bets: With the Bank of Japan’s meeting approaching on December 19th, market expectations for a rate hike have risen dramatically to a 91% probability, setting the stage for potential continued JPY strength.

US Monetary Policy & Fixed Income

Federal Reserve Policy and Dovish Split

The Fed’s decision this week to cut the Federal Funds Rate by 25 basis points to a range of 3.5%–3.75% was met with mixed reactions, highlighting a deepening internal policy split:

The Cut: The move was almost universally priced in by markets (over 95% certainty) and was followed by the Fed’s announcement to initiate $40 billion per month in short-term Treasury purchases to enhance financial system liquidity—a move akin to Quantitative Easing.

Hawkish Caution: Comments from regional presidents tempered expectations for further aggressive cuts. Chicago Fed President Austan Goolsbee expressed optimism for lower rates in 2026 but warned against rushing more cuts and assuming inflation is transient. Kansas City’s Jeff Schmidt and Cleveland’s Beth Hammack also favored maintaining a restrictive stance due to persistent economic strength and inflation.

Dovish Counterpoint: Conversely, Philadelphia’s Anna Paulson expressed greater concern over labor market weakness than inflation, suggesting a more flexible approach. This internal debate complicates the forecast for 2026, where the looming end of Chair Powell’s term and the potential appointment of a more dovish successor, like Kevin Hassett, adds political uncertainty.

U.S. Treasury Yields and Investor Reassessment

U.S. Treasury yields experienced a significant rebound on Friday, reversing their post-Fed cut drop, as investors reacted to the cautious tone set by Fed officials like Goolsbee:

Yield Spike: The benchmark 10-year Treasury yield climbed by more than five basis points to 4.192%, while the 30-year yield jumped over six basis points to 4.852%. (Yields move inversely to bond prices).

Policy Path Scrutiny: This upward trend was a direct reaction to Goolsbee’s warning against rapid rate cuts, challenging the dovish interpretation that had driven yields down immediately after the Fed’s announcement.

The Dilemma: The bond market is now focused on the Fed’s delicate balancing act: easing to support a gradually weakening labor market (as indicated by rising weekly jobless claims to a three-month high of 236K) versus restraining above-target inflation.

Equity Markets: Tech-Led Sell-Off

Wall Street’s Sharp Decline

U.S. stock markets suffered a marked downturn on Friday, largely due to a severe sell-off in the technology sector:

Major Index Losses: The S&P 500 fell nearly 1.00%, the Nasdaq 100—the most tech-exposed index—slumped approximately 2.00% to a two-week low, and the Dow Jones Industrial Average dropped about 0.6%.

The Broadcom Shock: Chip giant Broadcom was the primary catalyst, plunging over 11.00% after reporting a weaker sales outlook and failing to provide clear revenue projections for AI in 2026. This performance disappointed investors who had pushed the stock up 75-80% year-to-date.

Source: Bloomberg

AI Angst: This disappointment compounded existing “AI angst” triggered by similar performance and debt concerns at Oracle. The overall weakness across AI-related stocks (Micron, Marvell, Lam Research, AMD, Applied Materials all down over 4%) reflects investor uncertainty about the sector’s high valuations and the return on massive AI infrastructure spending.

Commodities: Oil, Gold, and Silver

Crude Oil: Oversupply Trumps Geopolitics

Crude oil prices continued their decline, with WTI falling 1.4% to a seven-week low, and gasoline reaching a five-year low, as fundamental oversupply concerns outweighed geopolitical risks:

Supply Flood: Bearish sentiment is driven by projections of a “super surplus” in the coming year, with the International Energy Agency (IEA) forecasting a record global surplus of 4 million barrels per day in 2026. U.S. production estimates for 2025 were also revised higher.

Demand Weakness: Falling refining rates and weak stock market performance, which reduces optimism for economic growth, signal softening energy demand. Price cuts by Saudi Aramco for Asian customers underscore this demand weakness.

Pressure Points: Despite supportive geopolitical factors (like tensions in Venezuela and Ukrainian attacks on Russian oil facilities), the sheer volume of expected global supply remains the dominant downward pressure on prices.

Precious Metals: Gold and Silver as Safe Havens

Gold and Silver maintained their upward momentum, benefiting from the Dollar’s post-Fed softening and ongoing uncertainty:

Gold Stability: Gold prices stabilized and regained ground lost earlier in the week. The metal was supported by the drop in the Dollar, which makes it cheaper for international buyers. The Fed’s cautious but still dovish tone reassured investors, keeping gold attractive as a reliable store of value.

Silver Surge: Silver experienced significant support, driven by a tightening supply environment. Chinese warehouse inventories linked to the Shanghai Futures Exchange dropped to a ten-year low (519K kg). Furthermore, renewed investment demand was clear, with long holdings in silver ETFs climbing to their highest level in 3.25 years, indicating strong renewed confidence in the white metal as a financial asset.

Dovish Fed Tone Lifts European Stocks as AI Giants Face Scrutiny

European equities advanced on Friday, buoyed by global risk appetite after the U.S. Federal Reserve adopted a more dovish tone. Investors largely shrugged off discouraging economic data from the U.K., choosing instead to focus on the supportive global sentiment following the Fed’s latest move. By 08:05 GMT (03:05 ET), the trend was clearly positive: Germany’s DAX climbed 0.5%, France’s CAC 40 gained 0.2%, and the U.K.’s FTSE 100 rose 0.4%.

Global Optimism Trumps Local Weakness

The positive momentum began on Wall Street, where the Federal Reserve’s decision to cut interest rates by 25 basis points—coupled with Chair Jerome Powell signaling potential for further easing next year—was less hawkish than many had anticipated. This spurred a relief rally, pushing the S&P 500 and Dow Jones Industrial Average to close at fresh record highs on Thursday. While the Nasdaq Composite lagged due to pressure on tech stocks, the constructive U.S. finish set a supportive tone for Asian markets and, consequently, Europe, ahead of the European Central Bank (ECB) and Bank of England (BoE) meetings next week.

U.K. Economy Fails to Impress, Rate Cut Still Expected

The macro picture in Britain was noticeably weaker, with October data revealing that U.K. GDP contracted by 0.1% month-over-month, matching September’s decline and missing forecasts for a slight gain. Subdued activity was attributed to budget uncertainty ahead of the Chancellor Rachel Reeves’ Autumn statement, weighing on both business investment and consumer spending. Despite the soft data, markets still anticipate the Bank of England will cut rates by 25 basis points to 3.75% next week, believing cooling inflation provides policymakers with room for monetary easing.

Eurozone Inflation Aligns with Target

Meanwhile, in the Euro area, inflation figures remained the central focus. German inflation for November was confirmed at 2.6%, with the EU-harmonized HICP standing at 2.3% year-over-year in October. With eurozone inflation broadly aligning with the ECB’s 2% target, the central bank is widely expected to keep rates on hold next week. The ECB is anticipated to maintain a wait-and-see stance rather than signaling any fresh cuts, reflecting a different stage in the monetary cycle compared to the U.K.

Oracle Slide Highlights AI Sector Tensions

Amid the market-wide positive moves, the tech sector continued to grapple with unique valuation challenges. Shares of Oracle tumbled after its latest quarterly earnings slightly missed analyst expectations, fueling fresh skepticism about the returns from its aggressive push into artificial intelligence. The minor revenue shortfall triggered a sharp sell-off, underscoring the extreme sensitivity of tech valuations in an overheated AI market where stocks are often “priced for perfection.” Despite Oracle reporting solid overall revenue growth of 14% and a significant 68% surge in its AI-focused cloud services, the miss weighed heavily on investor sentiment, also impacting other AI-related stocks like Advanced Micro Devices (AMD) and Meta. The episode highlights the growing tension over whether the rapid AI expansion can sustainably offset rising infrastructure and R&D costs—a question that remains central for tech companies on both sides of the Atlantic.

Bitcoin Holds Its Course Despite Monetary Easing

Bitcoin logged a slight increase on Friday, rising by 2.5% to reach $92,579.6, ending the week with gains of nearly 4%. This performance comes despite the tight price range dominating its trading, as markets digested the Federal Reserve’s recent decision to cut the interest rate by 25 basis points. Although interest rate cuts typically support high-risk assets, Bitcoin struggled to translate the Fed’s decision into a decisive price breakout, largely oscillating within a defined range throughout December, specifically between the $88,000 and $93,000 levels.

This performance reflects a state of hesitation in the market; while near-term monetary easing was supportive of crypto assets, the central bank’s cautious outlook for the future constrained full risk appetite, preventing a strong and sustained surge similar to what occurred in previous easing cycles.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations