As 2025 draws to a close, global markets continued to move with notable caution amid holiday-related low liquidity, with investors monitoring the performance of various assets before transitioning into 2026.

The markets in the last week (December 22–26) displayed a balance between optimism over strong annual performance and caution regarding economic and political pressures, including geopolitical tensions such as those related to Venezuela, which affected energy and metals markets. Economic data released during the week also played a role, including U.S. GDP growth exceeding expectations at 3.1% for Q3, declining jobless claims, and retail sales rising 4.2% during the holiday season. Policies from the Federal Reserve, which cut interest rates three times in 2025 while reaffirming its independence despite political pressures, further supported economic activity.

Source: FactSet

U.S. Stocks

U.S. equities showed relatively stable performance during the short Christmas week, with lower trading volumes:

- S&P 500: Fell 0.03% to close at 6,929.94, following a total weekly gain of 1.4%, supported by the technology sector.

- Nasdaq 100: Decreased 0.09% to 23,593.10, with a weekly gain of 1.2% driven by major tech companies and AI optimism. Nvidia invested around $20 billion to partially acquire Groq’s technologies and talent, highlighting a strategic shift toward AI inference, emphasizing low-latency and stable performance. The deal was structured to avoid regulatory pressure after the failed Arm acquisition, while Nvidia aims to expand its platform into an integrated ecosystem of GPUs, networking, software tools, and specialized processors to control infrastructure bottlenecks.

- Dow Jones: Dropped 20.19 points to 48,710.97, with a weekly gain of 1.2% and stability in industrial companies.

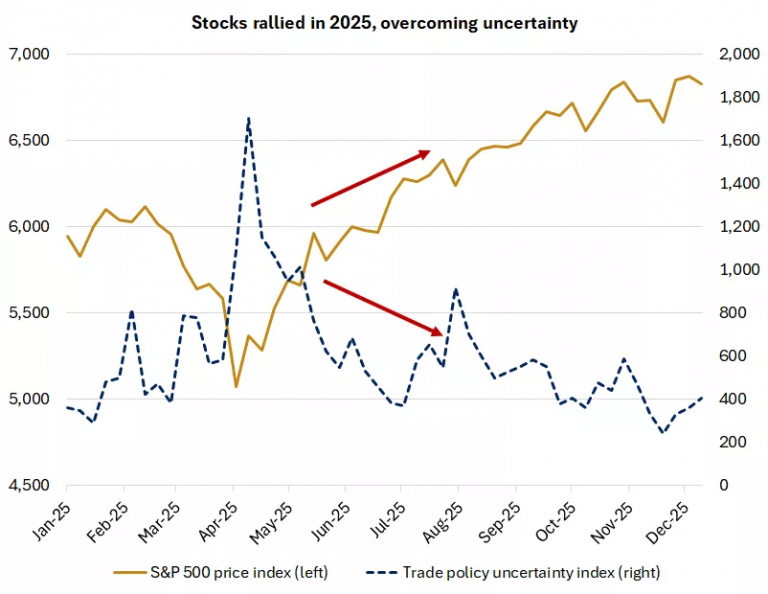

Annual Performance: U.S. equities recorded strong gains in 2025, with the S&P 500 reaching approximately 39 new all-time highs, supported by tech and AI profit growth. Nasdaq gained over 19.7%, while other major indices rose around 15%, despite volatility from trade policies and Fed actions.

Weekly Drivers: Monitoring earnings from major tech companies, low liquidity effects, and investor expectations of modest Fed rate cuts in 2026 based on economic growth and labor market data.

European Stocks

European markets opened the week quietly, with minor fluctuations amid low liquidity:

- STOXX 600: Fell 0.09% to 586.99, though it ended the week near record levels with some sessions rising 0.34%.

- FTSE 100: Down 0.4%, influenced by consumer sectors.

- CAC 40: Dropped 0.2%, while tech stocks rebounded 0.5% after previous underperformance.

- DAX: Rose 0.23% in some sessions, supported by industrial stocks.

Consumer and defense sectors slightly declined, while commodity-linked shares rose on gains in gold and copper prices. The financial sector remained stable amid merger activity.

Annual Performance: European equities outperformed U.S. equities by 13%, supported by ECB monetary flexibility, industrial and tech investments, with Germany and UK markets reaching new highs and their strongest performance since 2021.

Global Currencies

The U.S. Dollar Index (DXY) fell to around 98.02, reflecting investor evaluation of inflation, economic growth, and Fed expectations for 2026.

- Euro (EUR/USD): Held near 1.1784 on December 26, benefiting from a weaker dollar, with an expected range of 1.1750–1.2000.

- British Pound (GBP/USD): Rebounded to 1.3460, supported by aligned growth data.

- Australian Dollar (AUD/USD): Held steady around 0.6650.

- USD/JPY: Fell 0.5% following Japanese Finance Minister comments on government intervention, supported by the Bank of Japan’s 25-basis-point rate hike.

Annual Performance: Dollar declined 9.22% (worst since 2017), while the euro rose 13.26%, with the pound and yen benefiting from flexible monetary policies and relative regional growth.

Gold, Silver, and Copper

Metals recorded strong gains during the week, supported by safe-haven and industrial demand:

- Gold: Reached record levels around $4,505/oz, driven by investment demand and ETFs.

- Silver: Maintained strong gains, rising to $72.11, supported by industrial demand.

- Copper: Hit new record highs at $5.51/lb, with sustained industrial demand and commodity recovery.

Annual Performance: Metals saw strong annual gains: Silver +128.47%, Gold +66.59%, Copper +35.45%, with gold emerging as a safe haven amid dollar weakness and market uncertainty.

Oil and Gas

Oil prices fell during the week despite potential supply restrictions, influenced by Venezuelan tensions and inflation concerns:

- Brent Crude: Closed at $60.65/bbl, down 2.57% for the week after touching $62.13 on Thursday.

- WTI: Closed at $56.74/bbl, down 2.29% weekly.

- Natural Gas: Rose to $4.43/MMBtu, supported by winter demand.

Annual Performance: Oil experienced sharp volatility, down 19–21% from 2024 levels, while gas remained relatively stable with seasonal demand increases.

Bonds and Treasury Yields

U.S. bonds remained stable during the week:

- 10-Year Treasury: 4.14%

- 2-Year Treasury: 3.516%

- 30-Year Treasury: 4.793%

Annual Performance: U.S. investment-grade bonds posted strong gains, outperforming cash, supported by Fed rate cuts and labor market slowdown, with yields declining over the year.

Bitcoin and Cryptocurrencies

Cryptocurrencies saw limited declines in the final week of December:

- Bitcoin: Slightly down 0.9%, fluctuating between $87,000–$96,000.

- Crypto-related stocks like Coinbase and MicroStrategy fell over 1%, signaling potential selling pressure.

Annual Performance: Cryptocurrencies experienced high volatility, underperforming relative to 2024, yet remained part of high-risk, high-return investor strategies, with Bitcoin up 21.2% in certain periods.

Overall Annual Asset Performance

- U.S. Stocks: Strong gains, driven by technology and AI (Nasdaq +19.70%).

- European & International Stocks: Outperformed by 13%, aided by flexible monetary policies.

- Precious & Industrial Metals: Reached record highs (Silver +128.47%, Gold +66.59%, Copper +35.45%).

- Oil & Gas: Volatile, with year-end stability.

- U.S. Bonds: Best performance since 2020, surpassing cash.

- Cryptocurrencies: High volatility, integrated in high-risk portfolios.

Outlook for the Coming Week

Entering 2026, investors are expected to focus on:

- Inflation data projected to rise to 2.7% and U.S. labor market indicators to gauge the Fed’s path, with limited rate cuts anticipated to 3.00–3.25% alongside 2.2% GDP growth.

- Seasonal liquidity impacts on market movements.

- Tracking prices of gold, silver, copper, oil, and gas, with gold expected to reach $4,900 by December 2026.

- Evaluating AI-linked tech investments.

Relative caution is expected to continue, with diversified portfolios across equities, bonds, metals, cryptocurrencies, and foreign currencies, leveraging sectoral and geographic opportunities while monitoring global geopolitical and economic factors likely to influence growth in the new year.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations