Last week brought a surge of economic data that served as a vital stress test for the U.S. economy. It revealed a complex landscape where anxiety over Artificial Intelligence (AI) is rising, yet underlying economic fundamentals remain stronger than anticipated. While waves of market volatility—particularly in the tech sector—test investor nerves, the broader picture shows improving data, suggesting the Federal Reserve may take a cautious approach to rate cuts later this year.

Consumer Prices Ease

Following a massive spending spree throughout 2025, U.S. households appear to be adjusting to better-than-expected inflation data. However, December retail sales data was disappointing; overall sales remained flat, and excluding volatile categories, there was a contraction of about 0.1% after adjusting for inflation. This recent spending surge seems linked to declining personal savings, a trend that is unsustainable in the long run.

However, tailwinds are on the horizon for 2026: a combination of tax cuts enacted last year and withholding adjustments means roughly $100 billion will be injected into household pockets through tax refunds and increased take-home pay, providing a new income boost capable of driving a new wave of spending.

The Labor Market Breathes

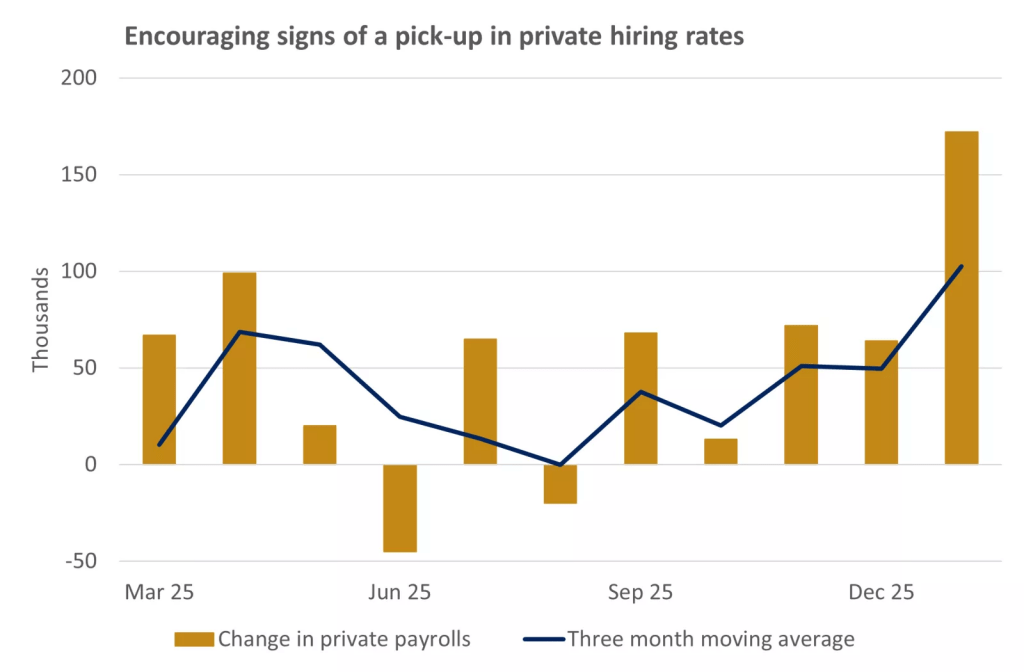

After the hiring freeze that defined 2025, the U.S. labor market has shown clear signs of a rebound. The January employment report was a positive surprise, with the private sector adding 172,000 jobs, compared to a monthly average of just 15,000 last year. Non-farm payrolls data indicated 130,000 jobs added against expectations of 55,000. As the caution imposed by the Trump administration’s trade policies subsides, the fog seems to be lifting. Furthermore, the unemployment rate dropped to 4.3% from a peak of 4.5%, reflecting stability that should support future income growth.

Source: Bloomberg

The Slow, Winding Road to Lower Inflation

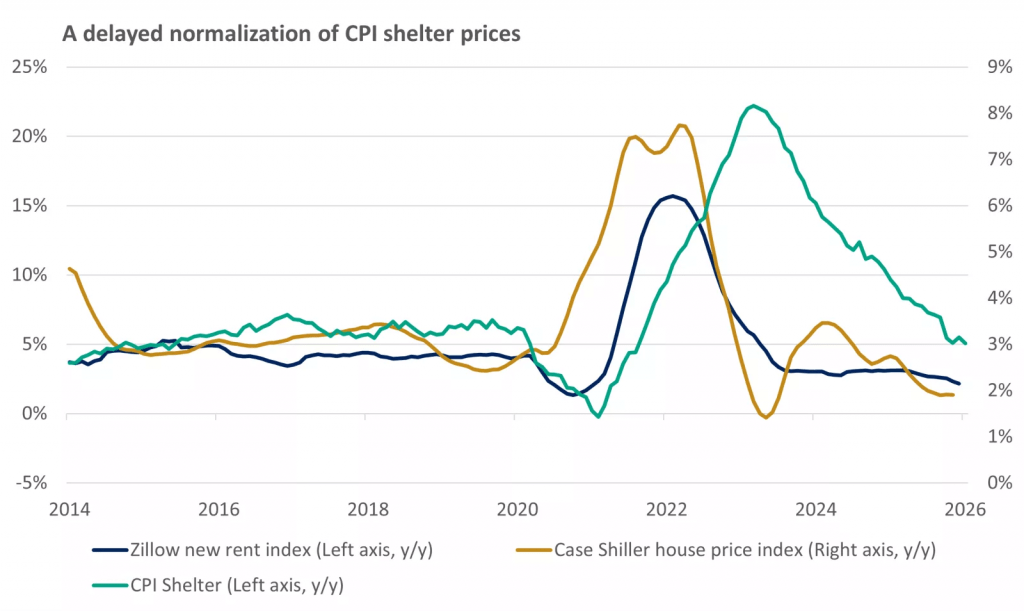

On the inflation front, headlines were encouraging, even if price growth remains slightly above the Federal Reserve’s preferred level. Headline inflation slowed to 2.4% year-over-year in January, supported by falling energy prices. Core inflation—excluding food and energy—remained stickier at 2.5%, but the overall trend points to a gradual decline. Notably, rent inflation has finally begun to ease, a pivotal factor that should drive headline inflation toward the 2% target. Although tariff pressures and a weaker dollar might cause a temporary spike in goods prices, the general trajectory suggests inflationary pressures will wane as 2026 progresses.

Source: Bloomberg

Fed Policy: A Steady Hand Until Summer

It is expected that recent data will not change the Fed’s short-term stance. With the labor market stabilizing and inflation gradually cooling, the central bank is expected to remain in a “wait-and-see” mode during its upcoming meetings. However, with the leadership change approaching in May, and Kevin Warsh poised to succeed Jerome Powell, there is significant room for rate cuts later this year. Although the urgent need for policy easing has diminished due to strong growth, structural fundamentals support lower borrowing costs by summer.

Volatility and AI Concerns

Despite the positive economic backdrop, equity markets have entered a more volatile phase. The “Magnificent Seven” tech stocks faced selling pressure, pushing broader indices down. More importantly, these concerns spread to non-traditional sectors like financial services, real estate, and logistics, as investors began pricing in the potential for AI-driven disruptions. While these fears are still more speculative than reflected in actual revenue data, they drove money toward defensive assets like Treasuries and utilities.

Developments Highlight the Importance of Portfolio Diversification

Despite high volatility and limited selling pressure, the fundamental drivers of corporate earnings expansion—tax relief, anticipated rate cuts later this summer, and solid economic growth—remain firmly in place. In a trading environment characterized by volatility and sudden market cycles, a more cautious and diversified approach is more essential than ever. Distributing risk across company sizes, sectors, and international regions remains vital to mitigating concentration risk and capitalizing on the expected broadening of market leadership in 2026.

Market Snapshot: Gold Hits Records, Tech Stumbles, Dollar Strengthens

Global markets experienced a tug-of-war last week between strong U.S. jobs data and easing inflation, leaving investors balancing hopes for monetary easing from the Fed against positive signals regarding the resilience of the U.S. economy.

Wall Street: Industrials shine while Tech retreats. The Dow Jones Industrial Average jumped to new record highs, rising over 1.2% as investors rotated toward financials and industrials. The S&P 500 managed slight gains, while the Nasdaq Composite fell sharply due to weakness in big tech stocks. Analysts noted that high valuations for AI-related stocks triggered profit-taking, even though overall sentiment remained positive.

International Markets: European stocks remained near record highs, supported by strong earnings in utilities and financials. Asian stocks were more turbulent: Japan’s Nikkei 225 recovered by the end of the week, but Hong Kong’s Hang Seng dropped over 1% amid ongoing real estate concerns. Korea’s KOSPI fell due to pressure on semiconductor companies, while China’s CSI 300 dipped 0.1% on weak manufacturing data.

Commodities: Gold enters the new trading week above $5,000 per ounce, an all-time high, supported by falling U.S. Treasury yields and weaker inflation data, which boosted demand for safe-haven assets. Silver fluctuated wildly to end the week lower. Oil prices continued to fall, with WTI settling near $62.50 per barrel amid fears of oversupply following the International Energy Agency’s forecast of record surplus in 2026.

Currencies: The U.S. dollar strengthened following the jobs report, reducing bets on imminent rate cuts. Conversely, the Euro achieved its strongest weekly gain in over a decade, supported by European monetary policy expectations and previous weak U.S. data.

Bonds: U.S. Treasury yields fell sharply mid-week, with the 10-year yield dropping to around 4.05%. Weak retail and housing data bolstered expectations for monetary easing later this year, though the strength of the labor market complicated the picture.

Cryptocurrency: Bitcoin enters the new trading week around $68,500, despite jumping above $70,000 earlier last week driven by cooling inflation and renewed optimism about institutional adoption. Trading volumes rose significantly, but analysts warned that recent fund outflows reveal fragility in investor sentiment.

Corporate Earnings: Mixed Signals

The earnings season showed mixed results; utilities and financials outperformed, while healthcare and information technology declined. PG&E announced strong 2025 results with more conservative guidance for 2026.

The Week Ahead

Monday, Feb 16: Japan releases GDP data. U.S. markets are closed for the Presidents’ Day holiday.

Tuesday, Feb 17: U.S. releases the February “Empire State” Manufacturing Index (Forecast: 10.0).

Wednesday, Feb 18: Investors focus on the minutes from the January Fed meeting for clues on the rate path, alongside January Industrial Production data (Forecast: 0.3% growth).

Thursday, Feb 19: U.S. Initial Jobless Claims (Expected: 220k) and the Philadelphia Manufacturing Index are released.

Friday, Feb 20: The peak of the week features the Q4 GDP release (Expected: 2.5% vs. 4.4% prior) and Personal Spending data. The December PCE index is also released (Expected: 0.3% monthly, 2.8% annually for headline; 0.3% monthly, 2.9% annually for core), which could strengthen expectations for delayed rate cuts if data comes in stronger than expected.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations