The US dollar experienced significant volatility last week, caught in a tug-of-war between positive and negative market forces. Support from Federal Reserve policymakers, led by Chair Jerome Powell, emphasized a cautious “wait-and-see” approach to interest rate cuts, bolstering the dollar. This stance was reinforced by stronger-than-expected consumer confidence, with the University of Michigan’s June Consumer Sentiment Index revised upward to 60.7, surpassing forecasts.

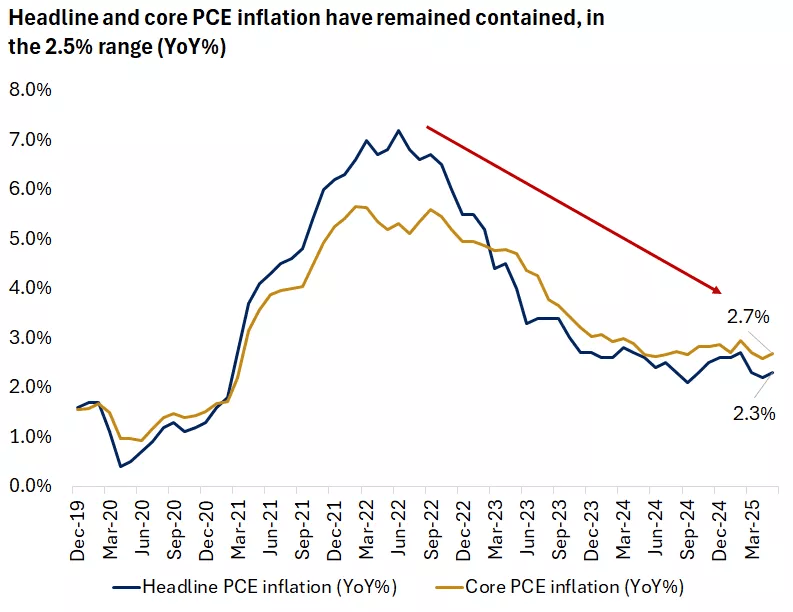

Additionally, optimism surrounding US-China trade talks, as announced by US Commerce Secretary Howard Lutnick, and PCE data indicating inflation nearing the Fed’s target further supported the greenback. However, these gains were offset by negative pressures, including a Qatari-brokered ceasefire between Iran and Israel, which reduced safe-haven demand and weakened the dollar. Reports of President Donald Trump considering a replacement for Powell also raised concerns about the Federal Reserve’s independence, further weighing on the currency.

Source: Bloomberg

Gold Prices Decline as Geopolitical Tensions Ease

Gold prices fell last week, driven by several key factors. The ceasefire in the Middle East diminished the metal’s safe-haven appeal, as markets embraced a more risk-on sentiment. Speculation about a potential change in Federal Reserve leadership sparked fears regarding the security of physical gold holdings, particularly for countries like Germany and Italy. Additionally, hawkish rhetoric from Fed policymakers, including Powell, strengthened the US dollar, which typically moves inversely to gold prices. These combined pressures led to a notable downturn for the precious metal.

Euro Gains Strength on Dollar Weakness and ECB Policy

The euro rose by 1.5% against the dollar, capitalizing on the greenback’s weakness and supportive developments in the Eurozone. ECB Governing Council member Centeno’s call for additional stimulus highlighted the need for economic support, while dovish comments from Villeroy de Galhau suggested potential rate cuts within the next six months. Positive economic data, including a 13-month high in Germany’s June IFO Business Climate Index and a 1.6% year-on-year increase in Eurozone May new car registrations, further bolstered the euro. Rising 10-year German bund yields also enhanced the currency’s appeal through favorable interest rate differentials.

Yen Rises Despite Mixed Economic Signals

The Japanese yen gained ground against the dollar, driven primarily by the greenback’s decline and reduced safe-haven demand following the Middle East ceasefire. However, domestic challenges weighed on the yen, including weaker-than-expected Japan May retail sales and June Tokyo CPI data, alongside concerns about rising energy costs impacting the economy. Despite these headwinds, Bank of Japan (BOJ) Board member Tamura’s comments about potential rate hikes if inflation risks intensify provided some support. Japan’s denial of a Financial Times report claiming US pressure to increase defense spending to 3.5% of GDP also influenced market sentiment.

Oil Prices Plummet as Middle East Tensions Subside

Oil prices dropped by nearly 12.1% last week, primarily due to the Qatari-brokered ceasefire between Iran and Israel, which alleviated fears of supply disruptions. Despite bullish factors such as declining US oil, gasoline, and distillate inventories, and a reduction in US oil rig counts reported by Baker Hughes, the de-escalation in the Middle East proved to be the dominant driver, pushing crude prices lower.

Bitcoin Rally Fueled by Market Optimism

Bitcoin continued its upward trajectory for the fourth consecutive trading day, driven by a combination of macroeconomic, monetary, and geopolitical factors. Federal Reserve Chair Jerome Powell’s reiterated “wait-and-see” approach to rate cuts, echoed by FOMC member Jeffery Schmid and Atlanta Fed chief Rafael Bostic, created a favorable environment for risk assets. A positive correlation with the S&P 500, which hit levels last seen in February, further supported Bitcoin’s rally. The Middle East ceasefire contributed to market stability, while significant inflows of $588.6 million into US spot Bitcoin ETFs on a single day in June, as reported by Binance, underscored strong investor confidence. As long as these factors persist, Bitcoin may see continued upward momentum.

Key Events to Watch This Week

Financial markets are gearing up for a busy week with several high-impact events. In the US, non-farm payrolls (NFP) and wage growth data, alongside a speech from Federal Reserve Chair Jerome Powell, will be closely monitored. In Europe, German retail sales, CPI, manufacturing, and unemployment data, as well as Eurozone CPI, will provide insights into the region’s economic health. China’s manufacturing data, Japan’s housing data, UK housing, GDP, and manufacturing figures, and Australia’s inflation and business confidence data are also on the radar, potentially shaping global market trends.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations