Throughout the last trading week, US dollar was a net loser amid improvement in risk appetite, increasing expectations of a rate cut by the Fed in September meeting, relative stability in prices, and fears of intervention in Fed’s policies.

Although Trump-Putin summit in Alaska didn’t reach a peace deal in Ukraine, it sent positive signals to markets as it could end a state of isolation on Russia imposed by the West.

The summit also saw delay of imposing sanctions on China for buying Russian oil. The third signal was positive too as Trump spoke about a proposed meeting between Putin and his Ukrainian counterpart Volodymyr Zelensky, but without any details.

Inflation data

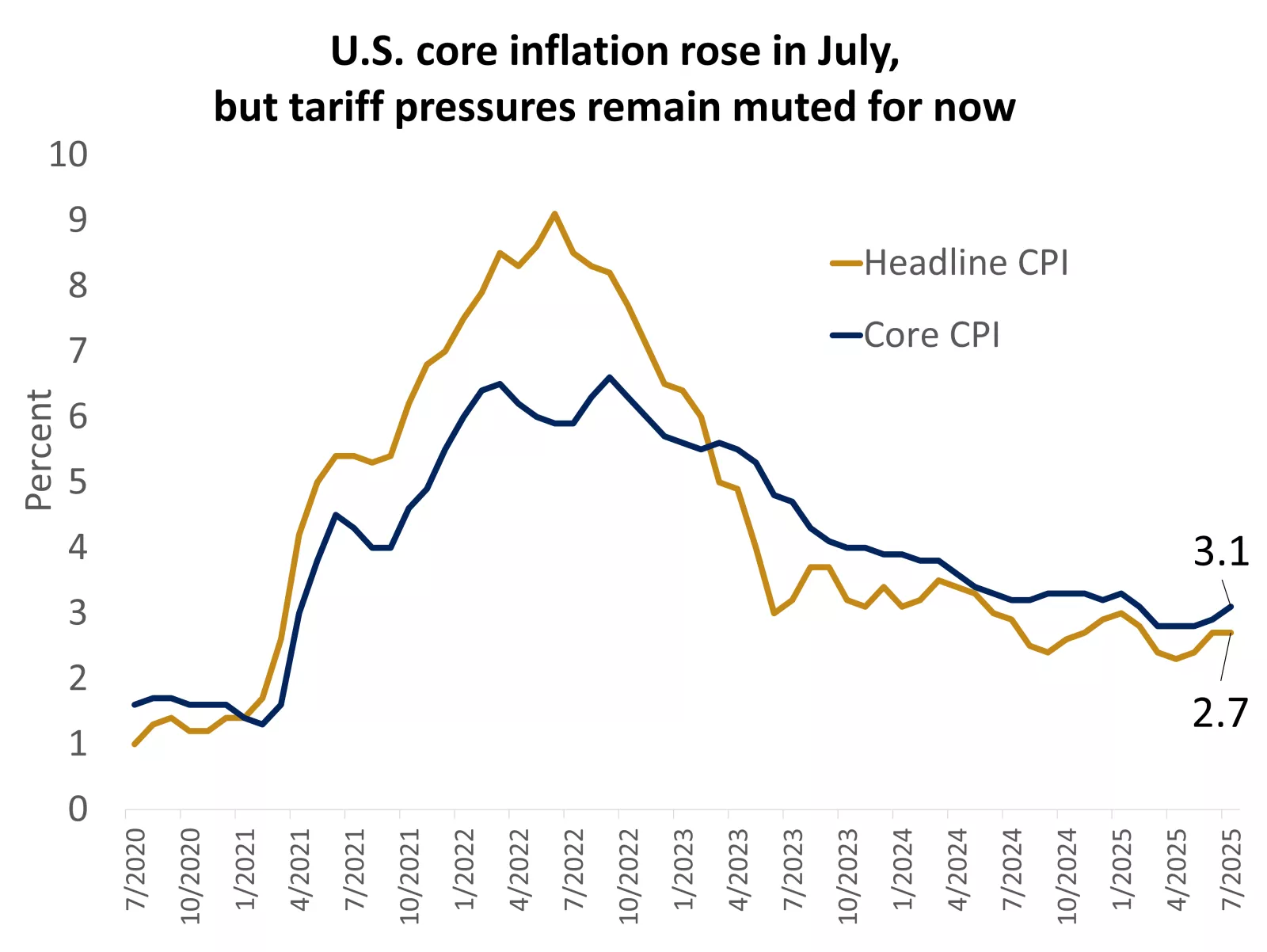

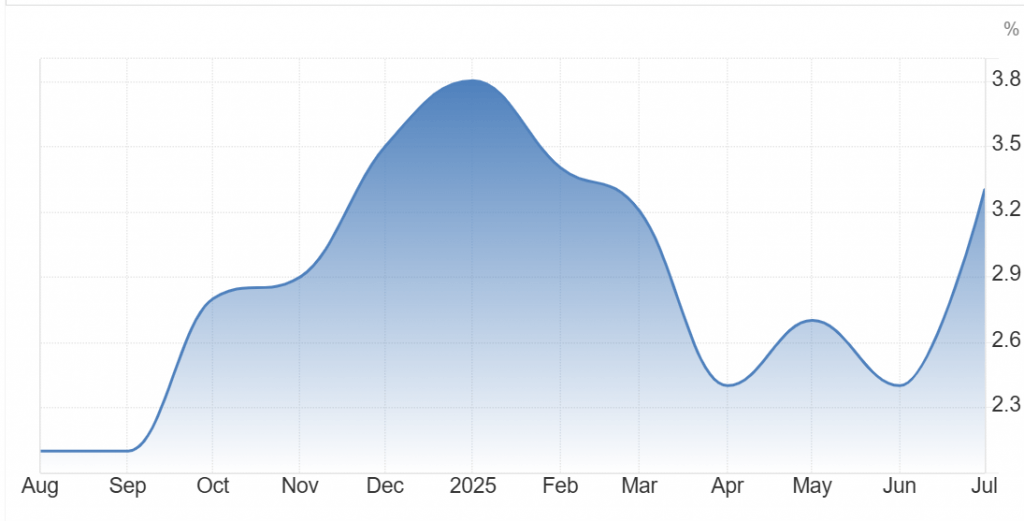

CPI readings also strongly contributed to dollar weakness las week after The July U.S.

CPI report showed a monthly increase of +0.2%, in line with market expectations.

On an annual basis, headline CPI came in at +2.7%, unchanged from June and slightly below expectations for a +0.1 point rise to +2.8%.

Core CPI rose by +0.3% month-on-month, also matching consensus forecasts.

The year-on-year core CPI reading stood at +3.1%, up from +2.9% in June and marginally above market expectations of +3.0%.

PPI report was stronger than expected, showing that wholesale prices are rising faster than anticipated.

This suggests businesses are passing on costs, including tariffs, more aggressively.

The data also challenges the market’s optimism about Tuesday’s CPI report, hinting that inflation may remain stubborn and higher consumer prices could follow as the increases in producers prices are to be passed on consumers after a while.

Other data contributed to dollar decline as UoM consumer confidence reading decline, adding to negative price action of the greenback.

Fed’s independency

Fears around intervention in Fed’s policies from the part of US administration also harmed US dollar.

Treasury Secretary Scott Bessent today said that interest rates are “too constrictive. Rates should probably be 150, 175 basis points lower.”

He added “There’s a very good chance of a 50 basis point cut. We could go into a series of rate cuts here, starting with a 50 basis point rate cut in September.”

President Donald Trump renewed his attack on Fed’s Chair Jerome Powell, threatening that he could allow a “major lawsuit” against Federal Reserve Bank chief.

The president said on Truth Social last week that the lawsuit would relate to Powell’s management of major renovations at the Fed’s headquarters in Washington, D.C.

Trump–Putin Summit in Alaska

The summit shed light on Russian President Vladimir Putin’s emergence from the international isolation imposed by the West—a positive development that could pave the way for greater political and economic rapprochement.

In subsequent remarks to Fox News, U.S. President Donald Trump announced a delay in imposing tariffs on China, citing its purchase of Russian oil as a key factor. He attributed the decision to “progress” made during his talks with Putin, adding: “I might have to reconsider in two or three weeks, but not right now.”

Trump also proposed a meeting between Putin and Ukrainian President Volodymyr Zelensky, suggesting he might attend personally. However, he did not specify who would organize the meeting or when it might take place. Putin, for his part, did not comment on the proposal, but emphasized that he expects Ukraine and its European allies to engage “constructively” with the outcomes of the negotiations.

President Zelensky had stated late last week that any decision made without Kyiv’s involvement would be “against peace,” reiterating his firm rejection of “ceding any territory seized by Russia.” This stance contributed to heightened risk aversion in the markets, leading to a rise in the U.S. dollar in early trading last week.

U.S. Equities Post Strong Weekly Gains

U.S. stocks recorded solid weekly gains, supported by data indicating a slowdown in consumer price growth for July.

Wall Street responded positively to these figures, which suggested that inflation remains within levels deemed acceptable by the Federal Reserve, though price pressures persist. The consumer price readings bolstered market expectations for a potential interest rate cut by the Fed in September. It is well understood that lower interest rates create a favorable environment for equity investment. Reduced borrowing costs enable companies to access capital more easily, expand operations, and ultimately deliver stronger financial performance—enhancing their appeal to investors.

Gold was a loser

Gold Declines by Nearly 2.00% Amid Market Optimism Following Trump–Putin Summit Gold lost approximately 2.00% by the close of last week’s trading, driven by a renewed appetite for risk following the Trump–Putin summit in Alaska, which sent positive signals to global markets.

Although the summit did not yield a peace agreement on Ukraine, it highlighted the possibility of Russia reopening to the West. Analysts suggest the meeting may mark the beginning of the end for the Western-imposed isolation of Europe in response to the invasion of Ukraine.

The precious metal also faced downward pressure from factors that supported the U.S. dollar—despite the greenback posting a weekly decline. U.S. producer price data pointed to a rising inflation, which contributed to dollar strength throughout some days of last week.

Additionally, comments from Federal Reserve officials expressing dissatisfaction with a proposed 50-basis-point rate cut at the upcoming Fed meeting weighed on the dollar, indirectly benefiting gold. However, the dollar later weakened following remarks by President Donald Trump and Treasury Secretary Scott Besant, which raised concerns over the Federal Reserve’s independence.

Gold is widely regarded as one of the most reliable stores of value among financial assets, often favored by investors seeking protection against inflation. Yet, as consumer price inflation shows signs of easing, demand for safe-haven assets—led by gold—has softened.

Looking ahead, global gold prices may enter a sideways trading pattern following last week’s decline, as markets brace for a busy week filled with key economic events and central bank communications.

European currencies

The euro and pound sterling posted weekly gains against the U.S. dollar, which came under pressure from softer U.S. consumer price data and remarks by President Donald Trump and Treasury Secretary Scott Besant that raised concerns over the Federal Reserve’s independence.

Despite the uptick, euro momentum remained fragile due to broader economic and geopolitical pressures weighing on the single currency. Comments by Ukrainian President Volodymyr Zelensky regarding the Trump–Putin summit in Alaska also limited the euro’s advance against the dollar. Zelensky reiterated late last week that any agreement involving territorial concessions to Russia would be unacceptable, dampening hopes for a peace deal at the summit—an outcome that ultimately materialized.

Sterling benefited from the dollar’s decline, as well as supportive domestic data and rising expectations that interest rates would remain unchanged. The UK’s Office for National Statistics reported that the British economy grew by 0.3% in Q2 2025, slower than the 0.7% expansion recorded in the previous quarter but exceeding market forecasts of a 0.1% rise. June’s performance was particularly strong, with monthly GDP growth reaching 0.4%.

The upbeat GDP figures reinforced expectations that the Bank of England may adopt a more hawkish stance, potentially easing pressure on policymakers to accelerate rate cuts. However, analysts cautioned that this solid performance is unlikely to deter the government from introducing new tax hikes in the autumn budget, which capped sterling’s gains.

Cryptocurrencies were winners

Bitcoin reached a new record high last week, just one month after setting a similar milestone in July. The surge was driven by U.S. consumer price index data released last Tuesday, which came in below expectations and fueled hopes of a potential interest rate cut at the Federal Open Market Committee’s upcoming meeting in September.

The softer inflation reading boosted risk appetite among investors, prompting increased demand for risk assets—chief among them, cryptocurrencies. Bitcoin climbed to $123,617 per unit by Wednesday, marking its highest level on record. The rally was supported by growing expectations of monetary easing, rising institutional interest, and continued weakness in the U.S. dollar.

The week ahead

Global financial markets are closely watching Federal Reserve Chair Jerome Powell’s remarks this week at the Jackson Hole Economic Symposium, a high-profile gathering of leading figures from the worlds of economics and central banking.

Also on the agenda are earnings reports from several major U.S. retail giants. These reports are significant as they offer insight into the impact of the tariffs recently imposed by President Donald Trump on a wide range of countries.

Investors are also awaiting the release of FOMC minutes from the Federal Reserve’s most recent meeting, hoping for fresh signals on the future path of monetary policy. The importance of these minutes is heightened by their timing—just ahead of a September meeting widely expected to deliver the Fed’s first rate cut since the start of 2025.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations