The past trading week was marked by a series of impactful developments, ranging from key economic data releases and ongoing tensions between the Federal Reserve and President Donald Trump, to the market reaction following the earnings report of semiconductor giant Nvidia. This weekly summary highlights the main factors that influenced price movements across financial markets.

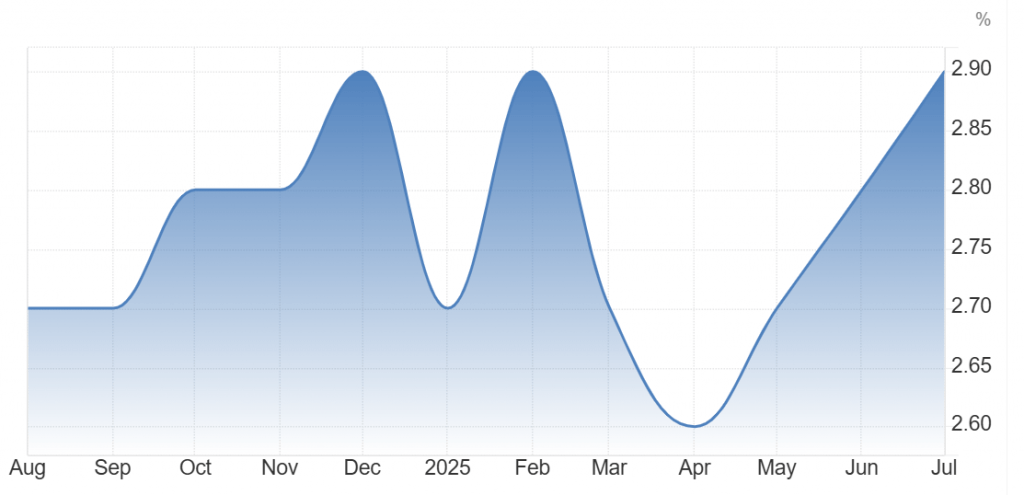

Data from the U.S. Bureau of Economic Analysis showed an increase in the Personal Consumption Expenditures (PCE) index—widely regarded by the Federal Reserve as the most reliable gauge of inflationary trends in the United States. The monthly reading aligned with market expectations, while the annual figure also met forecasts, though both readings for July reflected a slight decline compared to the previous month.

The PCE index rose by 0.2%, down from the prior reading of 0.3%, in line with consensus estimates. On an annual basis, the index registered 0.6%, matching both the previous figure and market expectations.

These figures reinforced speculation that the Federal Open Market Committee (FOMC) may be nearing a decision to cut interest rates at its upcoming September meeting—a development generally viewed as bearish for the U.S. dollar.

However, persistent friction between President Trump and the Federal Reserve added further pressure, ultimately contributing to the dollar’s weekly losses.

US PCE – Annual – July 2025 – Source: tradingeconomics

Trump’s Clash with the Federal Reserve

Last week saw notable developments surrounding President Donald Trump’s attack on Federal Reserve Board member Lisa Cook, following allegations that she had submitted falsified financial documents to obtain a mortgage.

On Friday, markets closely monitored the conclusion of a hearing related to a lawsuit filed by Cook, aimed at halting the president’s attempt to initiate proceedings to remove her from the Federal Open Market Committee (FOMC). The session ended without a judicial ruling on the dispute.

Cook’s legal action seeks to block her suspension from official duties and to challenge the allegations of document fraud. Her defense argues that the claims pertain to events that allegedly occurred prior to her appointment to the FOMC, and therefore do not legally justify her dismissal from the current post.

This legal standoff has added pressure to the U.S. dollar, which had already posted weekly losses. The case has amplified investor concerns over the Federal Reserve’s institutional independence.

The lawsuit is expected to remain a focal point for market participants, potentially weighing on the dollar until a ruling is issued in Cook’s favor. Conversely, if the court sides with Trump and allows the dismissal to proceed, the currency may face further downside risk.

Nvidia and the AI Bubble

U.S. equities posted modest gains over the past week, supported by rising expectations of interest rate cuts following the release of inflation data considered the most credible and reliable by the Federal Reserve.

Despite President Donald Trump’s confrontational stance toward the Fed, the New York Stock Exchange drew some strength from his allegations against Fed Board member Lisa Cook, accusing her of submitting falsified documents to obtain a mortgage. Investors interpreted Trump’s continued pressure on the central bank as a signal that a substantial rate cut could be imminent.

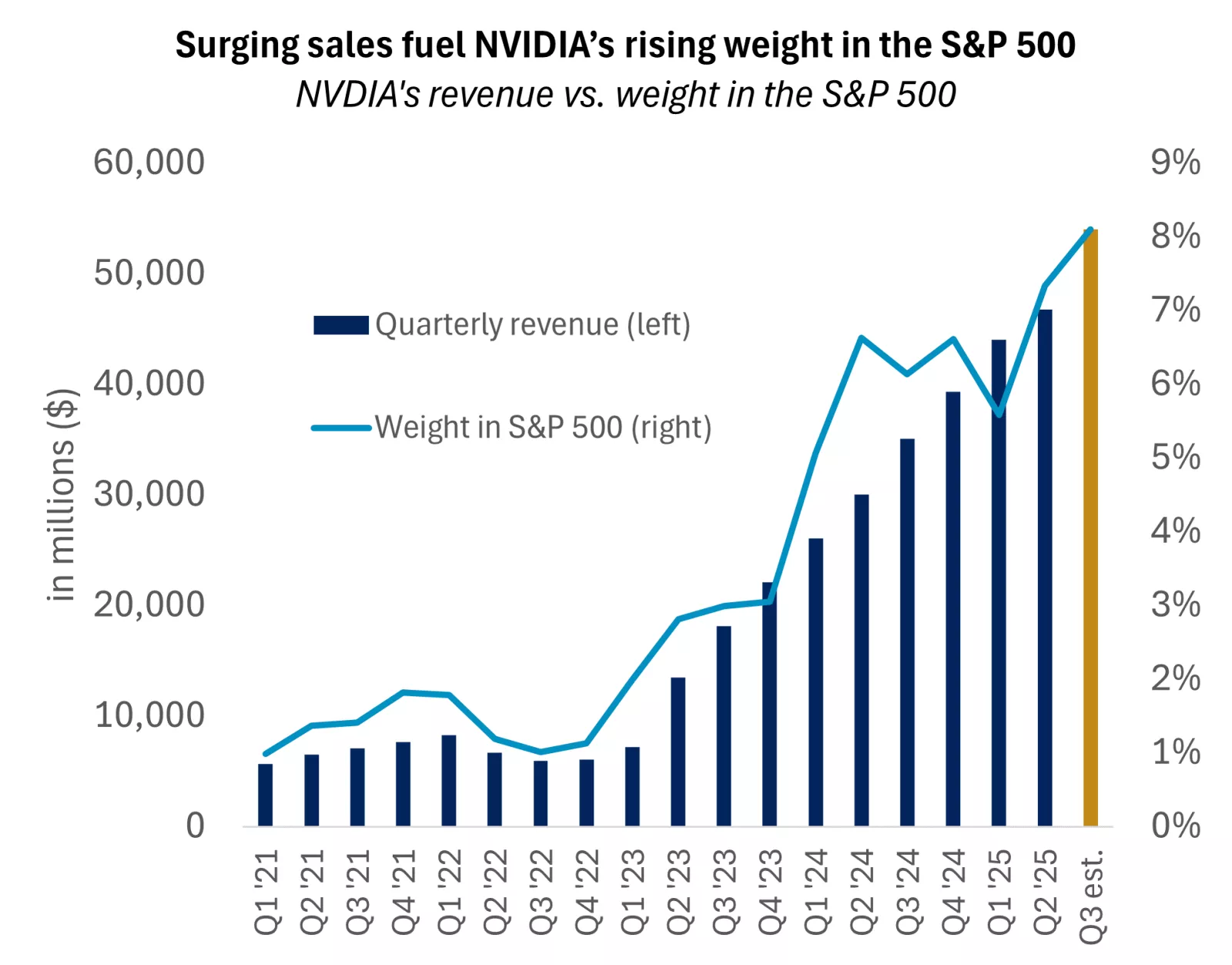

On the corporate front, Nvidia’s earnings failed to deliver the strong positive impact markets had anticipated, largely due to concerns surrounding the company’s forward guidance.

The semiconductor giant reported solid second-quarter results for 2025, including record sales during the period. However, the immediate market reaction was negative, with the stock falling more than 2.00% in the hours following the earnings release.

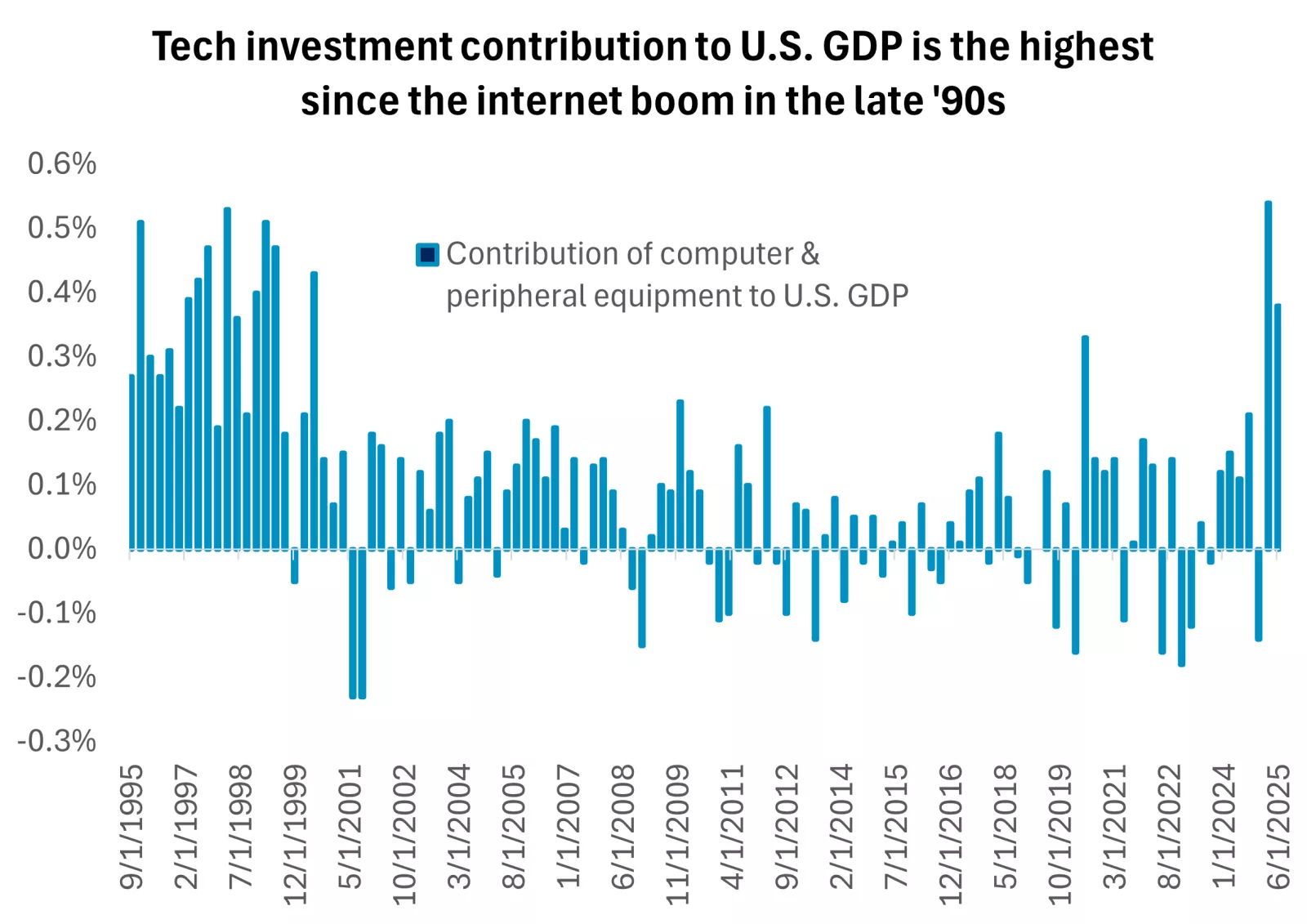

The muted response was attributed to the fact that sales, profits, and overall revenue came in below investor expectations. Additionally, growing concerns about a potential bubble in the artificial intelligence sector weighed on sentiment. These fears stem from intense competition between Western economies and China to launch new AI products, coupled with aggressive capital inflows into the sector—factors that could drive sharp price surges.

Such concerns have revived memories of the tech bubble of the 1990s, when investor enthusiasm for technology stocks led to unsustainable valuations and a subsequent collapse in Nasdaq-listed companies.

These apprehensions were a key factor in capping U.S. equity gains last week, despite the presence of several supportive market drivers.

Source: Bloomberg

Gold vs. the U.S. Dollar

Gold capitalized on the weakness of the U.S. dollar throughout the past week, with the precious metal posting gains of approximately 2.3% by Friday.

Among the key developments that supported gold’s performance was President Donald Trump’s renewed attack on the Federal Reserve, following his threat to initiate proceedings to remove Federal Open Market Committee member Lisa Cook over allegations of submitting falsified documents to obtain a mortgage.

Additionally, U.S. inflation data contributed to rising expectations of a potential rate cut at the Fed’s September meeting. The figures highlighted a decline in Personal Consumption Expenditures—considered the most reliable inflation gauge by the Federal Reserve—and came in line with market forecasts, reinforcing the view that inflationary pressures in the U.S. may be easing.

Weekly Losses for the Euro

The euro closed the week ending August 29 with notable declines, pressured by a combination of weak economic data and geopolitical tensions linked to the ongoing war in Ukraine.

One of the key drivers was the drop in the GfK Consumer Confidence Index for the eurozone, which fell to its lowest level in five months. This deterioration in sentiment is considered a bearish signal for the single currency, prompting increased selling pressure.

Political developments in France further weighed on the euro’s performance. As the eurozone’s second-largest economy, France’s political stability plays a crucial role in supporting broader economic confidence across the region. Prime Minister François Bayrou called for a parliamentary vote of confidence in his government, raising the possibility of its collapse. The move came amid heated debate over Bayrou’s proposed sweeping budget cuts, which have sparked significant political unrest.

On the geopolitical front, uncertainty continues to surround peace negotiations aimed at ending the conflict in Ukraine, adding another layer of risk to the euro’s outlook.

Oil Market Overview

Crude oil benefited last week from a series of developments across the global economic, political, and geopolitical landscape, which unfolded steadily throughout the week.

The commodity also drew support from rising expectations of interest rate cuts by the Federal Reserve, fueled by U.S. inflation data that pointed to easing price pressures.

Additionally, oil prices were influenced by the legal dispute that emerged between the Trump administration and the Federal Reserve, centered on allegations against FOMC member Lisa Cook, who is accused of submitting falsified documents to obtain a mortgage. This controversy has reinforced market speculation that the Fed may move toward a more accommodative monetary stance.

On the geopolitical front, uncertainty continues to surround peace negotiations aimed at ending the war in Ukraine. This ambiguity raises the likelihood that Russian oil exports will remain subject to U.S. sanctions, alongside the possibility of further economic restrictions being imposed on Moscow.

Meanwhile, a report from the U.S. Energy Information Administration indicated that average inventories of crude oil and petroleum products declined by approximately 5.6% compared to the seasonal five-year average—a key factor providing fundamental support to oil prices.

Source: Factset

Bitcoin

Bitcoin recorded weekly losses amid a downward trend that signaled a potential end to the summer rally that had supported the world’s most widely traded cryptocurrency in recent months.

Losses for the week ending Friday, August 29 amounted to approximately 4.2%. The latest bearish wave pushed Bitcoin down by around 5.5%, while Ripple—a promising altcoin—fell by roughly 6.8%. Ethereum also declined, shedding about 6.2% of its value.

Dogecoin and Tron posted respective losses of 5.8% and 6.2% by the end of the week.

In addition to seasonal factors contributing to the decline in digital assets, regulatory tightening by the Bank of Russia played a role in the weekly drop. The central bank announced new measures aimed at strengthening oversight of banking institutions’ dealings with cryptoassets.

Under the new framework, banks will be required to include digital assets in capital adequacy calculations and prudential ratios. The rules will apply to both direct investments in cryptocurrencies and exposure through related derivatives.

The Week Ahead

Markets are bracing for a series of key U.S. data releases in the coming week, most notably the employment report, which will shed light on labour market conditions—one of the Federal Reserve’s primary considerations in shaping monetary policy.

Purchasing Managers’ Index (PMI) readings are also due, offering insights into the performance of core economic sectors. In addition, data related to the U.S. manufacturing sector will be released, helping investors gauge industrial momentum.

Two members of the Federal Open Market Committee, John Williams and Alberto Musalem, are scheduled to speak during the week. Their remarks will be closely monitored by global financial markets for any signals regarding the Fed’s future policy direction.

Meanwhile, the U.S. Securities and Exchange Commission is reviewing new regulatory proposals aimed at streamlining the process for launching exchange-traded funds (ETFs) based on cryptocurrencies.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations