Three things dictated price action in financial markets last week, including reaching a trade deal between USA and Vietnam, positive US jobs data, and passing “the Big Beautiful Bill”.

The recent appreciation of the U.S. dollar was driven by improving investor sentiment toward America’s trade outlook, supported by Friday’s robust labour market data, which reinforced confidence in economic resilience and policy stability.

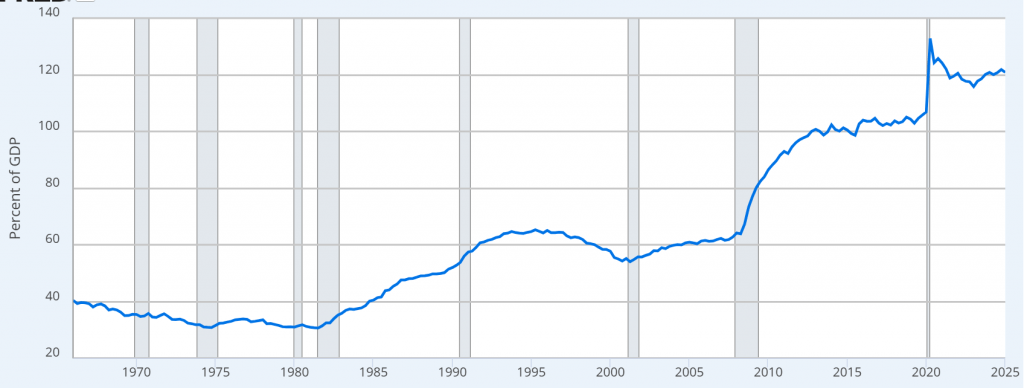

However, the enactment of the tax-cut bill—popularly referred to in the media as the “Big Beautiful Bill”—has intensified concerns over a looming fiscal imbalance, potentially undermining the dollar’s appeal as a safe-haven asset.

The U.S. Dollar Index, which tracks the greenback’s performance against a basket of major currencies, slipped to 96.96—down from last week’s close of 97.00

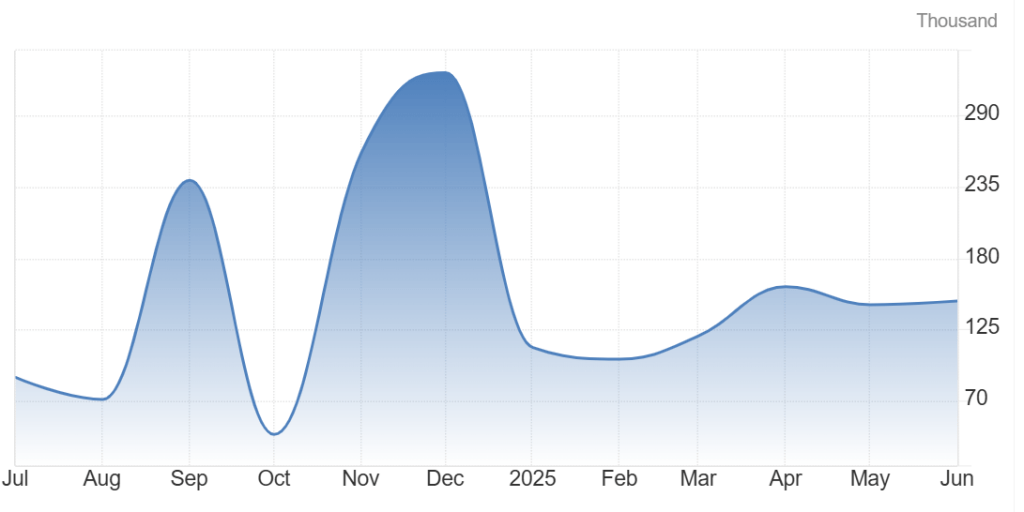

Recent jobs data pointed to a strengthening U.S. labour market in June, with job creation accelerating, unemployment declining, and wage growth moderating.

Nonfarm payrolls rose by 147,000, exceeding both the prior reading of 144,000 and market expectations of 110,0003. Meanwhile, average hourly earnings increased just 0.2% month-over-month, below May’s 0.4% and short of the 0.3% forecast. On an annual basis, wage growth eased to 3.7%, missing the anticipated 3.9%.

While the headline figures reflect solid labour market momentum, the softer-than-expected wage growth was the key driver behind the rally in U.S. equities. It signalled to markets that inflationary pressures may remain contained in the near term.

Taken together, these indicators have reinforced investor confidence that the Federal Reserve may be successfully engineering a “soft landing”—curbing inflation without tipping the economy into recession.

NFP Monthly – Source: US Bureau of Labour Statistics

Trade Optimism

Despite recent remarks by President Donald Trump expressing scepticism about reaching a trade deal with Japan, he announced the conclusion of a bilateral agreement with Vietnam governing commercial exchange between the two countries.

According to Vietnamese media, the deal includes a 20% tariff on U.S. imports from Vietnam, a rate notably lower than the initial 46% tariff previously imposed by the U.S. administration on Southeast Asian goods.

The agreement also stipulates a 40% tariff on transshipped goods—shipments routed through Vietnam without direct origin-destination pathways—aimed at curbing circumvention of trade barriers.

U.S. Treasury Secretary Scott Bessent stated that the President would be sending letters to selected trade partners, signaling that tariffs announced in April will take effect on August 1 for countries that have not yet finalized trade agreements with Washington2. Bessent clarified that August 1 is not a new deadline, but rather a procedural step to allow additional time for negotiations. He also anticipated several major trade deals to be announced in the coming days. Addressing U.S. trading partners, Bessent remarked: “We decide when this happens. If you want to accelerate the pace, go ahead. If you prefer to stick with the previous rhythm, that’s your choice.”

The “Big Beautiful Bill”

Combines sweeping tax cuts, major spending reforms, and controversial policy measures—sparking intense debate over its projected $3.3 trillion addition to the national debt.

As the legislation moves into the implementation phase, its broad economic implications are under close scrutiny from markets, policymakers, and the public, all seeking clarity on its execution and fiscal impact.

Formally known as the Tax Cut Bill, the package includes several core provisions aligned with President Trump’s campaign pledges: a permanent extension of the 2017 tax cuts, substantial reductions in corporate tax rates, and new tax exemptions primarily benefiting high-income earners and businesses.

On the spending side, the bill enacts deep cuts to social programs such as Medicaid and food assistance—measures that have drawn sharp criticism from Democrats, who argue they disproportionately harm vulnerable populations.

The legislation also allocates significant funding for infrastructure and border security, including contentious immigration enforcement provisions that have added to the political divide.

US debt percentage to GDP – Source: Federal Reserve Bank

A stocks -Friendly Bill

U.S. equity markets responded favorably to President Trump’s tax relief and public spending legislation—unlike the dollar, which faced headwinds. The bill’s corporate tax cuts are expected to stimulate business activity and enhance both operational and financial performance by reducing the share of revenues allocated to tax obligations.

The legislation is also projected to trigger a surge in investment, both domestically and from abroad, as firms capitalize on improved after-tax returns. Additionally, the substantial increase in government spending—particularly on infrastructure and strategic projects—is anticipated to fuel broader economic expansion.

Reflecting this optimism, U.S. stocks posted record gains last week: the Dow Jones Industrial Average rose 2.3%, the S&P 500 advanced 1.7%, and the Nasdaq 100—dominated by tech heavyweights—climbed 1.6% respectively.

Euro Defies Headwinds

The euro posted strong weekly gains by the close of trading (June 30–July 4), largely supported by persistent weakness in the U.S. dollar.

This came despite developments that would typically favor the greenback. Early in the week, President Donald Trump expressed doubts about reaching a trade agreement with Japan in the near term—remarks that added uncertainty to U.S. trade policy.

Further pressure on the dollar stemmed from the passage of Trump’s “Big Beautiful Bill,” which triggered renewed concerns over ballooning U.S. debt and fiscal sustainability.

Meanwhile, a string of disappointing data releases—including softer-than-expected inflation figures and a decline in German retail sales—added to the mixed global macro backdrop.

Gold Retreats Amid Risk-On SentimentGold ended last week on a downward trajectory, pressured by waning demand for safe-haven assets.

Market optimism was fueled by the newly announced U.S–Vietnam trade agreement, which lowered tariffs on most Vietnamese imports to 20%, down from the previously imposed 46%, easing trade tensions and boosting investor confidence.

Further support for risk assets came from upbeat U.S. employment data, which confirmed stronger job growth and a decline in unemployment. Wage growth, while positive, came in below expectations—helping temper inflation concerns and reinforcing the narrative of a soft landing.

Against this backdrop, gold posted a weekly loss of 1.6%, settling at $3,325 per ounce by the end of the week.#

Cryptocurrencies

Bitcoin, the world’s most actively traded digital asset, rallied in tandem with record highs in the S&P 500—highlighting its growing correlation with traditional equity markets.

The surge was further supported by the announcement of a U.S.–Vietnam trade agreement, which lowered tariffs on Vietnamese imports from 46% to 20%. This deal was interpreted as a macro-positive development, boosting sentiment across risk assets, including crypto.

Adding to the momentum, House Financial Services Chairman French Hill (R-AR) and Agriculture Committee Chairman GT Thompson (R-PA), alongside House leadership, declared the week of July 14th as “Crypto Week”. During this period, lawmakers will consider three major bills: the CLARITY Act, the Anti-CBDC Surveillance State Act, and the Senate-approved GENIUS Act—all part of a broader push to establish the U.S. as the global hub for digital assets.

These developments provided an additional tailwind for Bitcoin, which posted weekly gains of approximately 0.8%, as investors viewed the legislative momentum as a step toward greater regulatory clarity and institutional legitimacy.

The Week Ahead

Markets are bracing for a pivotal week, headlined by the release of minutes from the Federal Reserve’s latest policy meeting—widely expected to reinforce the messaging delivered by Chair Jerome Powell in recent appearances.

The prevailing theme remains “Waiting”, as Powell has repeatedly emphasized the Fed’s commitment to holding rates steady until greater clarity emerges on the economic outlook.

Meanwhile, the deadline set by President Trump for the expiration of the 90-day suspension on reciprocal tariffs is fast approaching. Late last week, Treasury Secretary Scott Bessent signalled that countries still without trade agreements may be granted an extension until August 1, offering a narrow window for final negotiations.

Let me know if you’d like this adapted for investor briefings or integrated into a broader macroeconomic outlook.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations